As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the industrial distributors industry, including Rush Enterprises (NASDAQ: RUSHA) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 24 industrial distributors stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

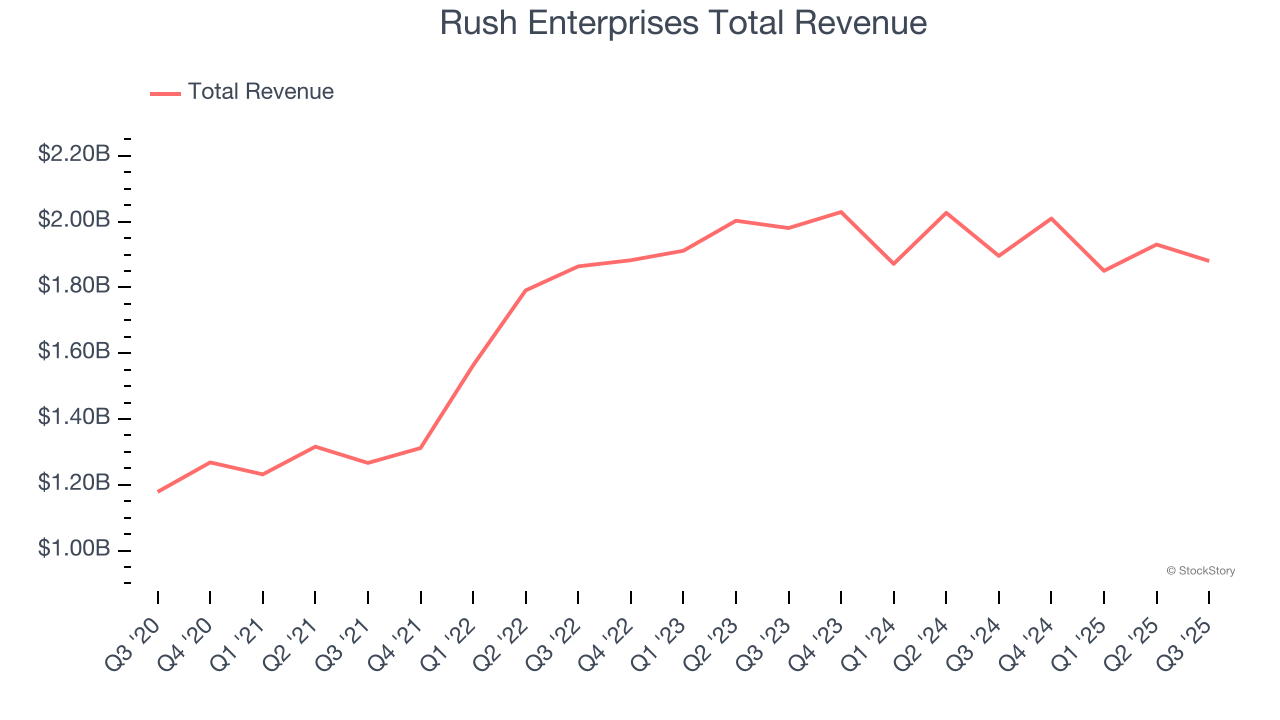

Rush Enterprises (NASDAQ: RUSHA)

Headquartered in Texas, Rush Enterprises (NASDAQ: RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $1.88 billion, flat year on year. This print exceeded analysts’ expectations by 5.7%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

“The commercial vehicle industry continued to face challenging operating conditions in the third quarter of 2025. Freight rates remain depressed and overcapacity continues to weigh on the market. In addition, while the industry gained some clarity regarding the tariffs that will be imposed on certain commercial vehicles and parts beginning November 1, economic uncertainty and regulatory ambiguity remains, especially with respect to engine emissions regulations. These factors are impacting our customers’ vehicle replacement decisions. On a positive note, we experienced modest gains in aftermarket revenue and light-duty vehicle sales. However, overall demand remained soft, particularly with respect to new heavy-duty and medium-duty commercial vehicle sales,” said W.M. “Rusty” Rush, Chairman, Chief Executive Officer and President of Rush Enterprises, Inc.

Rush Enterprises achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 17.1% since reporting and currently trades at $58.99.

Is now the time to buy Rush Enterprises? Access our full analysis of the earnings results here, it’s free.

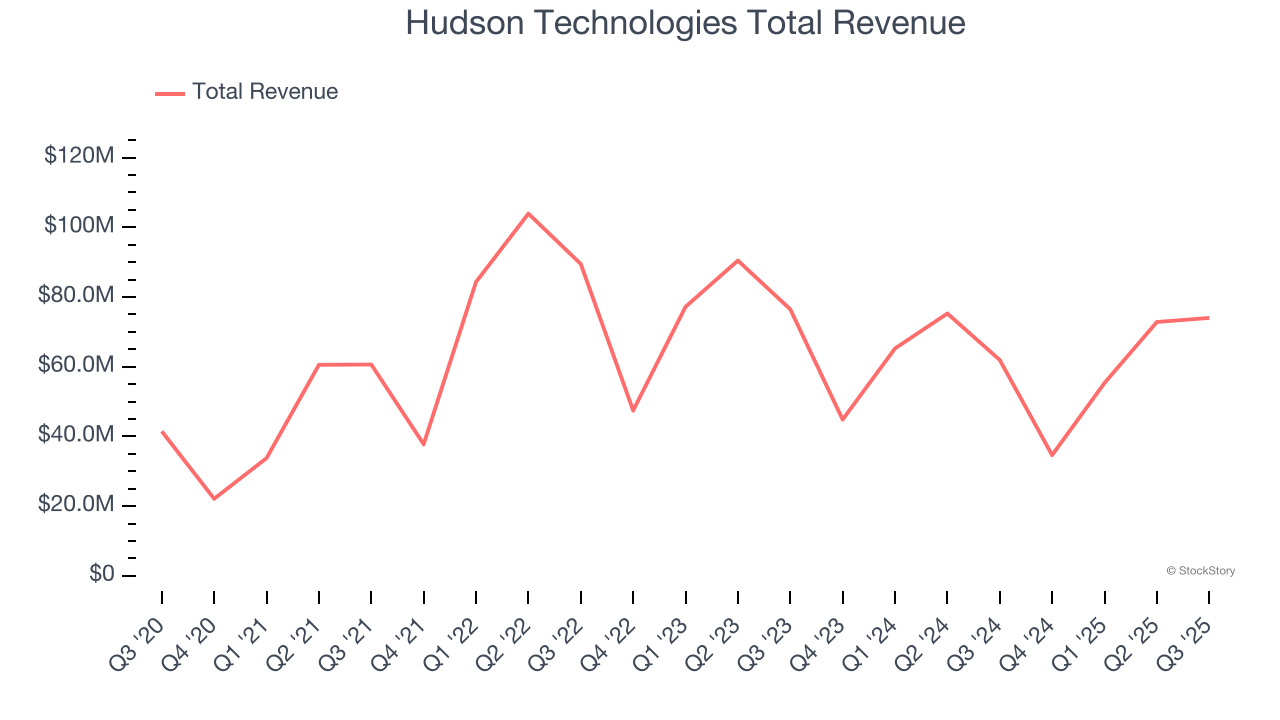

Best Q3: Hudson Technologies (NASDAQ: HDSN)

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $74.01 million, up 19.5% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.1% since reporting. It currently trades at $7.33.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Alta (NYSE: ALTG)

Founded in 1984, Alta Equipment Group (NYSE: ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $422.6 million, down 5.8% year on year, falling short of analysts’ expectations by 8.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Alta delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 3.2% since the results and currently trades at $6.06.

Read our full analysis of Alta’s results here.

DNOW (NYSE: DNOW)

Spun off from National Oilwell Varco, DNOW (NYSE: DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

DNOW reported revenues of $634 million, up 4.6% year on year. This print was in line with analysts’ expectations. It was a strong quarter as it also logged a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 7.1% since reporting and currently trades at $13.56.

Read our full, actionable report on DNOW here, it’s free.

United Rentals (NYSE: URI)

Owning the largest rental fleet in the world, United Rentals (NYSE: URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $4.23 billion, up 5.9% year on year. This number beat analysts’ expectations by 1.6%. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ organic revenue estimates but a significant miss of analysts’ EPS estimates.

The stock is down 4.5% since reporting and currently trades at $946.86.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.