Over the past six months, GameStop’s stock price fell to $21.00. Shareholders have lost 11.4% of their capital, which is disappointing considering the S&P 500 has climbed by 11.1%. This may have investors wondering how to approach the situation.

Is now the time to buy GameStop, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think GameStop Will Underperform?

Despite the more favorable entry price, we're cautious about GameStop. Here are three reasons you should be careful with GME and a stock we'd rather own.

Note that our analysis is rooted in fundamentals, not meme-stock technicals.

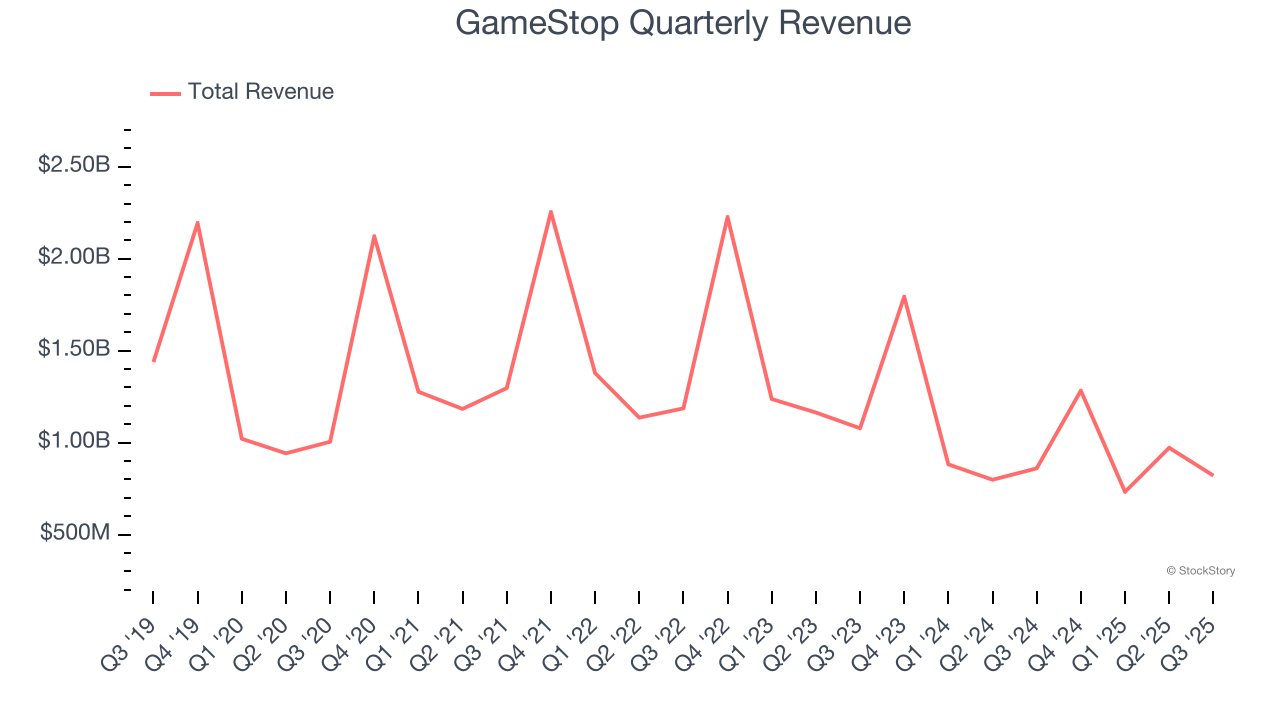

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. GameStop’s demand was weak over the last three years as its sales fell at a 13.8% annual rate. This was below our standards and signals it’s a low quality business.

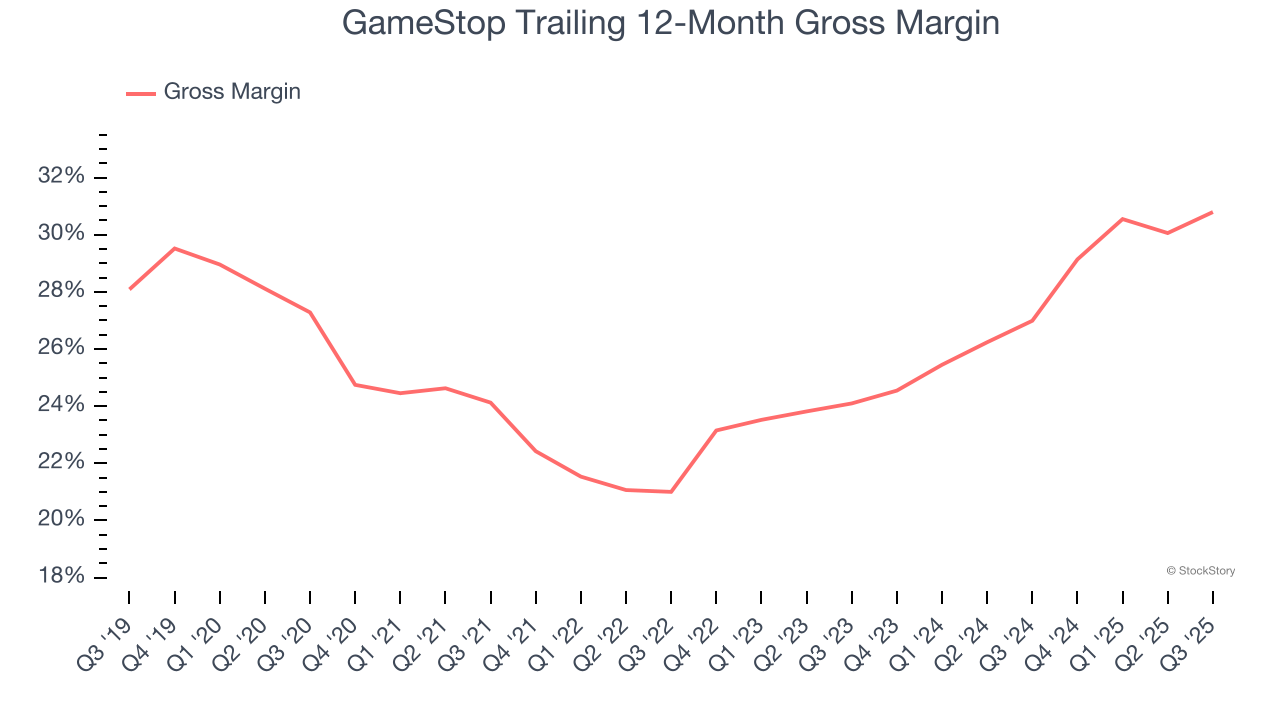

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

GameStop has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 28.8% gross margin over the last two years. That means GameStop paid its suppliers a lot of money ($71.23 for every $100 in revenue) to run its business.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

GameStop’s five-year average ROIC was negative 10.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

Final Judgment

GameStop doesn’t pass our quality test. After the recent drawdown, the stock trades at 25× forward P/E (or $21.00 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of GameStop

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.