Cloud analytics platform Teradata (NYSE: TDC) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 2.9% year on year to $421 million. On top of that, next quarter’s revenue guidance ($426.4 million at the midpoint) was surprisingly good and 3.8% above what analysts were expecting. Its non-GAAP profit of $0.74 per share was 33.1% above analysts’ consensus estimates.

Is now the time to buy Teradata? Find out by accessing our full research report, it’s free.

Teradata (TDC) Q4 CY2025 Highlights:

- Revenue: $421 million vs analyst estimates of $399.6 million (2.9% year-on-year growth, 5.4% beat)

- Adjusted EPS: $0.74 vs analyst estimates of $0.56 (33.1% beat)

- Adjusted Operating Income: $95.99 million vs analyst estimates of $82.54 million (22.8% margin, 16.3% beat)

- Revenue Guidance for Q1 CY2026 is $426.4 million at the midpoint, above analyst estimates of $410.7 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.60 at the midpoint, beating analyst estimates by 2%

- Operating Margin: 12.8%, up from 9.5% in the same quarter last year

- Free Cash Flow Margin: 35.9%, up from 21.2% in the previous quarter

- Annual Recurring Revenue: $1.52 billion (3.3% year-on-year growth, beat)

- Market Capitalization: $2.64 billion

Company Overview

Pioneering data warehousing technology in the 1980s before "big data" was a common term, Teradata (NYSE: TDC) provides cloud-based data analytics and AI platforms that help large enterprises integrate, analyze, and leverage their data across multiple environments.

Revenue Growth

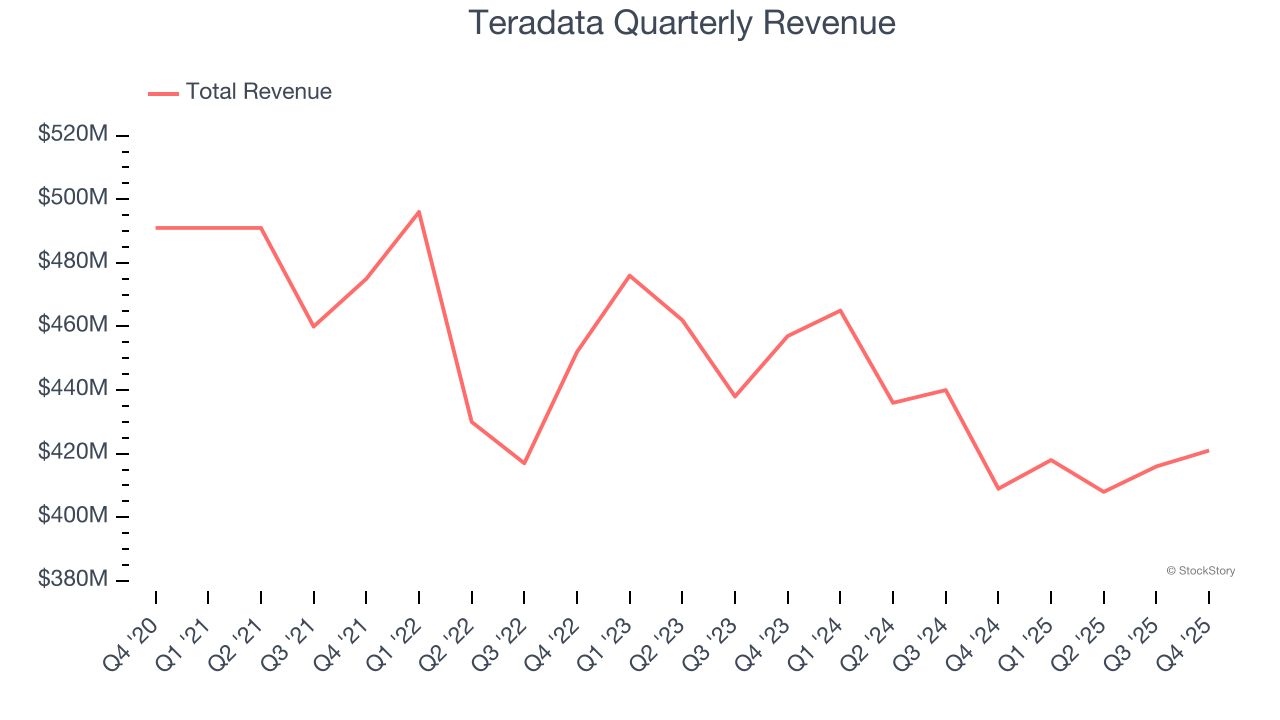

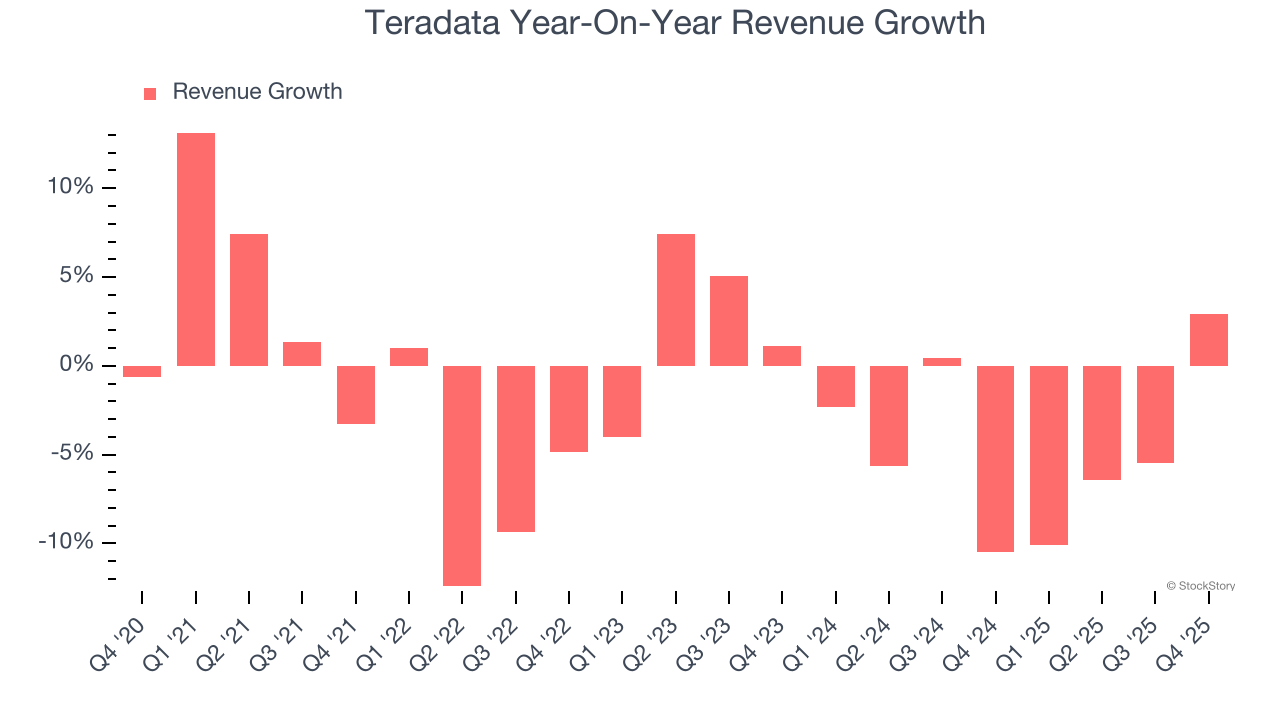

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Teradata’s demand was weak over the last five years as its sales fell at a 2% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Teradata’s recent performance shows its demand remained suppressed as its revenue has declined by 4.8% annually over the last two years.

This quarter, Teradata reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 5.4%. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.8% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

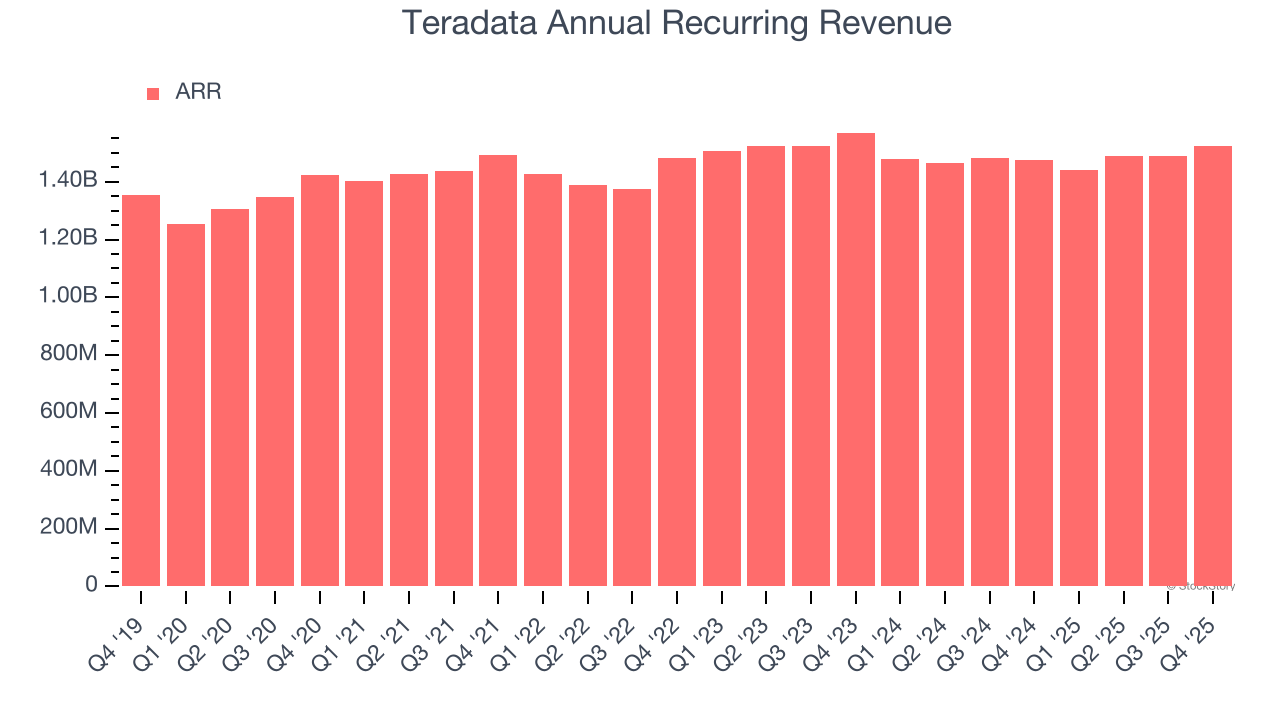

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Teradata failed to grow its ARR, which came in at $1.52 billion in the latest quarter. However, this alternate topline metric outperformed its total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Teradata to acquire new customers as its CAC payback period checked in at 54.6 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Teradata’s Q4 Results

We were impressed by Teradata’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. As for the quarter, that was quite solid as well, with revenue and adjusted operating income beating expectations. Zooming out, we think this was a very good print with some key areas of upside. The stock traded up 14.2% to $33.40 immediately following the results.

Sure, Teradata had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).