Telecommunications infrastructure company Lumen Technologies (NYSE: LUMN) met Wall Streets revenue expectations in Q4 CY2025, but sales fell by 8.7% year on year to $3.04 billion. Its non-GAAP profit of $0.23 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Lumen? Find out by accessing our full research report, it’s free.

Lumen (LUMN) Q4 CY2025 Highlights:

- Revenue: $3.04 billion vs analyst estimates of $3.04 billion (8.7% year-on-year decline, in line)

- Adjusted EPS: $0.23 vs analyst estimates of -$0.27 (significant beat)

- Adjusted EBITDA: $767 million vs analyst estimates of $784.8 million (25.2% margin, 2.3% miss)

- EBITDA guidance for the upcoming financial year 2026 is $3.2 billion at the midpoint, below analyst estimates of $3.37 billion

- Operating Margin: -6.6%, down from 4.6% in the same quarter last year

- Free Cash Flow was -$765 million compared to -$174 million in the same quarter last year

- Market Capitalization: $8.68 billion

“The combination of a solid fourth quarter and the close of the AT&T transaction marks a defining moment for Lumen and strengthens our foundation for growth,” said Lumen CEO Kate Johnson.

Company Overview

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $12.4 billion in revenue over the past 12 months, Lumen is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Lumen to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

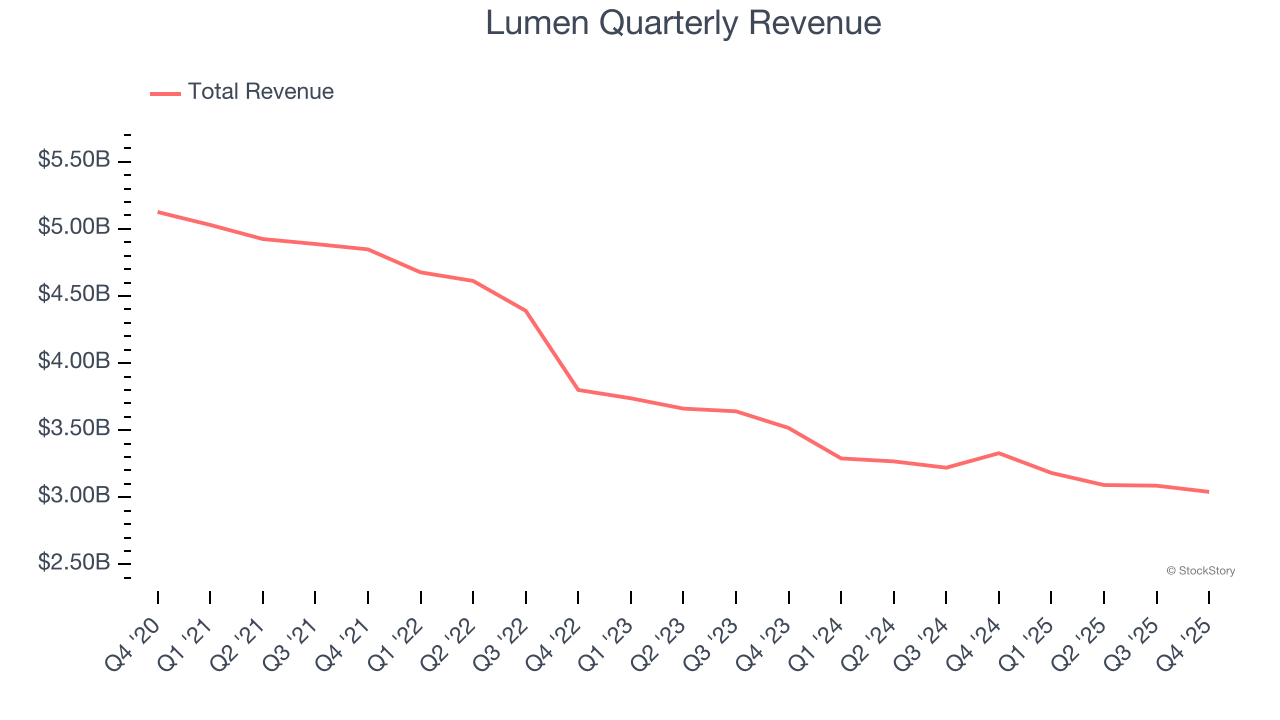

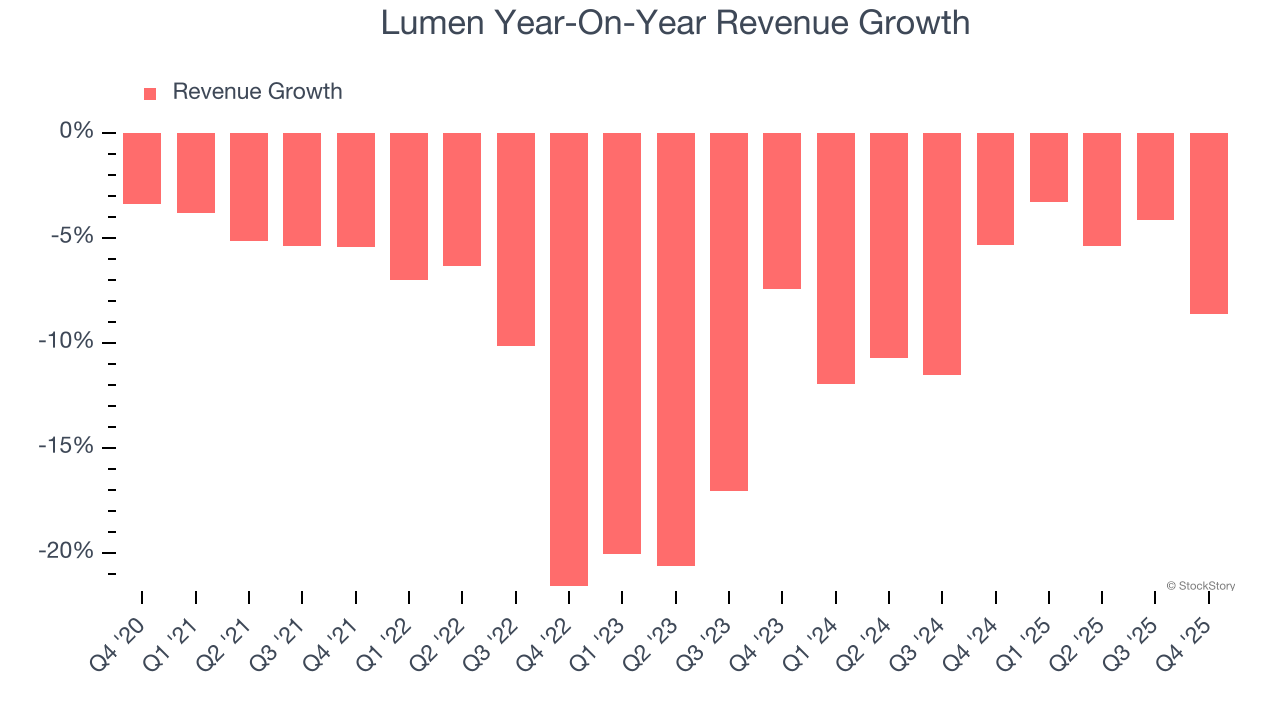

As you can see below, Lumen’s revenue declined by 9.7% per year over the last five years, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Lumen’s annualized revenue declines of 7.7% over the last two years suggest its demand continued shrinking.

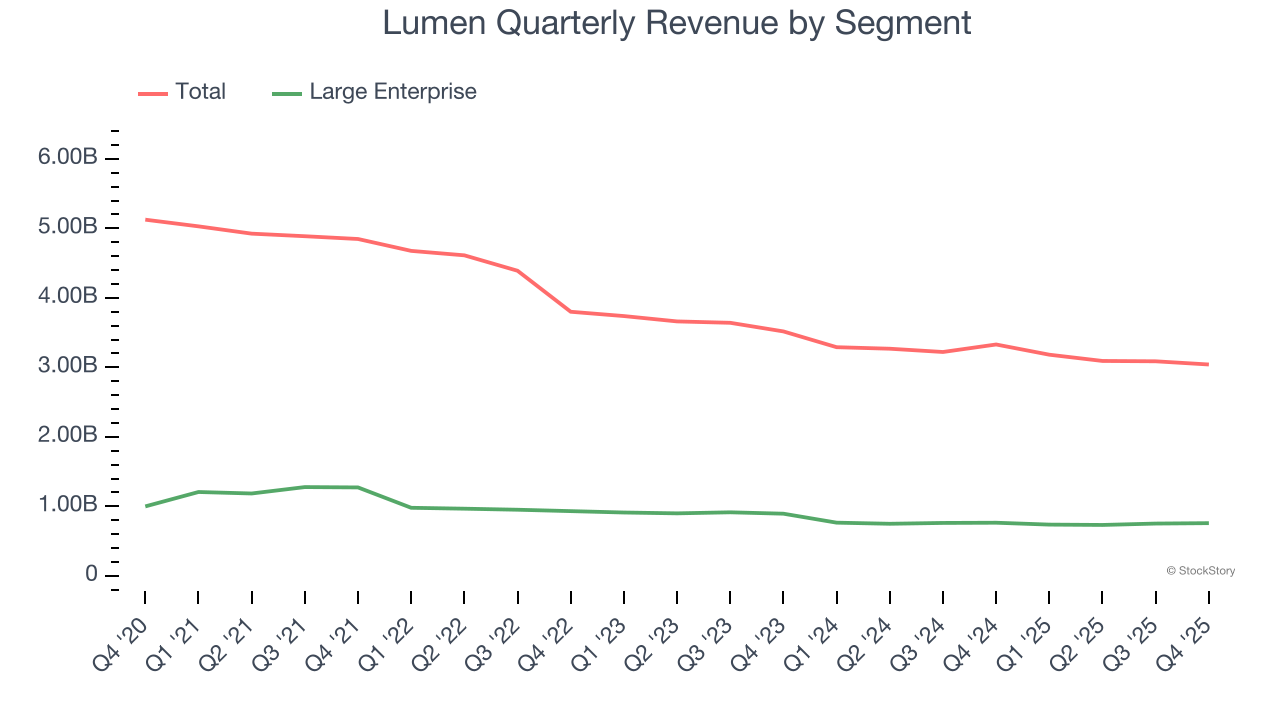

We can better understand the company’s revenue dynamics by analyzing its most important segment, Large Enterprise. Over the last two years, Lumen’s Large Enterprise revenue (services provided to businesses) averaged 9% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Lumen reported a rather uninspiring 8.7% year-on-year revenue decline to $3.04 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 12.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

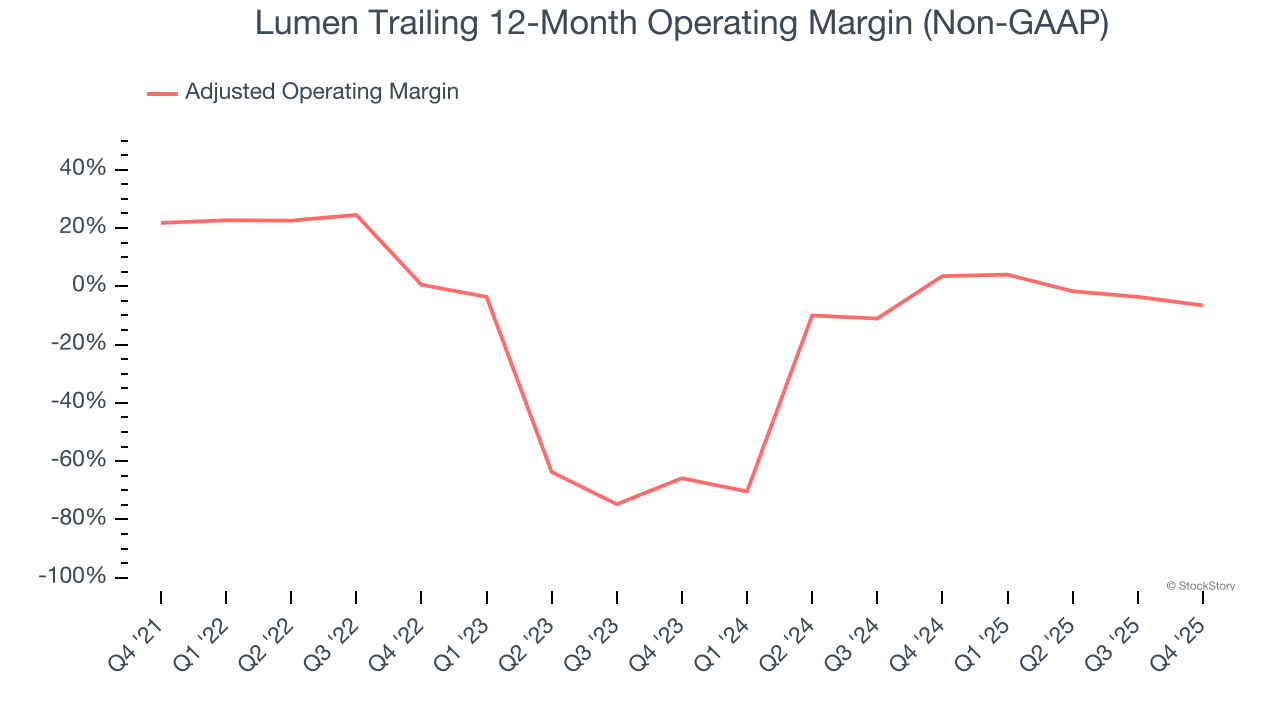

Lumen’s high expenses have contributed to an average adjusted operating margin of negative 7.2% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Lumen’s adjusted operating margin decreased by 28.3 percentage points over the last five years. Lumen’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Lumen’s adjusted operating margin was negative 6.6% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

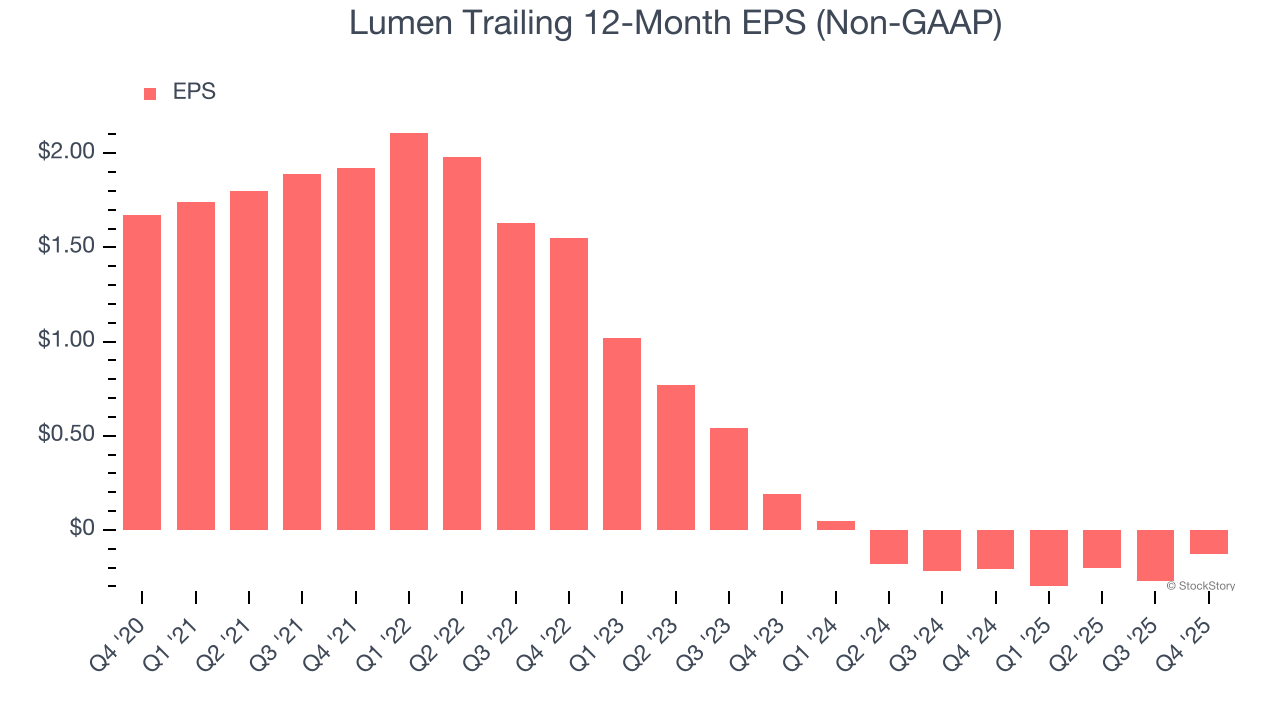

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Lumen, its EPS declined by 15.8% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its adjusted operating margin and repurchased its shares during this time.

We can take a deeper look into Lumen’s earnings to better understand the drivers of its performance. As we mentioned earlier, Lumen’s adjusted operating margin declined by 28.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Lumen’s two-year annual EPS declines of 63.8% were bad and lower than its two-year revenue losses.

In Q4, Lumen reported adjusted EPS of $0.23, up from $0.09 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lumen to perform poorly. Analysts forecast its full-year EPS of negative $0.13 will tumble to negative $0.53.

Key Takeaways from Lumen’s Q4 Results

It was good to see Lumen beat analysts’ EPS expectations this quarter. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $8.45 immediately following the results.

Lumen put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).