( click to enlarge )

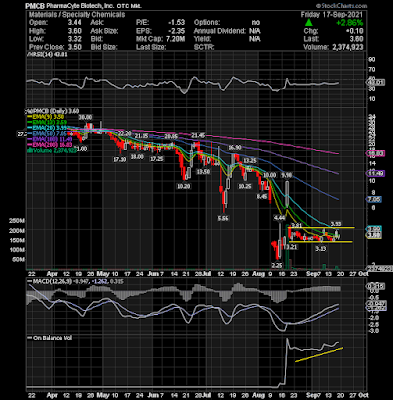

( click to enlarge )Pharmacyte Biotech Inc (NASDAQ:PMCB) has been in the process of forming a bottom pattern for the past couple of weeks. A move past $3.93 would be a strong indicator of a further rebound in the stock. Once it breaks through resistance, we should see strong volume as the stock will breakout and move higher. The money seems to be flowing into the stock as indicated by the On Balance Volume line. Keep watching the stock. I took a big position last week.

( click to enlarge )

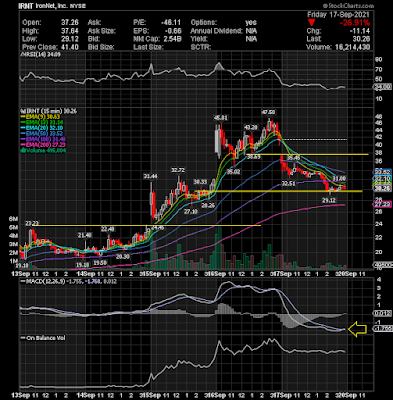

( click to enlarge )Ironnet Inc (NYSE:IRNT) stock has pulled back to $30 from $47 after a profit-taking run, providing a suitable entry point for active traders. Short-term MACD is crossing up while OBV remains at high levels. Might bounce here.

( click to enlarge )

( click to enlarge )Silverback Therapeutics Inc (NASDAQ:SBTX) has been in a tremendous tailspin the last two months. I think this stock will post a sharp rally from current levels. This was a $31 stock in August and at $12.55, in my honest opinion, there is a compelling risk/reward scenario. Plus, the OBV indicator is displaying a bullish divergence, showing high buying volumes. I bought some shares on Friday afternoon. The risk is the stock continues to fall, the reward is a swift 20-35% type move for this highly oversold stock. I've been spot on with these bottom plays recently.

( click to enlarge )

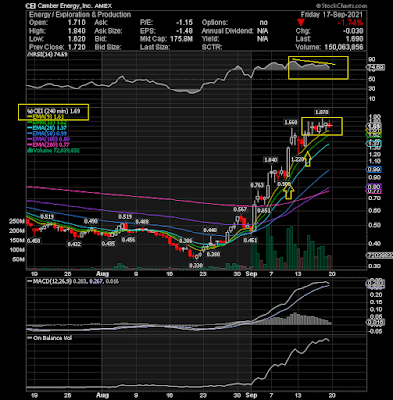

( click to enlarge )Camber Energy Inc (NYSEAMERICAN:CEI) has been in a strong upwards trend the past few weeks and it seems to be working out the overbought conditions. As you can see on the chart above, the rising EMA9 line on the 4H has been providing a significant support for the stock on the rise, so only a close below that line would indicate that a pullback is on its way. In that scenario, there are a lot of supports below. On the other hand, if a breakout above 1.87 occurs, we could see an acceleration of momentum and move toward the 2-2.26 area.

( click to enlarge )

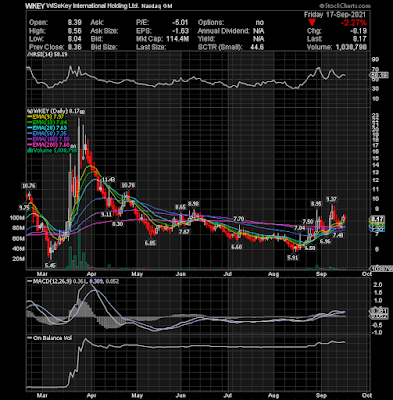

( click to enlarge )Wisekey International Holding AG (NASDAQ:WKEY) is a NFT play to keep an eye on. I am still watching WKEY shares due to the recent price action, volume, news and momentum. Overall, the stock is showing some positive technical signs of reversing its long-term downtrend. If it breaks 9.37 next week, the first target on a swing would be the $12 area.

( click to enlarge )

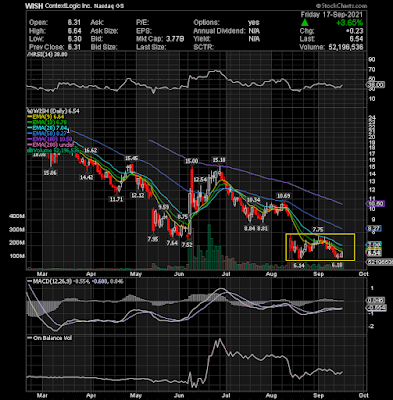

( click to enlarge )Wish (NASDAQ:WISH) is a stock that could head higher from Friday's close. It is in the process of bottoming and I expect a pop above $7.75 at some point in the coming weeks.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC