The market has been hot out of the gate to start the new year. Perhaps too hot as the applause for softer inflation blocked out the noise that these lower prices happened because of serious recessionary red flags.

I sense this may be the last gas for bulls and the bears are about to take the steering wheel again.

Why?

That will be the focus of today’s commentary...

Market Commentary

The new year always brings with it fresh optimism. That alone could explain the +4.2% showing for the S&P 500 (SPY) to kick off the year.

On the surface, bulls can point to exciting news that inflation continues to decline. That was the headline read for sure, especially after the 1/12 CPI report. Let’s dig in deeper on that one...

At this stage month over month is more important than year over year. That’s because most of the inflation pain happened many months ago, especially in the spring of 2022. That makes inflation look high year over year...but the month over month tells you the true current pace.

On that front we see Core Inflation up +0.3% month over month which points to annualized +3.6% which is nicely lower than the past...but still well above the Feds desired 2% target.

More specifically “sticky inflation” is still a problem. This report shows an +0.8% increase in shelter prices (housing) which translates to nearly 10% a year. Far too hot.

Further wage inflation was report last week at +4.6% year over year with a slight slowing of trend to +0.3% month over month (+3.6%) per year.

The sum total of this information says that the Fed will not change there tune. So given what the Fed has said in the past about keeping rates higher for a long time...and then repeating that mantra over and over again including this past week...then it points to the February 1st Fed announcement as another cold shower for bulls.

Now let’s get to what is causing lower inflation. That being 9 straight months of restrictive Fed policy that is finally doing its job. However, that is the view over the left shoulder. If you look over the right shoulder you will see it has come at the cost of an economy on the brink of recession.

- 48.4 ISM Manufacturing on 1/4 with 45.2 New Orders (reads recession)

- 49.6 ISM Services on 1/6 with 45.2 New Orders (reads recession)

- 89.8 NFIB Business Optimism Index on 1/10 (lower reading than during Covid...reads recession)

- 1/13 Earnings season begins with 2 of the 4 major banks soiling the bed. JPM warning that they are braced for recession.

Note that the US has not had an inflation induced recession since the 1980’s, so investors are a bit out of tune on how to handle this rare environment. Meaning they are far too interested in watching inflation data and predicting the likely Fed response as opposed to what they should be doing. That being to monitor the health of the economy as their guide of whether to be bullish or bearish.

If recession is on the way, that begets lower corporate earnings (typically 20% drop in EPS) and this begets lower stock prices given what investors are willing to pay for that weakened earnings profile. This is why it’s very hard to be bullish at this time.

Let’s press forward with a discussion of earnings season. The previous quarter was likely one of the worst in years as earnings estimates got slashed precipitously for coming quarters. Another round of that would be harmful to stock prices.

This means we have to watch earnings trends closely. Specifically speaking, the change in estimates going forward and if the current expectations for a 7% decline in earnings in Q1 darkens or brightens from here. That will have market moving consequences.

Here again, the average recession leads to a 20% reduction in EPS expectations. That is certainly not factored into stock prices at this time. All the more reason to watch earnings estimates more carefully. The early bank results foreshadow more pain on the way.

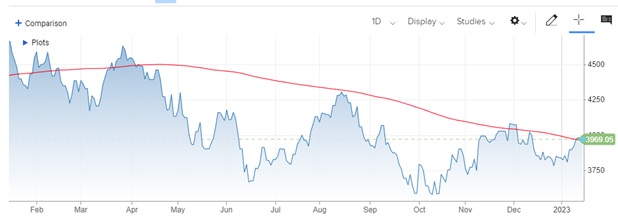

Now let’s rotate to price action. Bulls have already had some pretty impressive runs in the midst of the past years bear market only to get thwarted at the moment of truth. See S&P 500 one year chart below.

Be sure to focus on the 200 day moving average (red line) which keeps ending bullish advances. Both in mid-August and late-November and perhaps once again here in January.

Note that as of the Friday close the S&P stands at 3,999 while the 200 day moving average is at 3,981. Sounds scare that we are above that mark at this time. But before joining the bull party, please hear me out.

This is VERY typical behavior at the end of a bull run. Especially one that ends on a Friday.

Here we had premarket futures down 1% after some really bad bank earnings reports. Yet even then I knew that stocks would end the day higher pressing up against 4,000.

Why?

Just call it pattern recognition as I have seen it many times before. That being where the bulls have just enough energy to punch back one more time setting up a cliff hanger type moment: Will we break higher?...Are will the bear be back on the prowl? Tune in next week for the exciting conclusion.

Unfortunately, the Friday action is kind of like sprinting into the tape at the end of a marathon...just not a lot of energy to run again any time soon. This sets up for high likelihood of downside action on the way. However, I admit that anything is possible and indeed the bulls could have a couple more laughs in store.

Yet with the recessionary clouds darkening and earnings season off to a rocky start and the Fed likely to repeat their hawkish “a long time” mantra at the February 1st meeting...then I suspect we are soon at the end of this bullish run with more downside on the way.

Even if stocks do break above the 200 day moving average at this time, I would be hard pressed to join that party til the Fed announcement on 2/1 where they are likely to pour cold water on bulls once again.

What To Do Next?

Watch my brand new presentation: “2023 Stock Market Outlook” covering:

- Why 2023 is a “Jekyll & Hyde” year for stocks

- 5 Warnings Signs the Bear Returns in Early 2023

- 8 Trades to Profit on the Way Down

- Plan to Bottom Fish @ Market Bottom

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

Watch Now: “2023 Stock Market Outlook” >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares rose $0.08 (+0.02%) in after-hours trading Friday. Year-to-date, SPY has gained 4.20%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Investor Alert: The 2023 Bull Run is Over? appeared first on StockNews.com