Advanced Micro Devices (AMD) is riding a powerful wave of demand for artificial intelligence that shows no signs of slowing down. At the recent analyst day event, CEO Lisa Su outlined an ambitious growth vision driven by what she termed "insatiable" demand for AI computing power.

Su estimates revenue to grow by roughly 35% annually over the next three to five years. During this period, AMD’s data center business is projected to increase by 80% annually, which should enable the tech giant to generate tens of billions in AI chip sales by 2027.

AMD is optimistic about strong demand and partnerships with other Big Tech companies, including OpenAI, Meta (META), and Oracle (ORCL), validating its growing presence in the AI infrastructure market.

AMD forecasts the total addressable market for AI data center components to touch $1 trillion annually by 2030, above its earlier forecast of $500 billion by 2028. The revised figure includes graphics processing units (GPUs) and central processing units (CPUs), highlighting the increasing computing demands of modern AI systems.

Currently, Nvidia (NVDA) dominates the AI chip segment with a market share of over 90%. However, AMD aims to capture double-digit share in the upcoming decade as data center operators seek alternatives to diversify their supply chains and manage costs. The competition between these semiconductor behemoths is intensifying as companies continue to invest heavily in AI infrastructure.

The Bull Case for Investing in AMD Stock

In Q3 of 2025, AMD reported revenue of $9.25 billion and adjusted earnings of $1.20 per share. Comparatively, analysts forecast the chipmaker to report revenue of $8.74 billion and an adjusted earnings per share of $1.16 in the September quarter. While revenue increased by 36% year-over-year (YoY), net income rose to $1.24 billion, from $771 million last year. In Q4, AMD expects its top line to expand by 25% to $9.6 billion, surpassing the consensus forecast of $9.15 billion.

AMD's data center segment reported sales of $4.34 billion, representing a 22% YoY increase. This figure highlights the company's progress in challenging Nvidia's dominance in the artificial intelligence chip market.

The client business also performed well with $2.75 billion in revenue, up 46% from a year ago. Gaming revenue surged 181% to $1.30 billion as Microsoft (MSFT) and Sony (SONY) increased production of Xbox and PlayStation consoles ahead of the holiday shopping season. This boost in semi-custom chip demand provided a welcome tailwind for AMD's gaming division.

Su addressed the company's China business during the earnings call and noted that AMD has received some licenses to ship its Instinct MI308 chips to the region. However, the fourth-quarter guidance excludes any revenue from China, as the company continues to work with customers to assess demand.

The OpenAI partnership announced last month continues to generate excitement about AMD's AI prospects. Su stated the deal could produce over $100 billion in revenue over the coming years, with the broader AI business targeting tens of billions in annual revenue by 2027. Oracle's commitment to deploy 50,000 AMD Instinct MI450 chips further validates the company's competitive position in the data center AI market.

Is AMD Stock Undervalued Right Now?

Despite the strong quarter, investors appeared cautious about margins and the pace of future growth. AMD shares have more than doubled this year, significantly outpacing the Nasdaq's 21% ($NASX) gain, suggesting some profit-taking may be natural after such a substantial run-up.

Analysts tracking AMD stock forecast revenue to increase from $25.8 billion in 2024 to $77 billion in 2028. In this period, adjusted earnings are forecast to expand from $3.31 per share to $14.66 per share.

Today, AMD stock is priced at 45x forward earnings, which is higher than its five-year average multiple of 34x. If the tech stock reverts to its five-year average, it could return over 90% within the next two years.

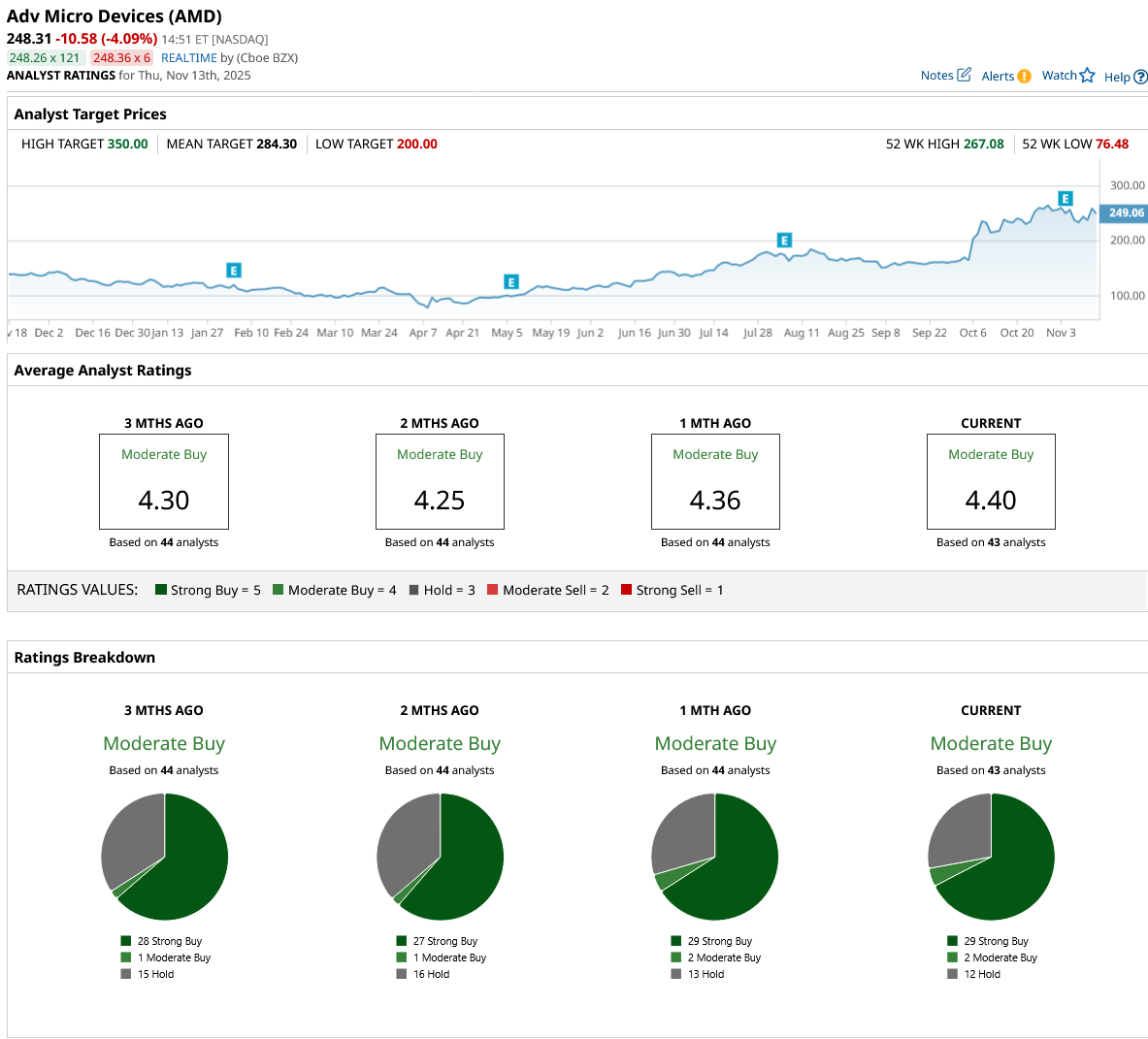

Out of the 43 analysts covering AMD stock, 29 recommend “Strong Buy,” two recommend “Moderate Buy,” and 12 recommend “Hold.” The average AMD stock price target is $284.30, above the current price of $248.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?

- Build-a-Bear Rivals Nvidia’s 5-Year Returns. Is BBW or NVDA Stock the Better Buy Here?