Investors seeking to benefit from the AI revolution do not have to restrict themselves to the “Magnificent Seven,” as there remain several other ways to create wealth in this exciting space. One of them remains through the infrastructure providers, the companies that provide the nuts and bolts that power the various AI applications, tools, and platforms.

To that end, CoreWeave (CRWV) is a name that has intrigued the investor community since it got listed earlier this year.

About CoreWeave

Founded in 2017, CoreWeave is a GPU-focused cloud provider purpose-built for AI/GenAI workloads. Its offerings include large-scale GPU clusters for model training and inference, VFX/rendering and other HPC workloads, managed infrastructure and platform tools, and an expanding set of developer/platform services.

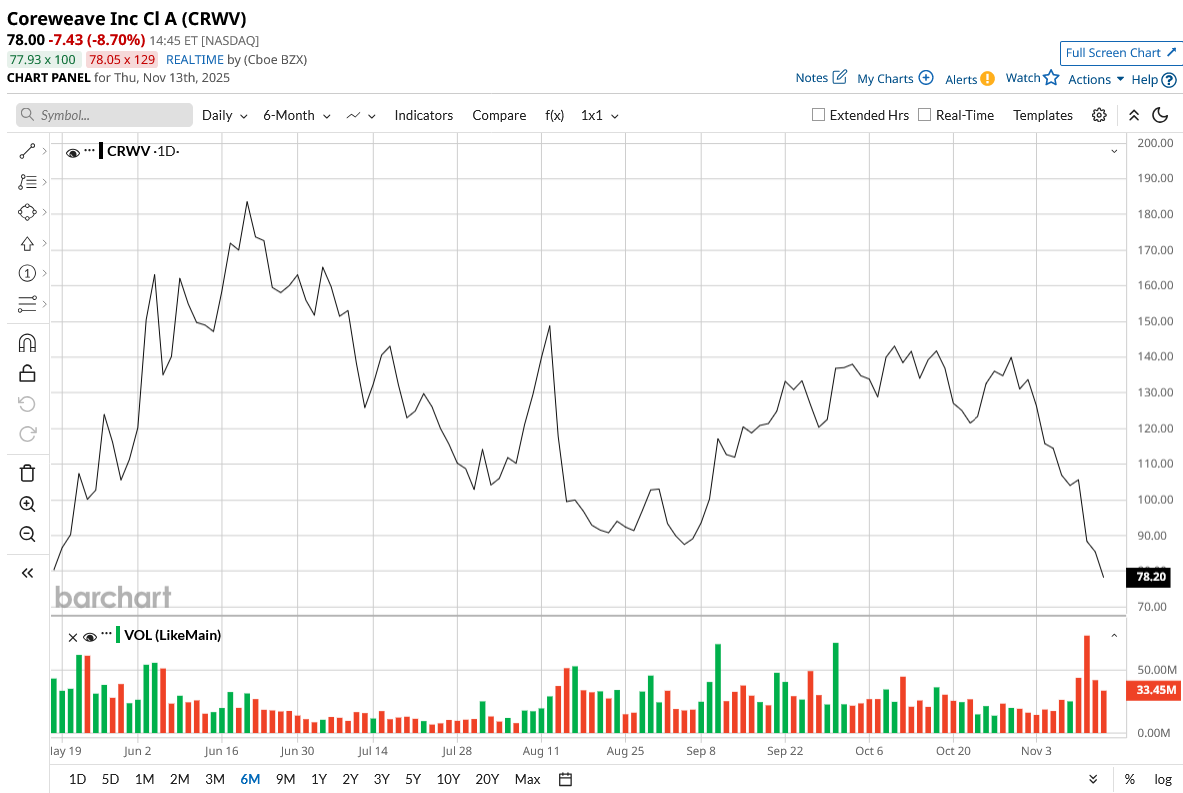

Since its IPO, CRWV stock has been a market favorite, as it has more than doubled, with a rise of 96% on a YTD basis. Notably, CoreWeave's market cap currently stands at $43.2 billion.

However, a lowered revenue guidance and vagueness about a data center buildout delay have resulted in some investors turning their backs on the stock.

Missing the Forest for the Trees

CRWV stock witnessed a sharp decline of over 16% following its Q3 2025 results, after the company reported a delay in capacity deployment from a third-party data center developer/partner, believed to be its earlier acquisition target, Core Scientific (CORZ). CoreWeave had looked to acquire the crypto miner for $9 billion earlier this year to augment its power capacity, reported to be about 1.3 GW.

Further, investors also did not take kindly to the reduction in revenue guidance for 2025, after it was lowered to $5.05 billion to $5.15 billion from $5.15 billion to $5.35 billion earlier.

Although some more clarity regarding the client where the delay occurred was desirable, CEO Mike Intrator said CoreWeave had “boots on the ground” with the client, the lowered revenue guidance seemed more conservative in the sea of optimism and elevated projections in the AI space currently. Thus, the subsequent share price reaction was unwarranted, and the stock was a victim of being a conservative outlier. A closer look at the Q3 results would solidify this assertion.

In Q3 2025, CoreWeave reported record revenues of $1.36 billion, up a considerable 133.7% from the previous year, as losses narrowed to $0.22 per share from $1.82 per share in the same period. Further, revenue backlog, a key indicator of revenue visibility, saw a whopping yearly uptick of 271% to reach $55.6 billion, as collaborations with crucial hyperscalers such as OpenAI ($6.5 billion expansion deal) and Meta (META) (six-year $14.2 billion agreement) deepened.

Net cash from operating activities also saw a significant jump to $1.69 billion from $641.22 million in the year-ago period. Overall, CoreWeave ended the quarter with a cash balance of $1.89 billion, much lower than its short-term debt levels of $4.11 billion. Although it puts a question mark on the liquidity of the company, its strong growth in operating cash flows allays those fears.

Opportunity Gained

Notably, the recent pullback is an opportunity for investors to partake in the growth story of CoreWeave, which has over 41 data centers worldwide, 590 MW of active power, and 2.9 GW of contracted power, as the neocloud market is projected to reach about $175 billion by 2030.

Moreover, CoreWeave distinguishes itself through a fully integrated technology framework, encompassing Nvidia (NVDA)-powered servers, purpose-built data centers, advanced high-speed connectivity, and custom software layers. This setup positions the firm as a foundational provider, enabling third parties to construct and deploy their AI solutions atop its robust infrastructure.

Complementing this strength is the company's deliberate push toward a more varied client portfolio, now evident in its order book. Of the $55.6 billion in committed contracts, approximately 60% stems from investment-grade accounts, and no individual customer accounts for over 35%, a balance that highlights both the caliber and spread of its revenue sources.

About 40% of that backlog is slated for recognition over the coming two years, delivering a clear line of sight into top-line expansion at least through 2026. Such forward-secured commitments place CoreWeave among the steadiest growth paths in the AI compute space.

Moreover, the platform avoids rigid, single-purpose designs, supporting both model training workloads and inference operations, which allows seamless repurposing across user bases. A key differentiator lies in its proprietary Mission Control orchestration tool, which streamlines the assembly of demanding, low-delay GPU environments with speed and precision.

Finally, the firm has also kept the innovation cadence brisk, introducing fresh offerings like AI Object Storage, OpenPipe, Marimo, and Monolith, while venturing into untapped areas such as government contracts, European markets, and in-house construction projects. These steps widen the addressable opportunity set and target pockets of demand where leadership identifies high potential for uptake.

Analyst Opinion on CRWV Stock

Thus, analysts remain cautiously optimistic about the CRWV stock, attributing to it a consensus rating of “Moderate Buy,” with a mean target price of $133.20. This denotes an upside potential of about 56% from current levels. Out of 27 analysts covering the stock, 12 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 13 have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?

- Build-a-Bear Rivals Nvidia’s 5-Year Returns. Is BBW or NVDA Stock the Better Buy Here?

- As Momentum Slows for Rigetti Computing, Should You Sell RGTI Stock Here?