Nvidia (NVDA) investors already know that surging demand for artificial intelligence (AI) hardware has turned the chipmaker into one of the most powerful forces in the market. But over the weekend, CEO Jensen Huang signaled something even more significant: the AI boom isn’t slowing down—it’s accelerating. During a high-profile visit to Taiwan, Huang met with top executives at Taiwan Semiconductor Manufacturing Company (TSM), Nvidia’s most critical manufacturing partner, to ask for one thing: more wafers.

That request may sound technical at first glance, but it actually carries major implications. Wafers are the foundational building blocks of advanced chips, and Nvidia’s next-generation AI lineup will rely heavily on TSMC’s most advanced manufacturing processes. When Huang personally flies out to Taiwan to secure additional production capacity, it sends a clear message: Nvidia expects AI demand to remain exceptionally strong, and the company is racing to lock in supply before competitors can.

With that, let’s break down why this meeting matters and what it could mean for NVDA stock moving forward.

About Nvidia Stock

Nvidia Corporation is a premier technology firm known for its expertise in graphics processing units and artificial intelligence solutions. The company is renowned for its pioneering contributions to gaming, data centers, and AI-driven applications. Nvidia’s technological solutions are developed around a platform strategy that combines hardware, systems, software, algorithms, and services to provide distinctive value. The chipmaker has a market cap of $4.69 trillion, making it the world’s most valuable company.

Shares of the AI darling have rallied 37.5% on a year-to-date (YTD) basis. NVDA stock came under pressure last week as Big Tech names retreated amid valuation concerns. Still, the stock kicked off this week on an upbeat note, rising more than 5% on Monday amid optimism about a possible end to the U.S. government shutdown and positive sentiment following CEO Jensen Huang’s meeting with executives at Taiwan Semiconductor Manufacturing. On Tuesday, the stock faced renewed selling pressure after Japan’s SoftBank Group (SFTBY) disclosed it had sold its entire $5.83 billion stake in the chipmaker.

Today, it is feeling a bit of pressure and is down about 5% as the overall market has already moved on from the positive news of the government reopening.

Nvidia CEO Requests More TSMC Wafers Amid Surging AI Demand

Nvidia CEO Jensen Huang visited Taiwan over the weekend, where he met with executives from key supplier Taiwan Semiconductor Manufacturing Company. Huang said he requested additional chip supplies from TSMC as AI demand remains strong. “The business is very strong, and it’s growing month by month, stronger and stronger,” Huang told reporters.

TSMC Chief Executive C.C. Wei told reporters that Huang had asked for increased wafer production, though the specific quantity remains confidential, according to Reuters. Notably, a wafer is a thin layer of semiconductor material that serves as the basis for manufacturing microchips and integrated circuits. After meeting with Huang, Wei reportedly told employees he expects the company to achieve record-breaking sales year after year. “TSMC is doing a very good job supporting us on wafers,” Huang said during his fourth public visit to Taiwan this year, adding that Nvidia’s success wouldn’t be possible without TSMC. “No TSMC, no Nvidia,” he said.

And now we come to the most interesting part. Taiwanese media reported that Nvidia’s demand could require TSMC to ramp up production of its 3-nanometer wafers at its Taiwan facilities. Nvidia is in talks to boost capacity allocation for TSMC’s N3 process to ensure sufficient semiconductor supply for the next-gen Vera Rubin lineup. The report said that TSMC plans to boost the 3nm capacity at its Southern Taiwan Science Park facility from 100,000 to 160,000 wafers per month, an increase of more than 50%, with a significant portion of that additional capacity expected to be allocated exclusively to Nvidia. This suggests that Nvidia is highly confident in massive demand for its Rubin AI chips, prompting the company to secure additional supply well in advance.

Nvidia’s next-generation Rubin AI lineup is set to be a major milestone, as the architecture is expected to deliver broad-based improvements and a substantial “compute leap.” In addition to utilizing TSMC’s N3P process, Rubin will feature the advanced HBM4 memory technology, significantly elevating the lineup’s performance capabilities. Notably, during his visit to Taiwan, Huang stated that the Rubin GPU has already entered the production line.

All Eyes on Nvidia’s Q3 Results

As Rubin moves into production, demand for Nvidia’s current-generation Blackwell and Blackwell Ultra GPUs remains unstoppable. Huang noted that demand for Blackwell remains “very strong” and extends beyond just GPUs. “Nvidia builds the GPU, but we also build the CPU, the networking, the switches, and so there are a lot of chips associated with Blackwell,” he said.

With that, all eyes are now on Nvidia’s third-quarter earnings report, scheduled for Wednesday, November 19th, after the market closes. Rising spending on AI hardware from major tech companies is expected to show up in strong revenue growth, effectively validating Huang’s optimism about AI demand. UBS analysts recently boosted their global AI capital expenditure forecast to $423 billion for this year and $571 billion for 2026, up from prior estimates of $375 billion and $500 billion, respectively.

Analysts project that Nvidia’s Q3 earnings per share (EPS) will climb 54.14% year-over-year (YoY) to $1.25. Revenue is expected to grow 56.30% YoY to $54.83 billion, fueled by strong growth in the data center segment powered by the Blackwell architecture.

Investors will also be closely watching Nvidia’s Q4 guidance, with analysts currently projecting revenue of around $61.3 billion. Many on Wall Street anticipate that the company will once again deliver above-consensus guidance, a trend that has become typical.

On Tuesday, Bank of America analyst Vivek Arya and his team reaffirmed their “Buy” rating and $275 price target, saying that with its dominant market position and expanding order book, Nvidia remains “one of the most compelling ways to invest in the AI revolution.” On Monday, Citi analyst Atif Malik lifted his price target for NVDA stock to $220 from $210, noting that supply, not demand, remains the key bottleneck in AI chips. Separately, Melius Research analyst Ben Reitzes reiterated a “Buy” rating on the stock with a $300 price target. “Given strong checks, hyperscaler buying and recent sovereign licenses, we are expecting upside to data center revenues for F3Q October quarter and upside to F4Q guidance for January, with positive commentary on the GB300 and overall demand trends,” Reitzes wrote.

What Do Analysts Expect for NVDA Stock?

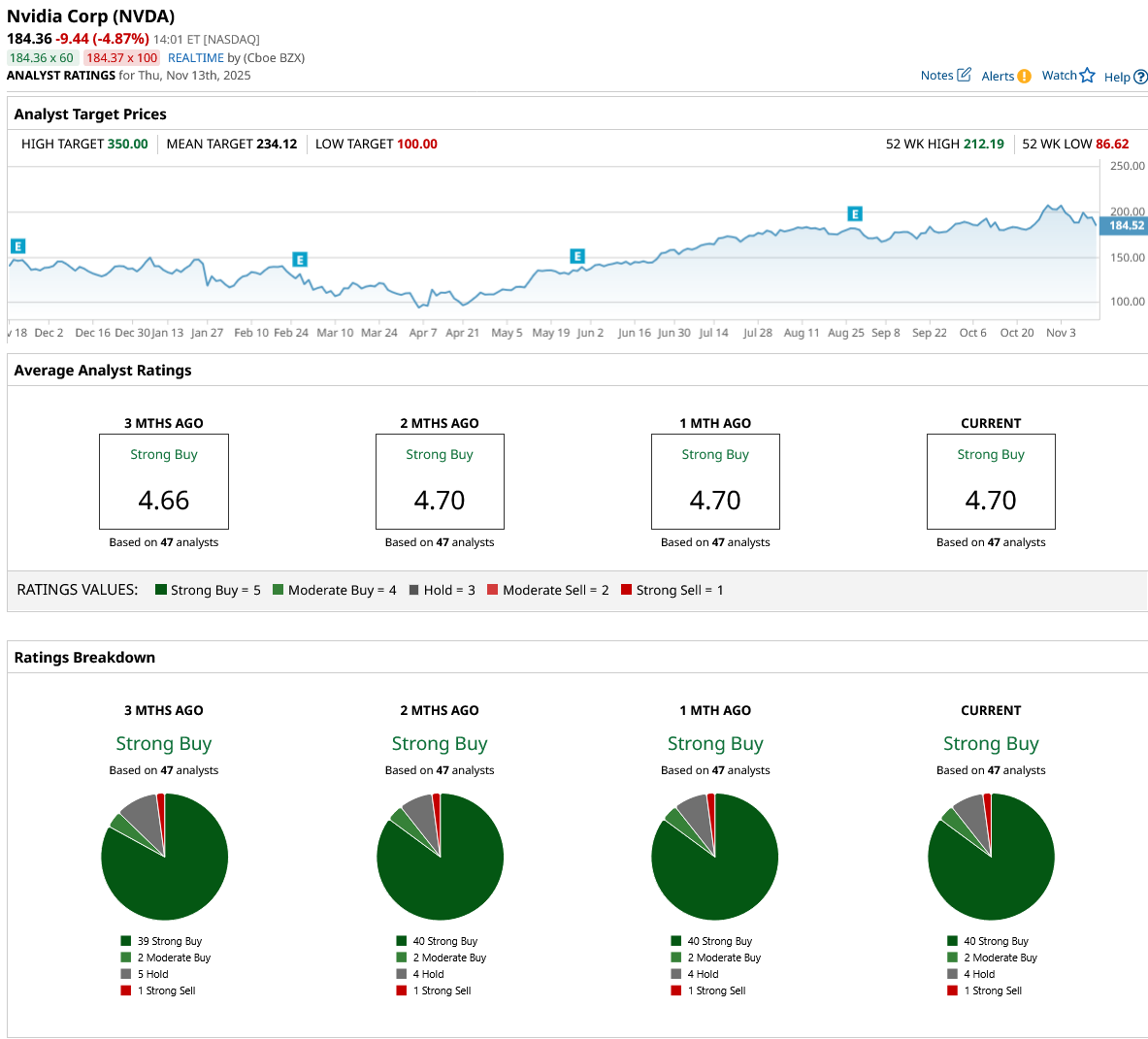

Wall Street analysts remain highly bullish on Nvidia’s growth prospects, as reflected in NVDA stock’s top-tier consensus “Strong Buy” rating. Of the 47 analysts covering the stock, 40 rate it a “Strong Buy,” two call it a “Moderate Buy,” four suggest holding, and one gives a “Strong Sell” rating. The average price target for NVDA stock stands at $234.12, indicating a 27% upside from current levels.

On the date of publication, Oleksandr Pylypenko had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?

- Build-a-Bear Rivals Nvidia’s 5-Year Returns. Is BBW or NVDA Stock the Better Buy Here?

- As Momentum Slows for Rigetti Computing, Should You Sell RGTI Stock Here?

- CEO Lisa Su Says that ‘Insatiable’ Demand Is Powering AMD. Should You Buy Its Stock Here?