The past 24 hours in the cryptocurrency market felt like watching a grand chandelier wobble before finally letting a few crystals fall. The market cap shrank 3.8% to $3.42 trillion, wiping out nearly $130 billion in what looked like an industry-wide cooldown. Bitcoin (BTCUSD) did not escape the turbulence either.

It slipped below the $100K mark and ended its latest session down 3.9% at $94,859.63. Stocks were not immune either. The U.S. government’s messy restart has raised concerns among economists, who fear that some federal economic data lost during the 43-day shutdown may never be fully restored.

At the same time, expectations for another Federal Reserve rate cut have faded, with the CME FedWatch Tool assigning just a 45.9% probability to a 25-bps cut in December. Caught in this downdraft, Bullish (BLSH), the digital asset trading platform known for its institutional-grade market infrastructure, saw its shares slump nearly 30% in the past month.

With BLSH shares sliding in step with the market’s broader shakeout, the important question now is whether this pullback represents a timely entry point or a signal to wait for a steadier footing.

About Bullish Stock

Based in George Town, Cayman Islands, Bullish is a fintech business focused on digital asset trading and market infrastructure. It operates Bullish Exchange, a regulated venue that offers both spot and derivatives trading. It also owns CoinDesk, which provides blockchain news and data analytics.

With a market cap circling around $6 billion, the company directs most of its energy toward institutional clients and toward innovation in blockchain-based financial solutions.

During the past three months, shares of BLSH dropped 39.7%, and the past five days alone brought another 8% decline, echoing the broader crypto market shakeout. The comparison with the Fidelity Crypto Industry and Digital Payments ETF (FDIG) paints a clearer picture, as it posted an 11.5% gain during the past three months yet dropped 14.6% in the past five days.

The sell-off has been dramatic for the sector, but the three-month period proved especially punishing for BLSH. Even so, its fundamentals continue to show resilience and offer a slight cushion for investors who still believe in the long-term narrative.

BLSH currently trades at 164.22 times forward adjusted earnings and 22.61 times sales. Both values indicate a premium valuation relative to broader industry multiples and confidence in its long-term ambition.

A Closer Look at Bullish’s Q2 Earnings

On Sept. 17, BLSH shares rose 5.8% after the company posted its second-quarter fiscal 2025 results. Adjusted revenue reached $57 million for the quarter. While this fell short of analyst expectations of $60.7 million, the report revealed impressive momentum in other areas.

Subscription Services and Other revenue climbed to $32.9 million, marking a 27.4% year-over-year (YoY) increase. Trading volume surged 35% YoY to $179.6 billion. Digital asset sales jumped 18.1%, reaching $58.6 billion. Meanwhile, average daily volume totaled 1.974 billion, a 35% increase from the prior year’s period.

The company delivered net income of $108.3 million, which represented a complete reversal from the net loss of $116.4 million reported last year. EPS arrived at $0.93 compared to a loss per share of $1.03 in last year’s quarter and easily exceeded analyst expectations of $0.03.

Looking ahead, Bullish’s management projects trading volume between $133 billion and $142 billion for the third quarter. It expects adjusted transaction revenue to range from $25.5 million to $28.0 million. Adjusted EBITDA is expected to land between $25 million and $28 million. The company also anticipates adjusted net income between $12 million and $17 million for the quarter.

The next milestone is scheduled to arrive on Wednesday, Nov. 19, before the market opens, when Bullish releases its Q3 fiscal 2025 earnings results. Analysts expect the quarter’s EPS to fall 100% YoY to $0.08. They forecast the full fiscal year bottom line to also drop 100% to $0.27.

However, the Street expects fiscal year 2026 EPS to widen 233.3% to $0.90, indicating renewed confidence in the growth narrative.

What Do Analysts Expect for BLSH Stock?

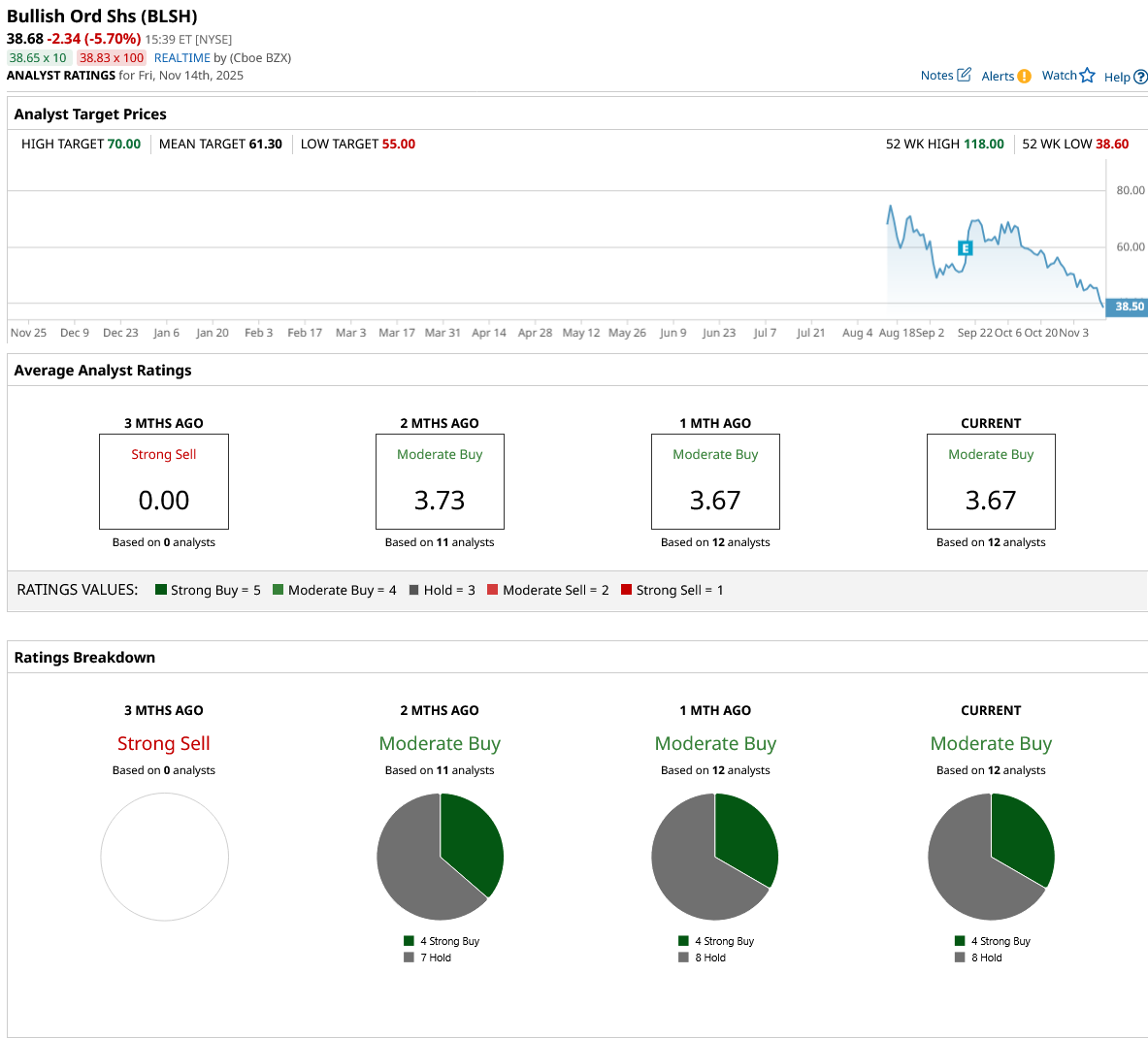

Recent times have delivered turbulence and pushed BLSH into deep waters. Yet analyst sentiment shows that the long-term outlook still carries promise. Analysts maintain a constructive view on BLSH, assigning it a consensus rating of “Moderate Buy.”

Among the 12 analysts who cover the stock, four have issued a “Strong Buy” rating while eight recommend a “Hold.”

The average price target for BLSH sits at $61.30, suggesting potential upside of 58%. Meanwhile, the Street-high target of $70 represents an even greater potential gain of 81% from current price levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Barchart’s Technical Indicators Are Flashing ‘Buy’ as Warren Buffett Loads Up on 17.8 Million Shares of Google Stock

- Bullish Shares Are Down 35% in the Past Month. Should You Buy the Dip in BLSH Stock?

- MicroStrategy Falls Below Net Asset Value Amid Crypto Crash. Should You Buy the Dip in MSTR Stock?

- This Rare Earths Stock Is Expanding Its Footprint. Should You Buy Shares Now?