Payoneer Global (PAYO) is an international financial technology company specializing in secure cross-border payments, digital money transfers, and global payroll solutions for businesses and entrepreneurs of all sizes. Its multi-currency platform enables users to send and receive funds, manage working capital, pay vendors, and access local accounts in over 150 global currencies across more than 190 countries.

Founded in 2005, Payoneer is headquartered in New York City. The company operates worldwide, serving customers in North America, Europe, Asia, the Middle East, and Latin America.

About Payoneer Stock

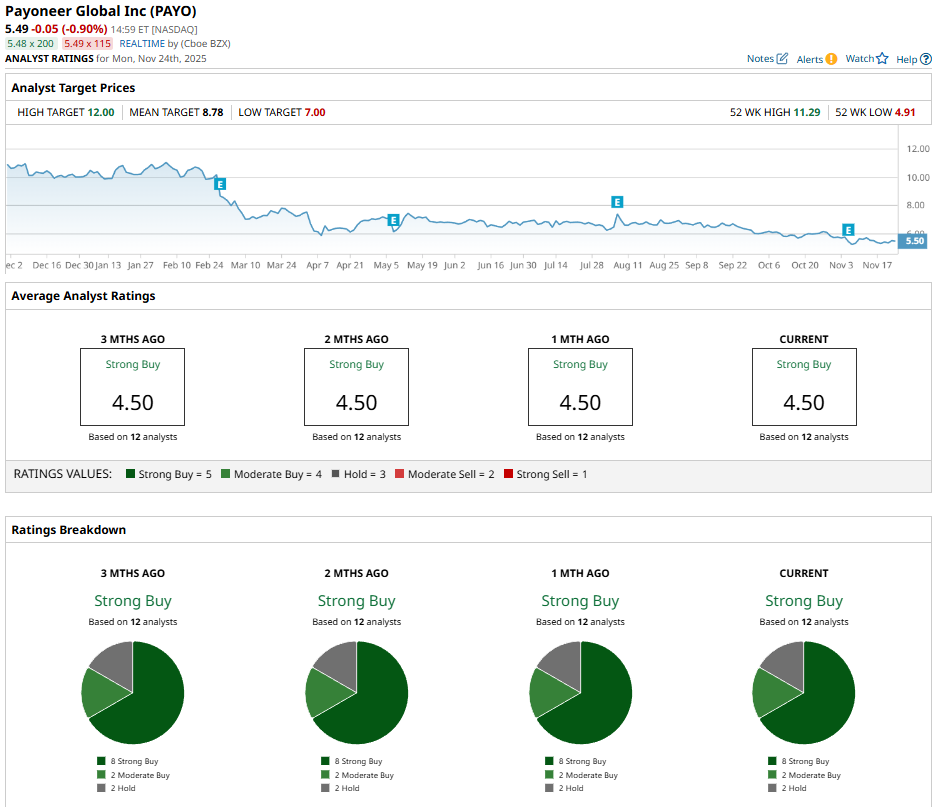

Payoneer stock has experienced moderate volatility in 2025. Over the past 6 months, Payoneer faced a decline of approximately 17%, reflecting broader sector weakness. On top of that, the stock is down 48% over the past 52 weeks and is currently trading just 15% above its 52-week low.

Payoneer Results

Payoneer Global reported its Q3 2025 results on Nov. 5, 2025, with revenue reaching $271 million, reflecting a 9% year-over-year increase. Earnings were $0.04 per adjusted share, slightly below analyst estimates. Revenue excluding interest income grew 15% year-over-year to $211 million, driven by higher transaction volumes and strategic pricing. Adjusted EBITDA margin stood at 26%, showing solid operational efficiency.

The company maintained a strong cash reserve of around $479 million and generated positive free cash flow, supporting ongoing investments and share repurchases totaling $45 million in 2025 year-to-date. Payoneer serves over 557,000 active Ideal Customer Profiles (ICPs), with significant growth in B2B and marketplace sellers.

For Q4, Payoneer projects continued revenue growth supported by expanding global e-commerce, cross-border payments, and a rising client base. The company expects to capitalize on increased demand for digital payment solutions and broader financial technology adoption globally, while managing costs prudently to sustain profitability.

Bridgewater Adds Stake

Bridgewater Associates added a new position in Payoneer Global during Q3 2025, purchasing 953,754 shares. This reflects Bridgewater’s conviction in Payoneer’s cross-border fintech solutions and growth potential amid expanding global digital commerce. The fund’s new exposure to Payoneer underlines confidence in the company’s ability to scale payment services for businesses and freelancers worldwide, leveraging its extensive global payment infrastructure to capitalize on continued fintech adoption and growth trends.

Additionally, Bridgewater Associates increased its total portfolio value from $24.79 billion in Q2 to $25.53 billion, with the number of holdings increasing from 585 to 1014.

Should You Buy PAYO?

Despite the weak market performance, Wall Street has the stock marked as a clear “Buy” with a consensus “Strong Buy” rating and a mean price target of $8.78, reflecting upside potential of 53%.

The stock has been rated by 12 analysts, receiving 8 “Strong Buy” ratings, 2 “Moderate Buy” ratings, and 2 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart