Wall Street can be surprising at times, as even when a stock takes a sharp hit, major analysts often stay confident instead of backing away. That’s exactly what’s happening with Astera Labs, Inc. (ALAB). Despite being down more than 45% from its 52-week high, analyst coverage remains overwhelmingly bullish.

BNP Paribas recently initiated coverage on Astera Labs with an “Outperform” rating and a $225 price target. The firm called the stock’s drop since mid-September’s high an attractive buying opportunity, citing expectations that Amazon’s next-gen Trainium systems could significantly boost Astera’s revenue over the next three years. Analyst Karl Ackerman noted that Astera’s content in these systems could jump from $100 to over $700 per accelerator, reflecting major growth potential.

This isn’t just another semiconductor play. Astera is positioning itself as a critical architect of artificial intelligence (AI) Infrastructure 2.0, supplying next-generation connectivity solutions that power rack-scale AI systems. With its PCIe 6 portfolio ramping into volume, switch fabric wins piling up, and a string of design partnerships in place. Let’s dig deeper.

About Astera Labs Stock

Astera Labs is a fabless semiconductor company that designs high-speed connectivity solutions for cloud and AI infrastructure. Headquartered in San Jose, California, the firm provides an intelligent connectivity platform built around PCIe, CXL, Ethernet-based ICs, and a system-management software suite called COSMOS. Founded in 2017, Astera Labs is rapidly scaling to serve hyperscalers and OEMs. The company has a market cap of $24 billion.

Astera Labs has been aggressively scaling its next-generation connectivity business: it recently ramped production of its PCIe 6 portfolio, adding gearbox solutions alongside fabric switches, retimers, and active cable modules. On top of that, Astera deepened its collaboration with Nvidia Corp (NVDA), contributing NVLink connectivity solutions for NVIDIA’s NVLink Fusion ecosystem to support high-performance, scale-up AI platforms.

Astera Labs’ share price has been highly volatile this past year, swinging between a 52-week low of $47.13 reached in April this year and a high of $262.90, reached on Sept. 18. After peaking in Sept., the stock has fallen sharply, down 46.1% from its high in just a few months.

On a year-to-date (YTD) basis, ALAB has delivered 7.1% gains, even as short-term momentum cooled. The stock is up 36.2% over the past 52 weeks.

The pullback from the highs could be interpreted as a consolidation phase, especially since the stock gained significantly on its way up to $262.90.

ALAB’s recent price performance paints the picture of a high-growth, high-risk semiconductor play: one that has delivered strong gains but now faces a critical test of support after a steep pullback. For long-term investors, the recent weakness might offer a compelling entry, but it comes with the caveat that the upside depends heavily on Astera’s ability to execute on its roadmap.

Despite the pullback, the stock is still trading at a premium valuation compared to its industry peers at 144.49 times forward earnings.

Record Topline Numbers

Astera Labs delivered a blowout third quarter on Nov. 4, posting a record $230.6 million in revenue for the quarter ended Sept. 30, a 20% sequential increase and 104% relative to the same period last year. Management attributed this surge to strong demand across its core product lines, particularly signal-conditioning ICs, smart cable modules (SCMs), and switch fabric solutions as customers scaled up next-generation AI platforms.

On the profitability front, the company achieved a non-GAAP gross margin of 76.4%, slightly down from 77.8% a year ago and a non-GAAP operating income of $96.1 million, up from $36.6 million in the year-ago quarter, yielding an operating margin of 41.7% versus 32.4% in the prior period. Non-GAAP EPS was reported at $0.49, up significantly from $0.23 a year earlier.

Looking ahead to Q4 FY2025, Astera guided for revenue between $245 million and $253 million, implying continued but more moderate growth. It expects both GAAP and non-GAAP gross margins to hover around 75%. The company forecasts non-GAAP EPS of $0.51.

Management also reiterated its long-term vision even as ALAB leans into continued PCIe 6 adoption, and expects Taurus Ethernet SCMs to contribute meaningfully in Q4. On top of that, the company’s latest acquisition of aiXscale Photonics is expected to expand the connectivity roadmap into interconnects, a move to complement its copper-based products and help address future high-bandwidth AI infrastructure needs.

Analysts remain optimistic as they predict EPS to be around $0.98 for fiscal 2025, up 238% year-over-year, before surging by another 32.7% annually to $1.30 in fiscal 2026.

What Do Analysts Expect for Astera Labs Stock?

Analysts’ sentiment around ALAB is clearly warming up as several firms have recently initiated or upgraded coverage, signaling growing attention.

Apart from BNP Paribas, Raymond James initiated coverage on Astera Labs with a “Market Perform” rating, noting that while the company is a key beneficiary of the GenAI boom and holds strong first-mover advantages in PCIe 5 and 6 technologies, the stock already trades at a premium valuation. The firm cited solid strengths, including leadership positions with major customers like Amazon.com (AMZN)and Alphabet (GOOGL), expanding opportunities in PCIe fabric switches and active electrical cables, and a healthy balance sheet.

On the other hand, Northland upgraded Astera Labs to “Outperform” earlier this month with a $175 price target, citing strong long-term earnings potential and upcoming growth catalysts such as the ramp of its Scorpio X product in spring 2026. The firm highlighted Astera’s deep hyperscaler relationships led by Amazon and sees the company well-positioned for sustained revenue acceleration despite challenges in overall data center buildouts.

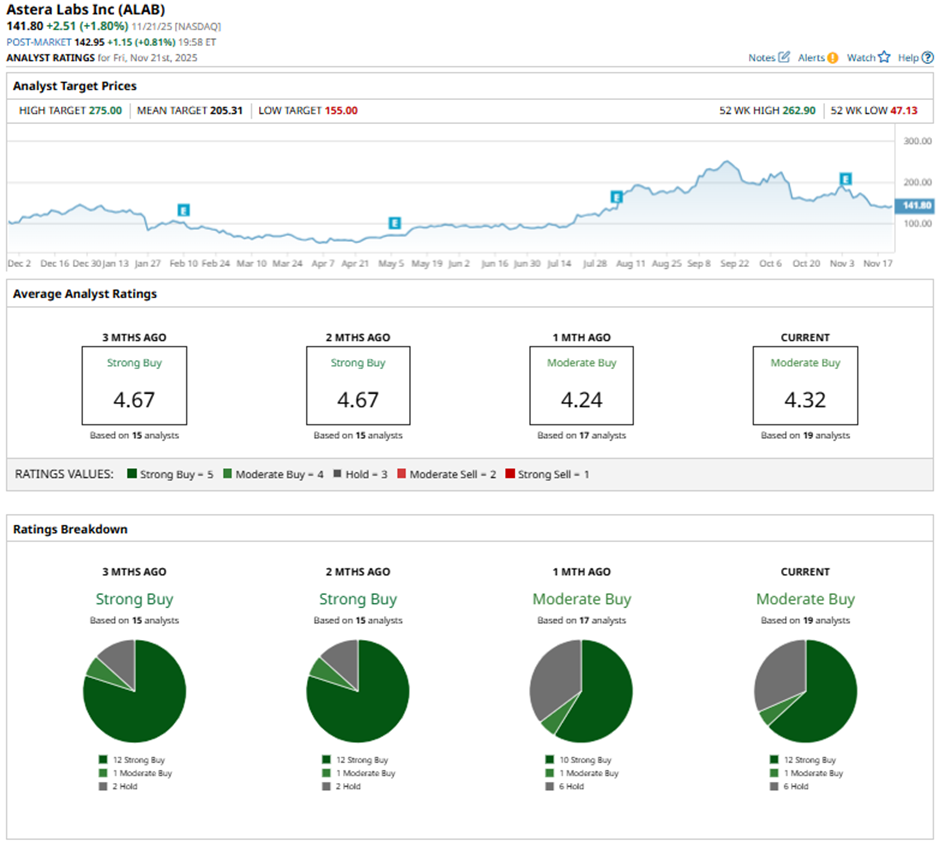

Wall Street is turning fairly bullish on ALAB. Overall, ALAB has a consensus “Moderate Buy” rating. Of the 19 analysts covering the stock, 12 advise a “Strong Buy,” one suggests a “Moderate Buy,” and the remaining six analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for ALAB is $205.31, indicating a potential upside of 44.8%. The Street-high target price of $275 suggests that the stock could rally as much as 93.9%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Google Is Getting the AI Spotlight, But Nvidia Says Its GPUs Are a ‘Generation Ahead.’ How Should You Play NVDA Stock Here?

- Can Dell Stock Break Through Its 100-Day Moving Average on Post-Earnings Pop?

- Unusual Activity in Oracle Corp Put Options Highlights ORCL Stock's Value