Kohl’s (KSS) shares closed over 40% higher on Nov. 25 after the chain of department stores posted a strong Q3 and raised its guidance for the full year.

The quarterly release arrives only a day after the retailer named Michael Bender its permanent CEO. Bender has been serving as the company’s interim chief executive since May.

Following the post-earnings surge, Kohl’s stock is up more than 280% versus its year-to-date low.

Should You Buy Kohl’s Stock on Post-Earnings Strength?

Kohl’s third-quarter earnings warrant owning the retail stock for the long-term as they confirm that Bender’s turnaround strategy has already started to reshape the firm’s operational playbook.

Under his leadership, Kohl’s is reintroducing value-focused categories like the petite section and comprehensive discounts to attract lower- and middle-income consumers amidst macroeconomic uncertainty.

And its revised outlook for a 4% sales decline this year, versus at least 5% it had guided for earlier. suggests this renewed focus on customer loyalty and affordability is already gaining traction.

More importantly, in the earnings release, Bender acknowledged the “progressive improvement,” but said “this performance is not representative of where we aspire to be.”

This signals confidence in continued momentum moving forward, further strengthening the case for owning KSS shares heading into 2026.

KSS Shares Are Trading at a Significant Discount

Despite a massive surge since early April, Kohl’s shares remain worth owning since the retail chain is still trading at a steep discount to its book value.

According to the company’s latest annual filing (10-K), the book value of its land and buildings is $9.44 billion, about a billion-dollar more than its current enterprise value.

KSS stock pays a dividend yield of 2.3% as well, which makes it even more attractive at least for income-focused investors.

From a technical perspective, the retail stock is now trading handily above all of its major moving averages (50-day, 100-day, 200-day) – reinforcing that it’s in a strong uptrend heading into 2026.

What’s the Wall Street’s View on Kohl’s Heading into 2026?

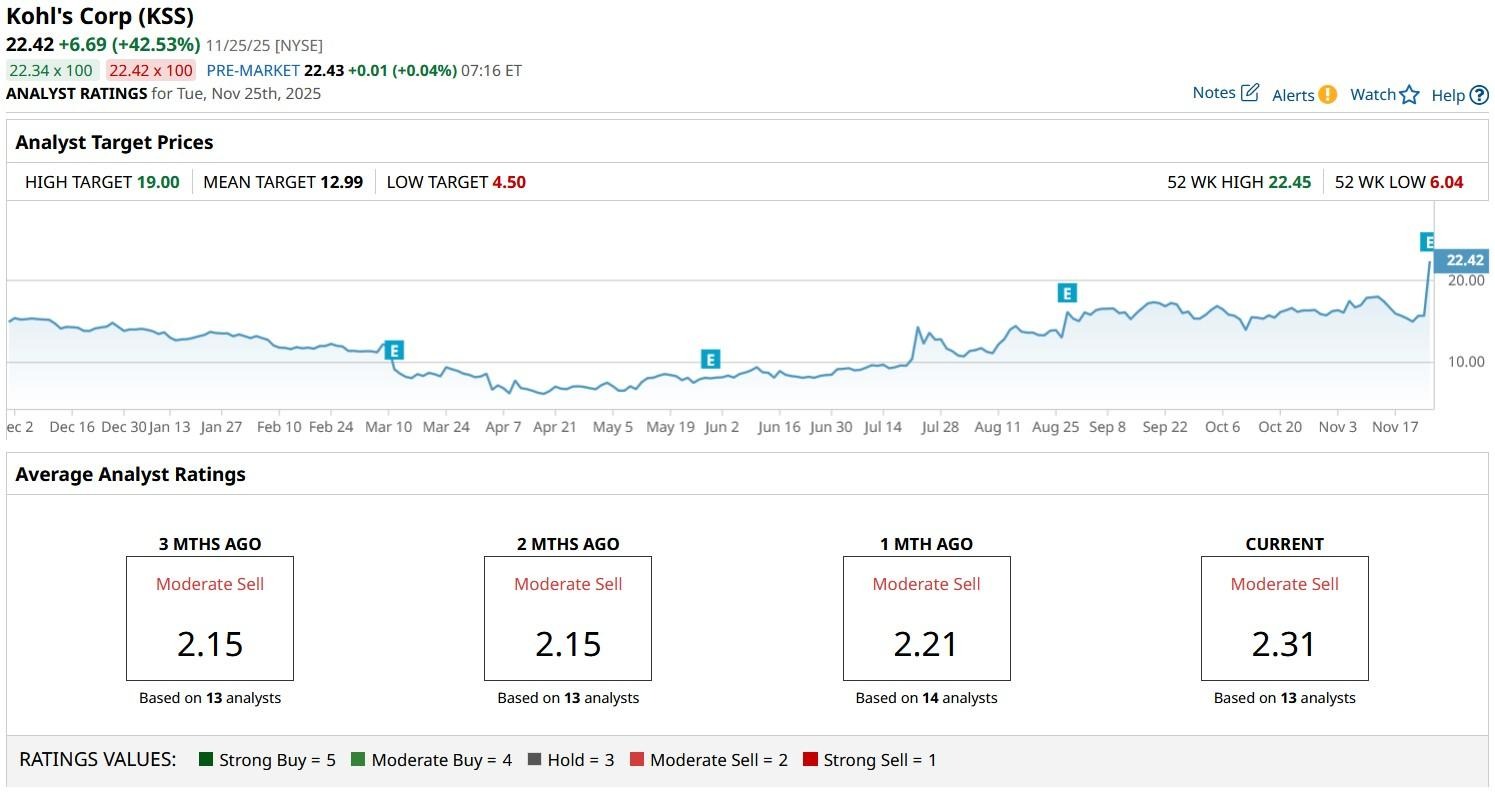

Heading into the Q3 earnings release, Wall Street had a consensus “Moderate Sell” rating on Kohl’s stock.

However, it’s reasonable to assume that at least some analysts will upwardly revise their estimates for KSS shares to reflect the quarterly strength in the sessions ahead.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?