With a market cap of $24 billion, Church & Dwight Co., Inc. (CHD) is a U.S.-based manufacturer and marketer of household, personal care, and specialty products, operating across Consumer Domestic, Consumer International, and Specialty Products segments. It owns a diverse portfolio of well-known brands spanning cleaning, personal care, health, and animal nutrition, sold through both retail and industrial channels worldwide.

Shares of the Ewing, New Jersey-based company have underperformed the broader market over the past 52 weeks. CHD stock has decreased 5.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.9%. However, shares of the company are up 19.3% on a YTD basis, outpacing SPX’s marginal decline.

Narrowing the focus, shares of the maker of household and personal products have lagged behind the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 10.8% return over the past 52 weeks.

Shares of Church & Dwight surged 4.7% on Jan. 30 after the company reported stronger-than-expected Q4 2025 adjusted EPS of $0.86, driven by steady demand for both value and premium household and personal care products. Investors also reacted positively to adjusted gross margin expanding 90 bps to 45.5% and management’s outlook for another ~100 bps margin expansion in 2026. Additionally, the company forecast volume-driven organic sales growth of 3% - 4% and adjusted EPS growth of 5% - 8% for 2026.

For the fiscal year ending in December 2026, analysts expect CHD’s adjusted EPS to grow 7.1% year-over-year to $3.78. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

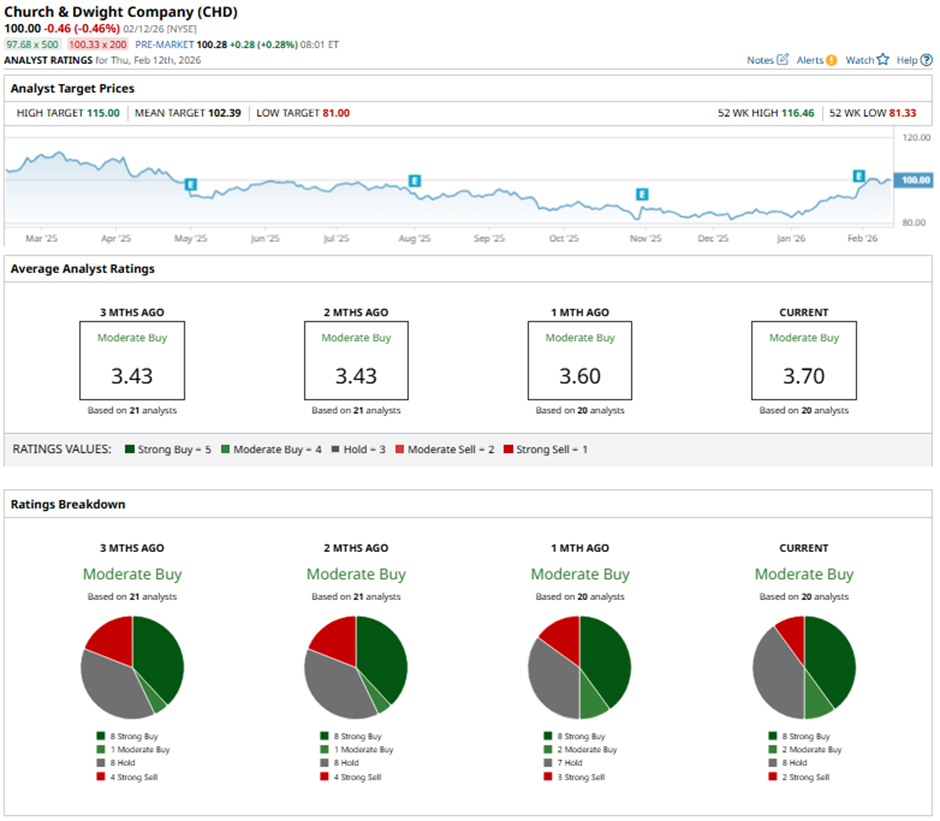

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buys,” eight “Holds,” and two “Strong Sells.”

On Feb. 2, BofA raised its price target on Church & Dwight to $115 and maintained a “Buy” rating.

The mean price target of $102.39 represents a 2.4% premium to CHD’s current price levels. The Street-high price target of $115 suggests a 15% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart