New York, New York--(Newsfile Corp. - August 21, 2025) - The latest data from the Bureau of Labor Statistics showed mixed trends in the U.S. leisure and hospitality sector, as analyzed by OysterLink.

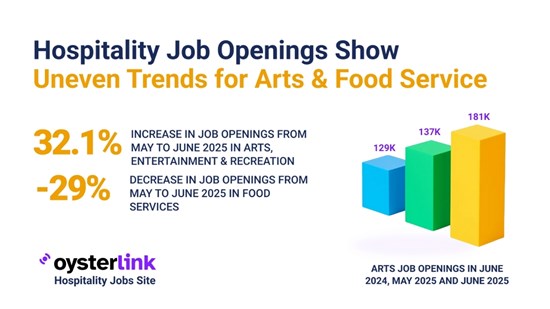

Hospitality Job Openings Show Uneven Trends for Arts & Food Service

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10722/263368_192baee474019a6a_001full.jpg

While Arts, Entertainment, and Recreation (AER) is adding jobs and expanding openings, Accommodation and Food Services (A&FS) is slowing after a strong May hiring period.

Overall, the sector remains more active than a year ago, with continued demand for workers and ongoing voluntary turnover.

Job openings

In June 2025, openings in AER increased sharply from May, while openings in A&FS dropped after a seasonal hiring peak. The overall leisure and hospitality sector remains above June 2024 levels despite the slowdown.

| Subsector | June 2024 | May 2025 | June 2025p | Change May → June |

| Arts, Entertainment & Recreation | 129,000 | 137,000 | 181,000 | +32.1% |

| Accommodation & Food Services | 777,000 | 1,062,000 | 754,000 | −29.0% |

| Leisure & Hospitality Total | 906,000 | 1,199,000 | 935,000 | −22.0% |

AER's openings climbed by 44,000 in June, showing growing demand for talent, while A&FS openings fell by 308,000, slightly below last year's level, indicating a return to normal hiring after a seasonal surge.

Hiring activity

Hiring followed a similar pattern. Overall, leisure and hospitality hires remain above June 2024 levels, even though June 2025 saw a slight decline from May.

| Subsector | June 2024 | May 2025 | June 2025p |

| Arts, Entertainment & Recreation | 139,000 | 205,000 | 163,000 |

| Accommodation & Food Services | 623,000 | 923,000 | 817,000 |

| Leisure & Hospitality Total | 762,000 | 1,128,000 | 980,000 |

The data show that even with fewer hires than in May, employers in both subsectors are still actively filling positions. AER hiring remains robust, reflecting expansion in the sector, while A&FS hiring is still elevated compared with last year despite the month-over-month pullback.

Turnover

Voluntary quits remain the largest driver of separations in hospitality. Most workers are leaving by choice rather than being laid off, signaling ongoing competition for talent across the industry.

| Subsector | Quits | Layoffs/discharges | Other separations | Total separations |

| AER | 74,000 | 60,000 | 6,000 | 140,000 |

| A&FS | 709,000 | 99,000 | 16,000 | 823,000 |

| Leisure & Hospitality Total | 783,000 | 159,000 | 22,000 | 963,000 |

This table underscores that voluntary quits account for about 81% of total separations in June 2025. Employers in both subsectors should focus on retention strategies, such as predictable scheduling and advancement opportunities, while continuing to recruit for hard-to-fill roles.

The June 2025 data highlight a split in the leisure and hospitality labor market. Arts and Entertainment is expanding its job openings, while food service is normalizing after a seasonal peak.

Despite the slowdown in A&FS openings, overall hiring and separations remain higher than in June 2024, reflecting strong ongoing labor demand and continued worker mobility. Employers can use these insights to plan recruitment and retention strategies as the summer season progresses.

About OysterLink

OysterLink is a job platform for restaurant and hospitality professionals with over 400,000 monthly visitors. OysterLink connects talent with opportunities across the U.S., including the top server jobs in New York City or bartender jobs in Los Angeles.

The platform also offers trend reports, expert insights, and interviews with leaders in hospitality. To explore more data-driven insights or post a job that works for today's talent, visit www.oysterlink.com.

Media Contact

Ana Demidova

ana@oysterlink.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263368