Clothing and footwear retailer Boot Barn (NYSE: BOOT) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 13.7% year on year to $425.8 million. The company expects next quarter’s revenue to be around $588.5 million, close to analysts’ estimates. Its GAAP profit of $0.95 per share wasalso in line with analysts’ consensus estimates.

Is now the time to buy Boot Barn? Find out by accessing our full research report, it’s free.

Boot Barn (BOOT) Q3 CY2024 Highlights:

- CEO leaves the company to join Ross Stores

- Revenue: $425.8 million vs analyst estimates of $424.4 million (in line)

- EPS (GAAP): $0.95 vs analyst expectations of $0.95 (in line)

- The company lifted its revenue guidance for the full year to $1.89 billion at the midpoint from $1.83 billion, a 3.1% increase

- EPS (GAAP) guidance for the full year is $5.45 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 35.9%, in line with the same quarter last year

- Operating Margin: 9.4%, in line with the same quarter last year

- Free Cash Flow was -$46.11 million, down from $39.87 million in the same quarter last year

- Locations: 425 at quarter end, up from 371 in the same quarter last year

- Same-Store Sales rose 4.9% year on year (-4.8% in the same quarter last year)

- Market Capitalization: $4.82 billion

Mr. Starrett stated, “John Hazen is very highly regarded within the Boot Barn organization and has a diverse background that includes brand building, digital, and store roles. He has a strong track record of growing sales and profits both at Boot Barn and prior to joining the Company. He also has been extremely instrumental in advancing Boot Barn’s customer-facing technology capabilities including many industry-leading applications of artificial intelligence. I am confident in his ability to step into the role as Interim CEO. Personally, I am looking forward to providing oversight and mentorship as Executive Chairman while the Board conducts an internal and external search before making a permanent decision on our next CEO.”

Company Overview

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

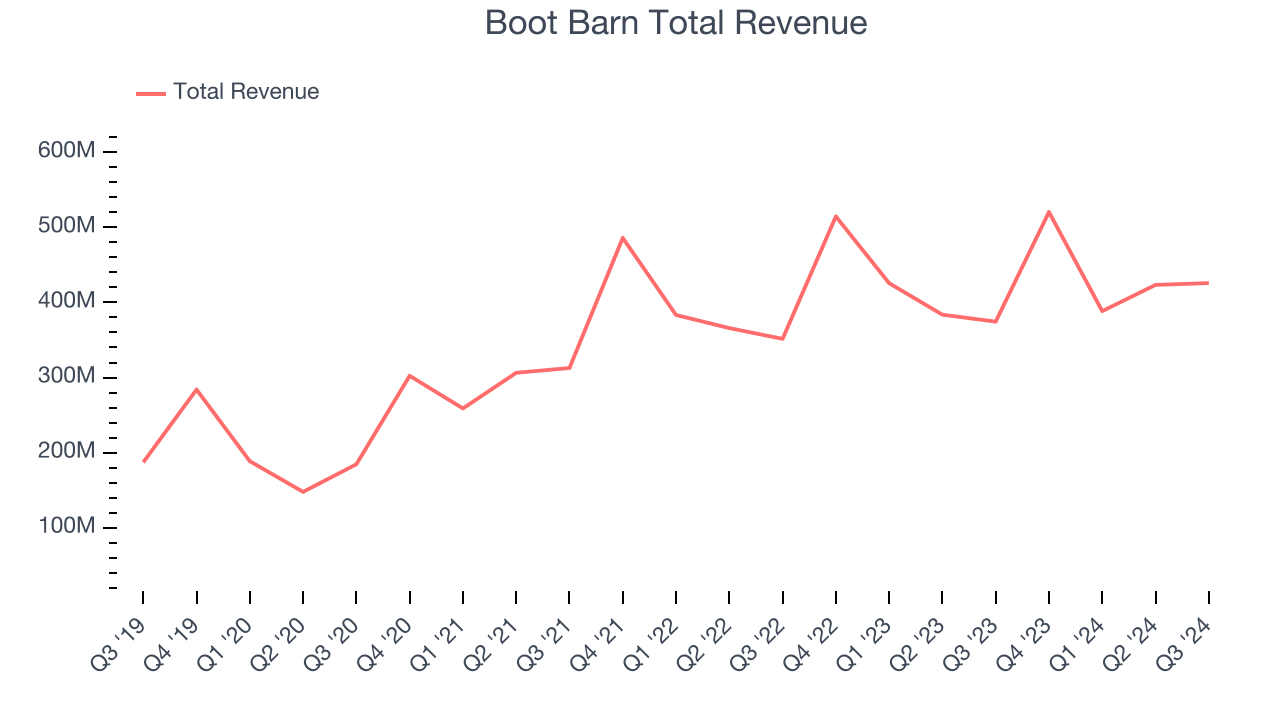

As you can see below, Boot Barn’s sales grew at an impressive 16.5% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Boot Barn’s year-on-year revenue growth was 13.7%, and its $425.8 million of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 13.1% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.6% over the next 12 months. Still, this projection is admirable and illustrates the market is factoring in success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

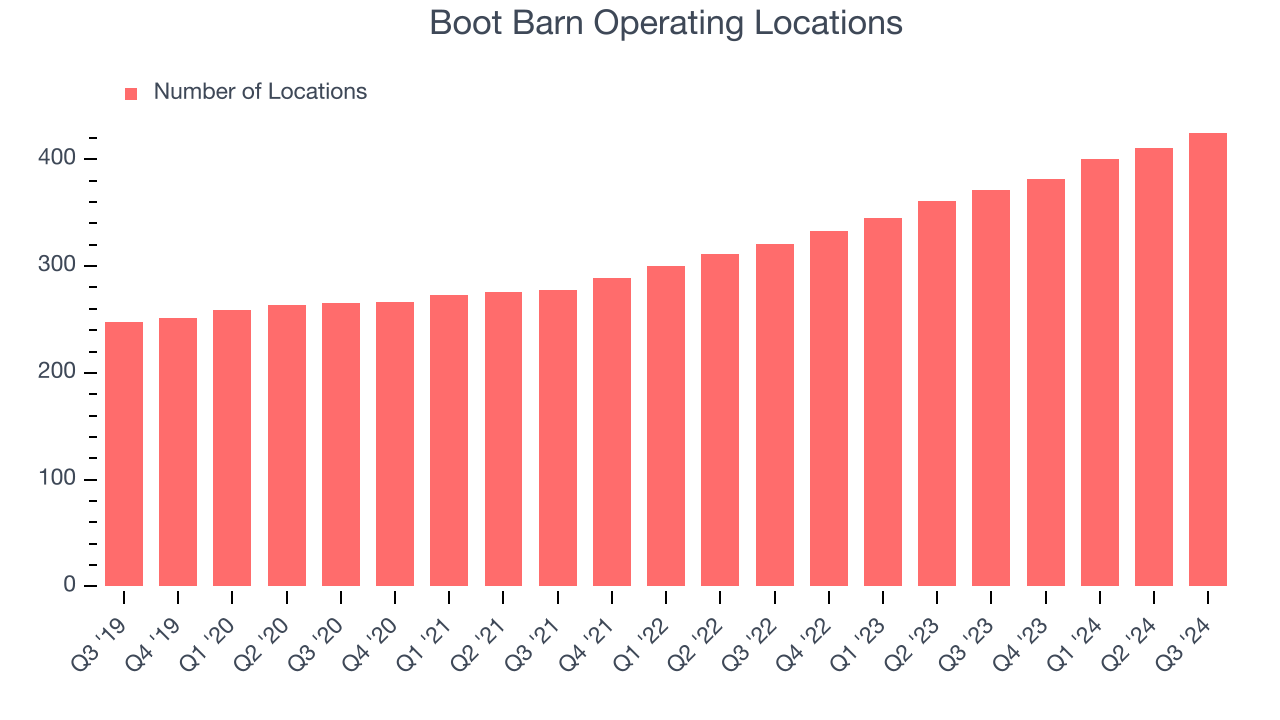

Boot Barn operated 425 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years and averaged 15.1% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

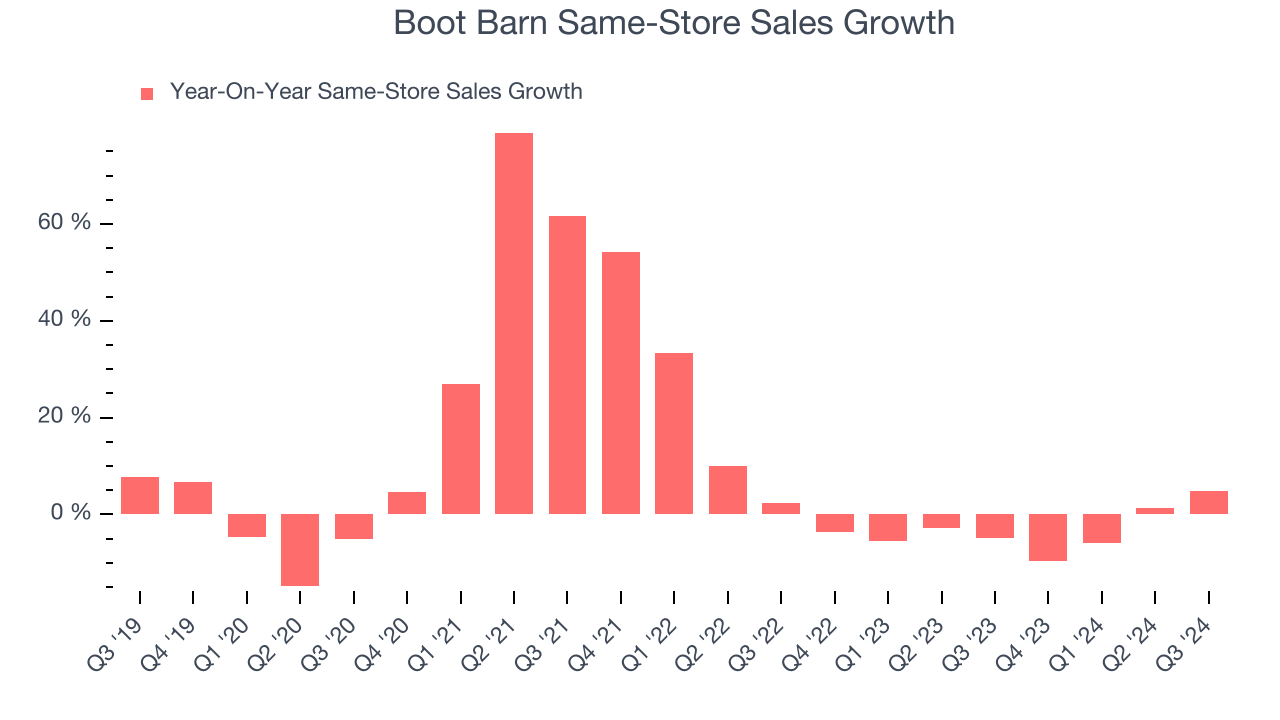

Boot Barn’s demand has been shrinking over the last two years as its same-store sales have averaged 3.3% annual declines. This performance is concerning - it shows Boot Barn artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Boot Barn’s same-store sales rose 4.9% annually. This growth was a well-appreciated turnaround from the 4.8% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Boot Barn’s Q3 Results

It was encouraging to see Boot Barn raise its full-year revenue guidance. On the other hand, its EPS forecast for next quarter missed. The company also reported that CEO Jim Conroy will step down to become CEO of Ross Stores (NASDAQ: ROST). Chief Digital Officer John Hazen is slated to replace him as Interim CEO. Overall, this was a softer quarter, and the management shake-up is spooking investors. The stock traded down 11.4% to $142.99 immediately following the results.

Is Boot Barn an attractive investment opportunity right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.