What a brutal six months it’s been for Graphic Packaging Holding. The stock has dropped 25.4% and now trades at $19.57, rattling many shareholders. This might have investors contemplating their next move.

Is there a buying opportunity in Graphic Packaging Holding, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Graphic Packaging Holding Will Underperform?

Even though the stock has become cheaper, we're cautious about Graphic Packaging Holding. Here are three reasons you should be careful with GPK and a stock we'd rather own.

1. Demand Slips as Sales Volumes Slide

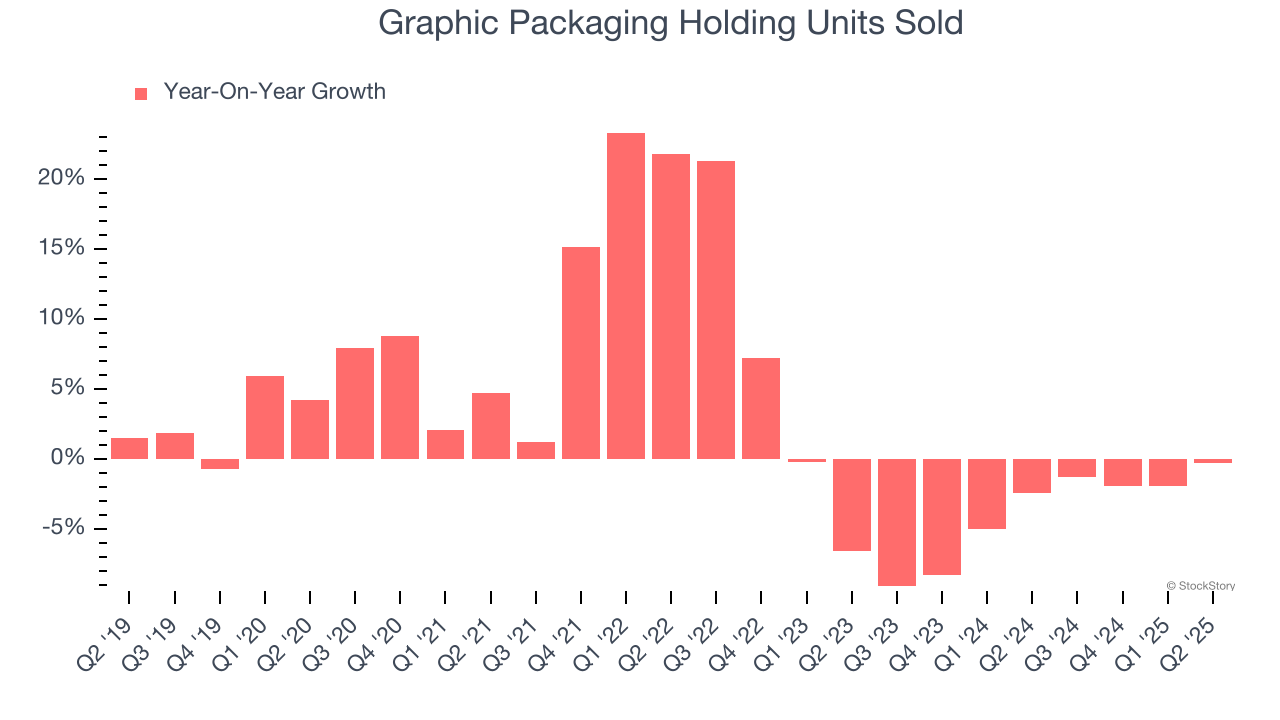

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Industrial Packaging company because there’s a ceiling to what customers will pay.

Over the last two years, Graphic Packaging Holding’s units sold averaged 3.8% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Graphic Packaging Holding might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

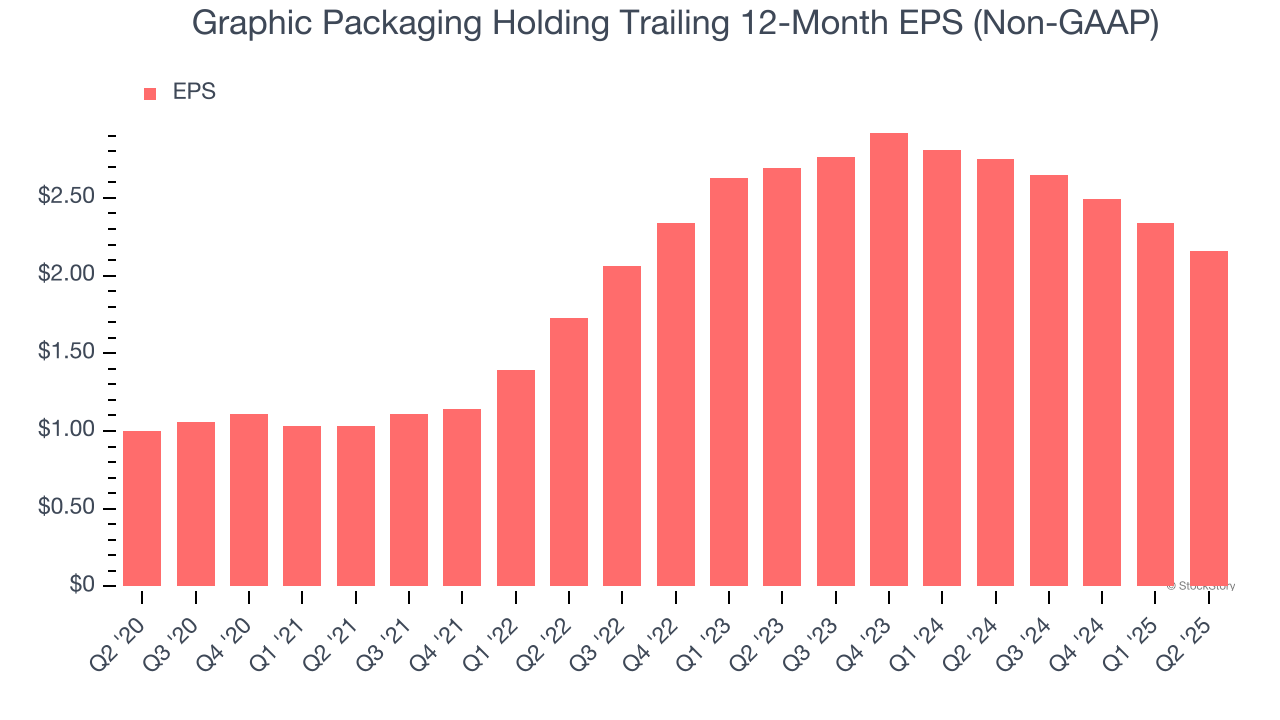

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Graphic Packaging Holding, its EPS declined by more than its revenue over the last two years, dropping 10.4%. This tells us the company struggled to adjust to shrinking demand.

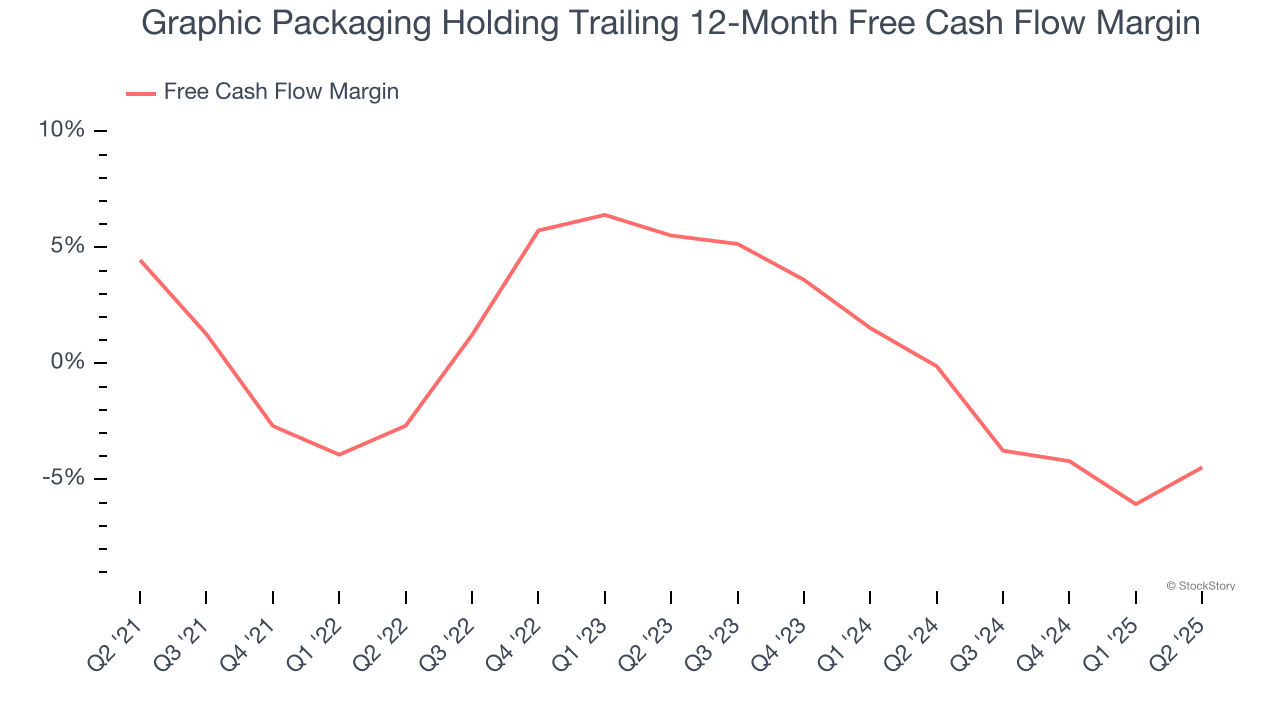

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Graphic Packaging Holding’s margin dropped by 8.9 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Graphic Packaging Holding’s free cash flow margin for the trailing 12 months was negative 4.5%.

Final Judgment

Graphic Packaging Holding doesn’t pass our quality test. After the recent drawdown, the stock trades at 9× forward P/E (or $19.57 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Graphic Packaging Holding

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.