Since November 2020, the S&P 500 has delivered a total return of 83.9%. But one standout stock has more than doubled the market - over the past five years, Toll Brothers has surged 194% to $139.68 per share. Its momentum hasn’t stopped as it’s also gained 29.4% in the last six months thanks to its solid quarterly results, beating the S&P by 16.3%.

Is there a buying opportunity in Toll Brothers, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Toll Brothers Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Toll Brothers. Here are three reasons we avoid TOL and a stock we'd rather own.

1. Backlog Declines as Orders Drop

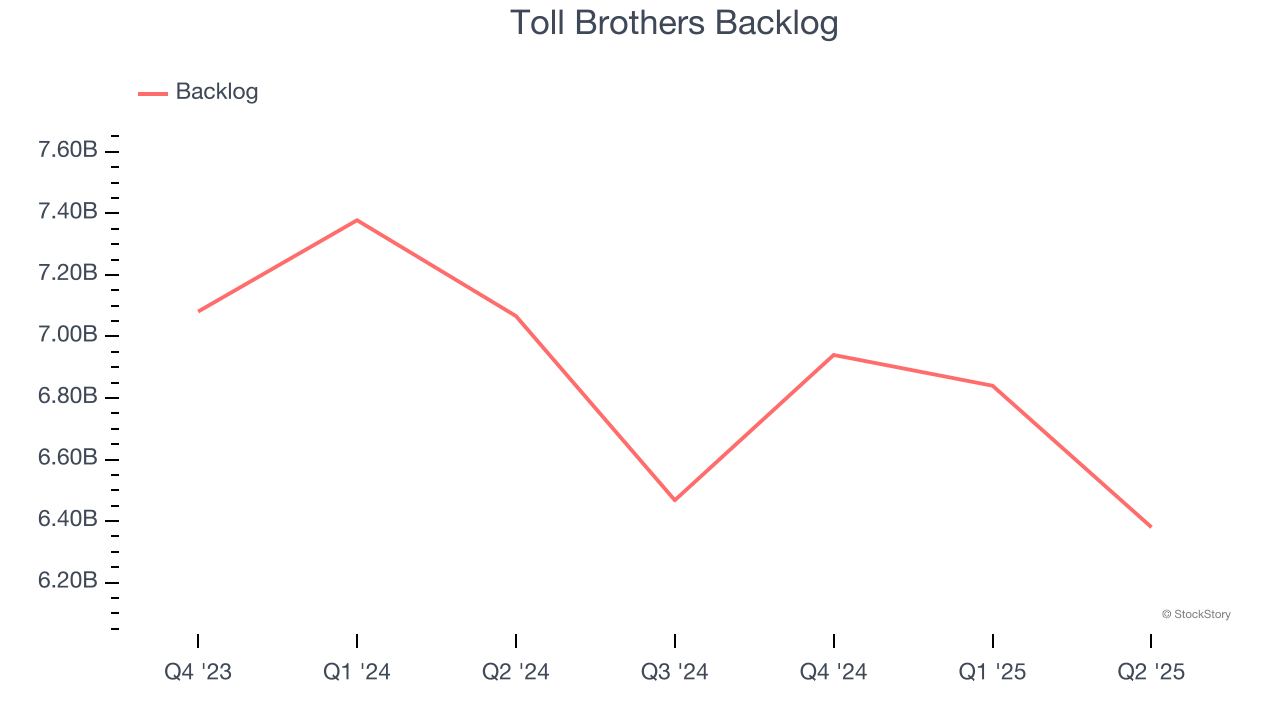

In addition to reported revenue, backlog is a useful data point for analyzing Home Builders companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Toll Brothers’s future revenue streams.

Toll Brothers’s backlog came in at $6.38 billion in the latest quarter, and it averaged 6.3% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. EPS Took a Dip Over the Last Two Years

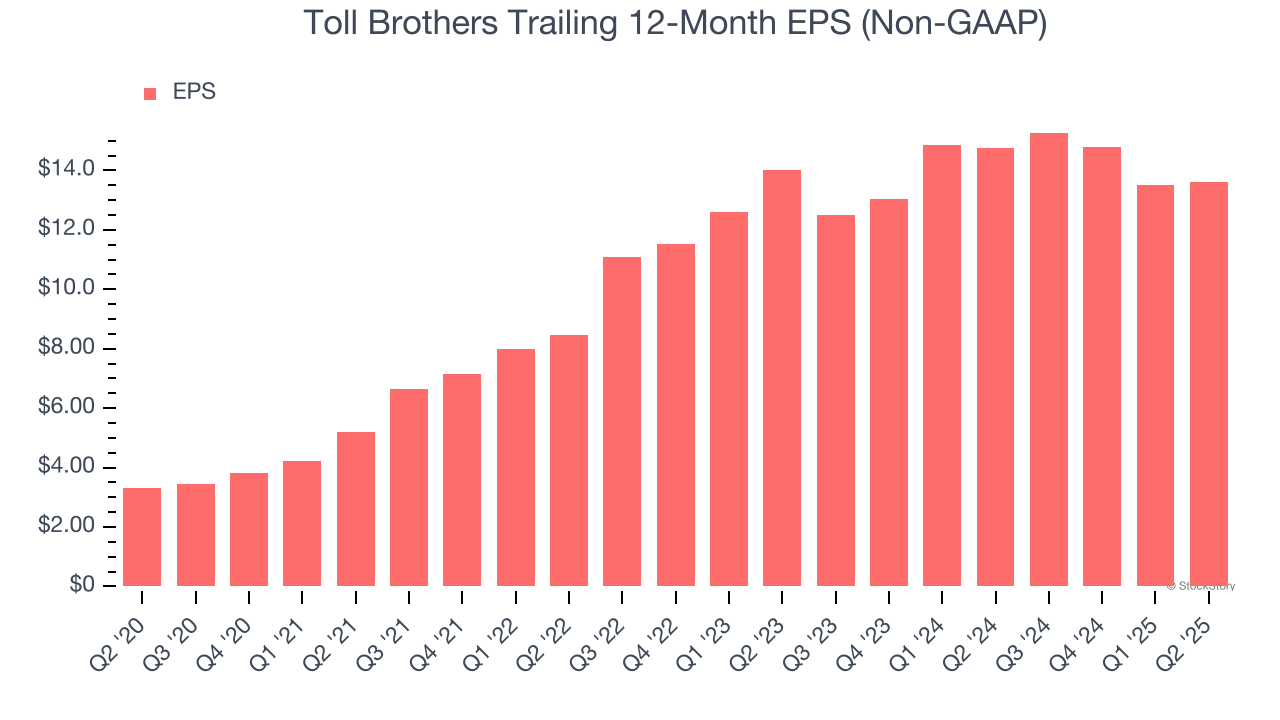

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Toll Brothers, its EPS declined by 1.4% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

3. Free Cash Flow Margin Dropping

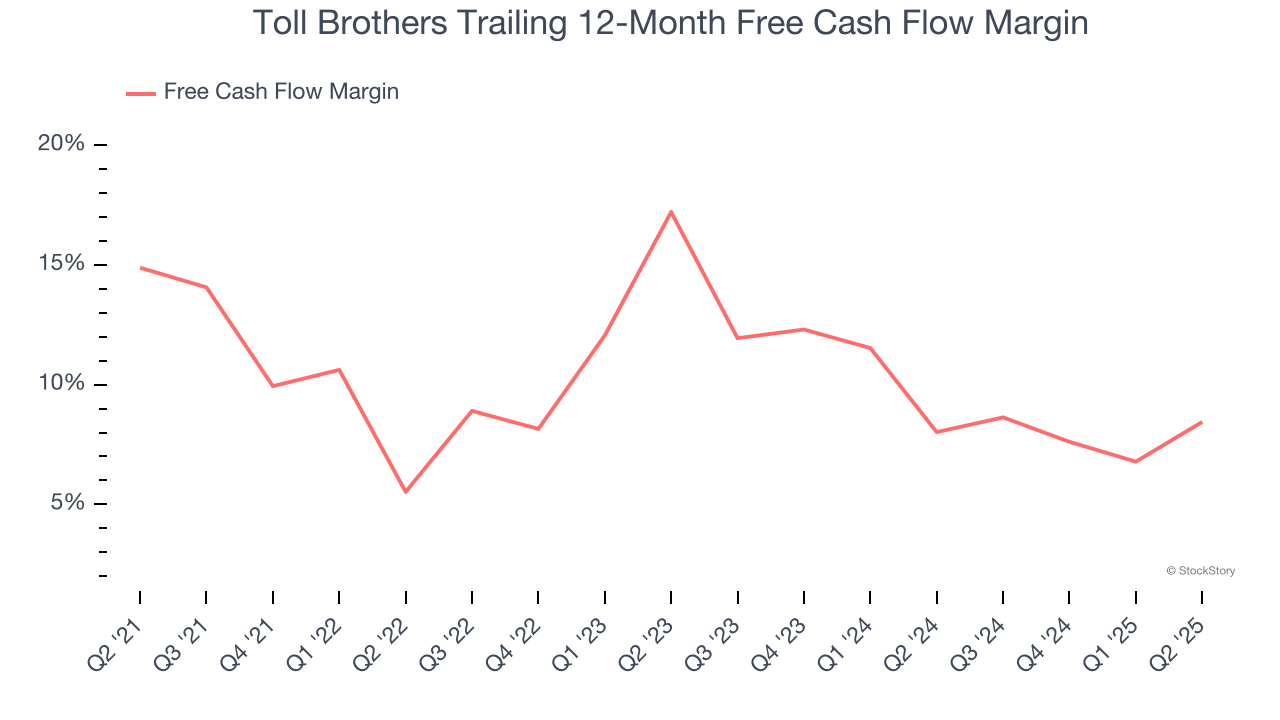

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Toll Brothers’s margin dropped by 6.4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Toll Brothers’s free cash flow margin for the trailing 12 months was 8.4%.

Final Judgment

Toll Brothers isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 9.5× forward P/E (or $139.68 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.