What a fantastic six months it’s been for CoreCivic. Shares of the company have skyrocketed 59.1%, hitting $20.13. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy CoreCivic, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we don't have much confidence in CoreCivic. Here are three reasons why we avoid CXW and a stock we'd rather own.

Why Do We Think CoreCivic Will Underperform?

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

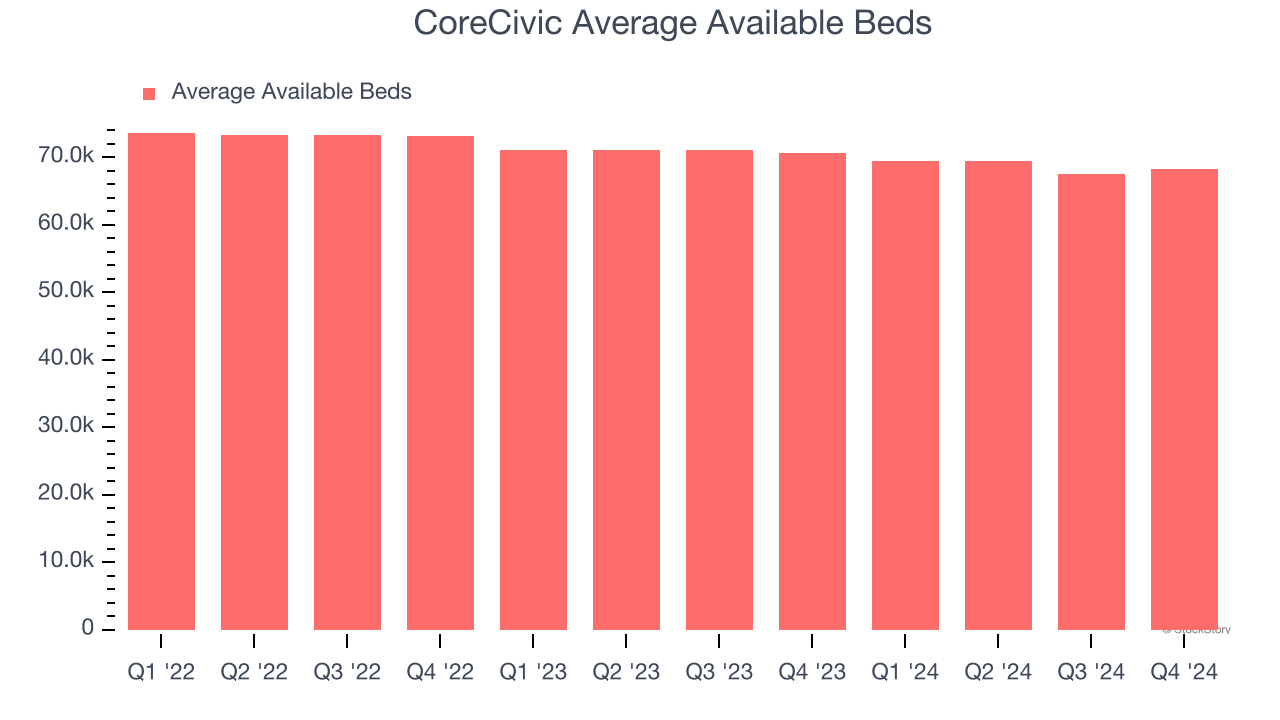

1. Decline in Average available beds Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like CoreCivic, our preferred volume metric is average available beds ). While both are important, the latter is the most critical to analyze because prices have a ceiling.

CoreCivic’s average available beds

came in at 68,200 in the latest quarter, and over the last two years, averaged 3.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests CoreCivic might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

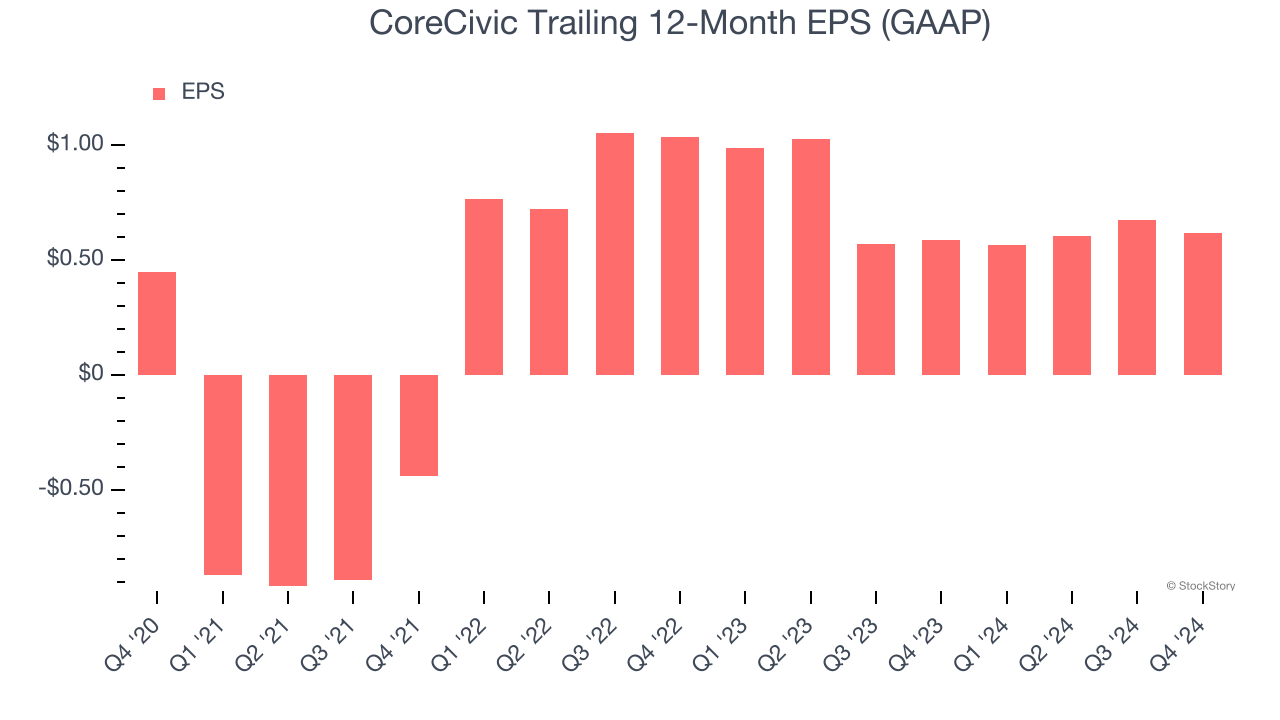

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for CoreCivic, its EPS declined by 22.8% annually over the last two years while its revenue grew by 3.1%. This tells us the company became less profitable on a per-share basis as it expanded.

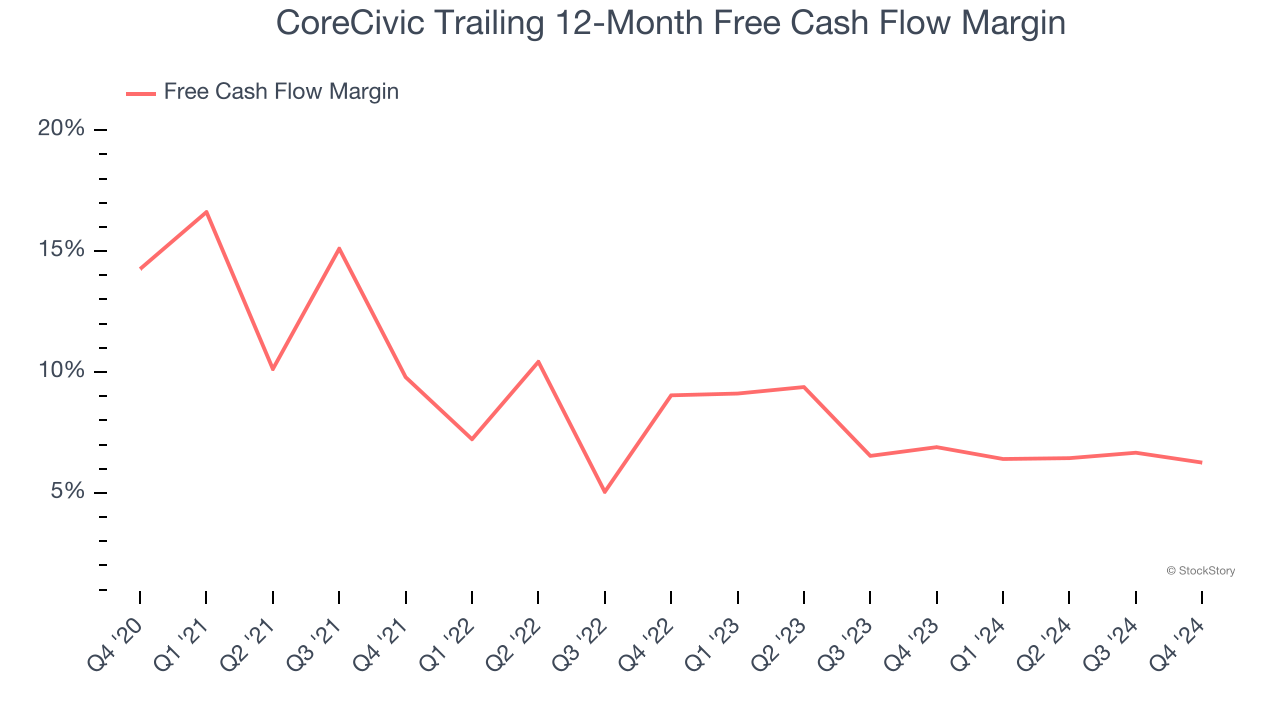

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, CoreCivic’s margin dropped by 8 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. CoreCivic’s free cash flow margin for the trailing 12 months was 6.3%.

Final Judgment

CoreCivic doesn’t pass our quality test. Following the recent rally, the stock trades at 20.4× forward price-to-earnings (or $20.13 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of CoreCivic

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.