AMD’s stock price has taken a beating over the past six months, shedding 39.5% of its value and falling to $94.77 per share. This might have investors contemplating their next move.

Following the pullback, is now the time to buy AMD? Find out in our full research report, it’s free.

Why Does AMD Spark Debate?

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices (NASDAQ: AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

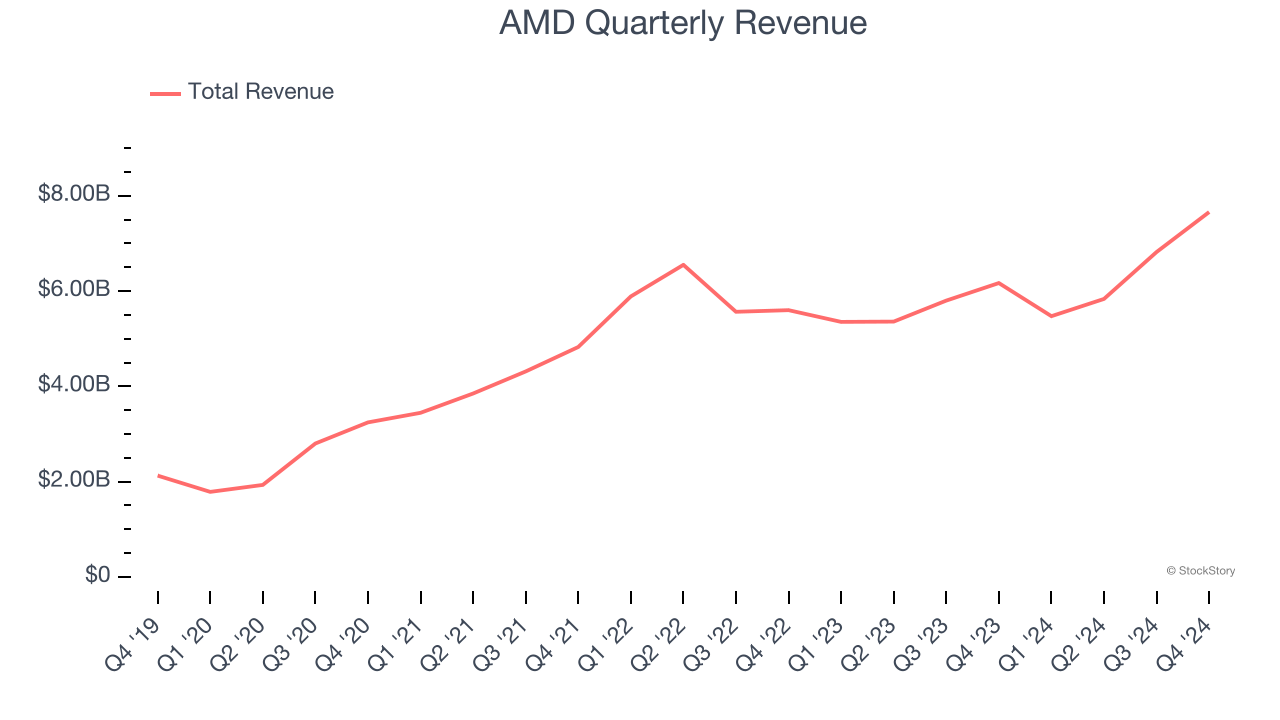

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, AMD’s sales grew at an incredible 30.8% compounded annual growth rate over the last five years. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect AMD’s revenue to rise by 22.4%, an improvement versus its 4.5% annualized growth for the past two years. This projection is eye-popping for a company of its scale and implies its newer products and services will fuel better top-line performance.

One Reason to be Careful:

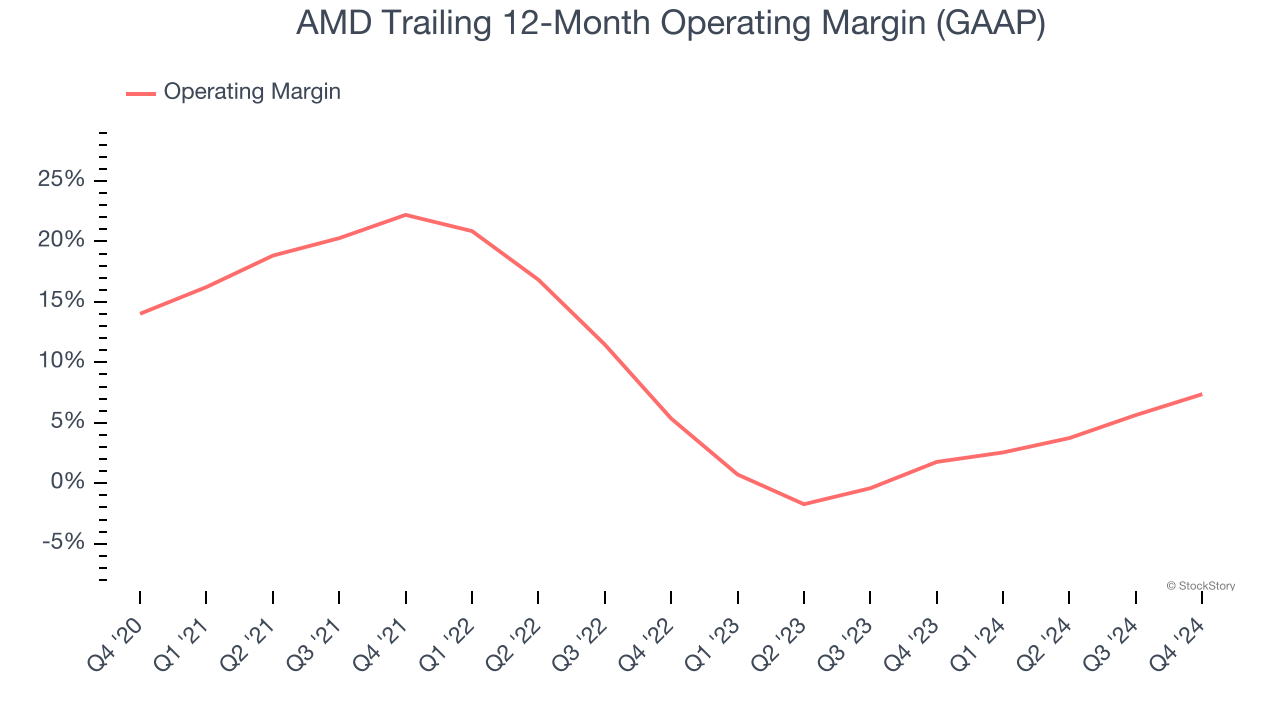

Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AMD was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.7% was among the worst in the semiconductor sector. This result is surprising given its high gross margin as a starting point.

Final Judgment

AMD’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 19.4× forward price-to-earnings (or $94.77 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than AMD

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.