MediaAlpha has gotten torched over the last six months - since August 2025, its stock price has dropped 26.8% to $7.42 per share. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for MAX? Find out in our full research report, it’s free.

Why Is MediaAlpha a Good Business?

Powering nearly 10 million consumer referrals each month in the insurance marketplace, MediaAlpha (NYSE: MAX) operates a technology platform that connects insurance carriers with high-intent consumers shopping for property, casualty, health, and life insurance products.

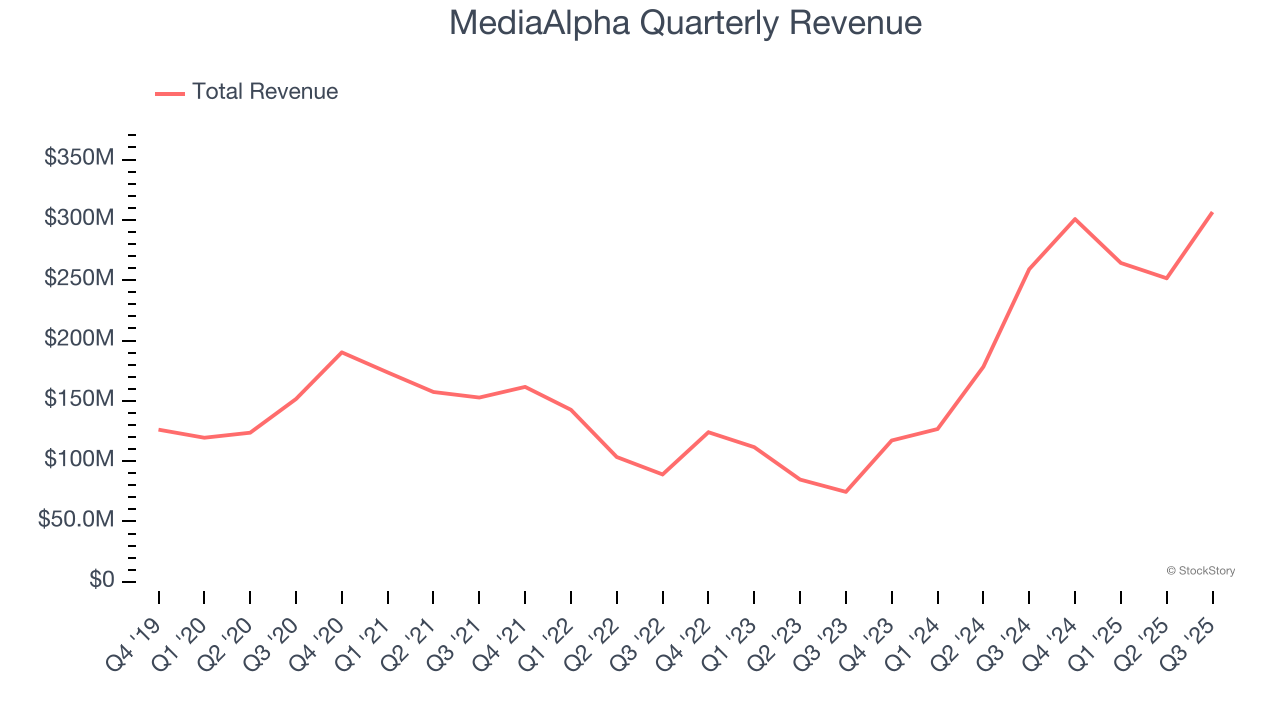

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, MediaAlpha grew its sales at an incredible 16.6% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

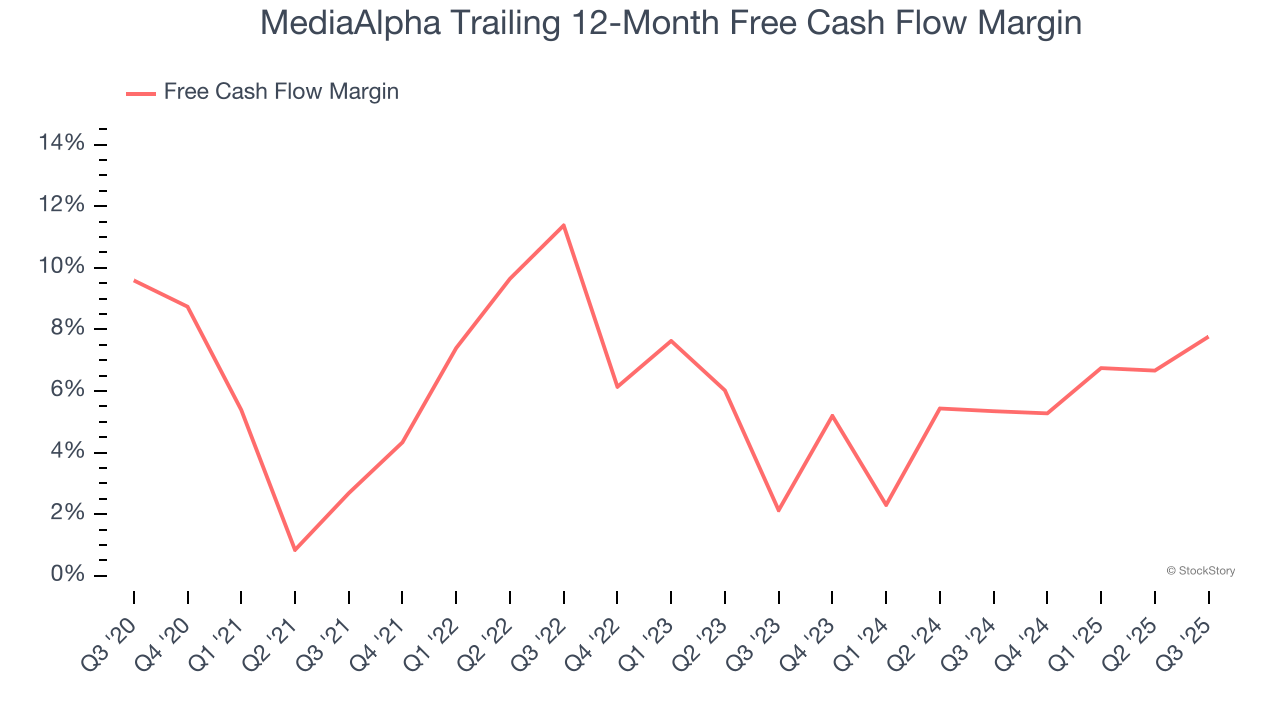

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, MediaAlpha’s margin expanded by 5.1 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell. MediaAlpha’s free cash flow margin for the trailing 12 months was 7.8%.

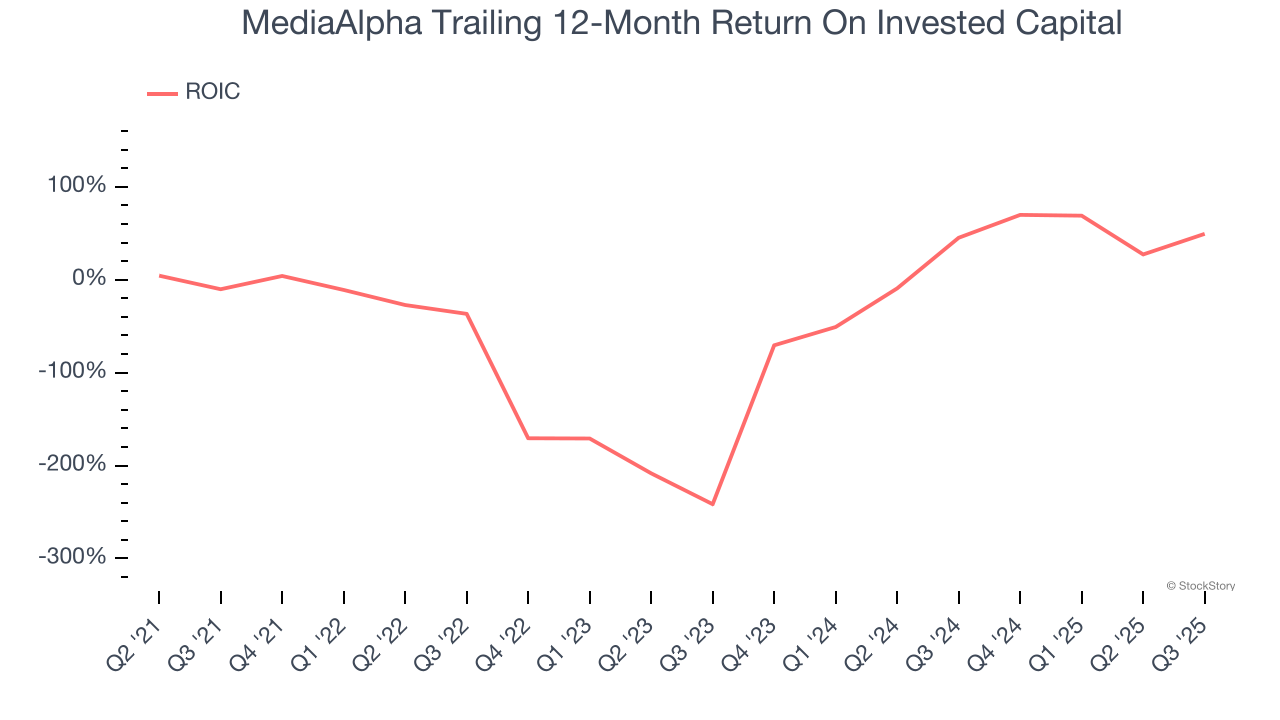

3. New Investments Bear Fruit as ROIC Jumps

We like to invest in businesses with high returns, but the trend in a company’s ROIC can also be an early indicator of future business quality.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. MediaAlpha’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why MediaAlpha ranks near the top of our list. After the recent drawdown, the stock trades at 6.2× forward P/E (or $7.42 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.