Personal care company The Honest Company (NASDAQ: HNST) announced better-than-expected revenue in Q4 CY2024, with sales up 10.6% year on year to $99.84 million. Its GAAP loss of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy The Honest Company? Find out by accessing our full research report, it’s free.

The Honest Company (HNST) Q4 CY2024 Highlights:

- Revenue: $99.84 million vs analyst estimates of $96.8 million (10.6% year-on-year growth, 3.1% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.02 (in line)

- Adjusted EBITDA: $8.54 million vs analyst estimates of $3.80 million (8.6% margin, significant beat)

- EBITDA guidance for the upcoming financial year 2025 is $28.5 million at the midpoint, above analyst estimates of $25.9 million

- Operating Margin: -1%, down from 1.3% in the same quarter last year

- Free Cash Flow was -$17.17 million, down from $9.66 million in the same quarter last year

- Market Capitalization: $562.4 million

“Our Q4 and full year 2024 financial results demonstrate that our strategy, which focuses on the disciplined execution of our Transformation Pillars of Brand Maximization, Margin Enhancement and Operating Discipline, is working. In 2024, we achieved record results ahead of our outlook with revenue growth of 10% and first full year positive adjusted EBITDA as a public company. We also achieved gross margin of 38%, an expansion of 900 basis points compared to last year,” said Chief Executive Officer, Carla Vernón.

Company Overview

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $378.3 million in revenue over the past 12 months, The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

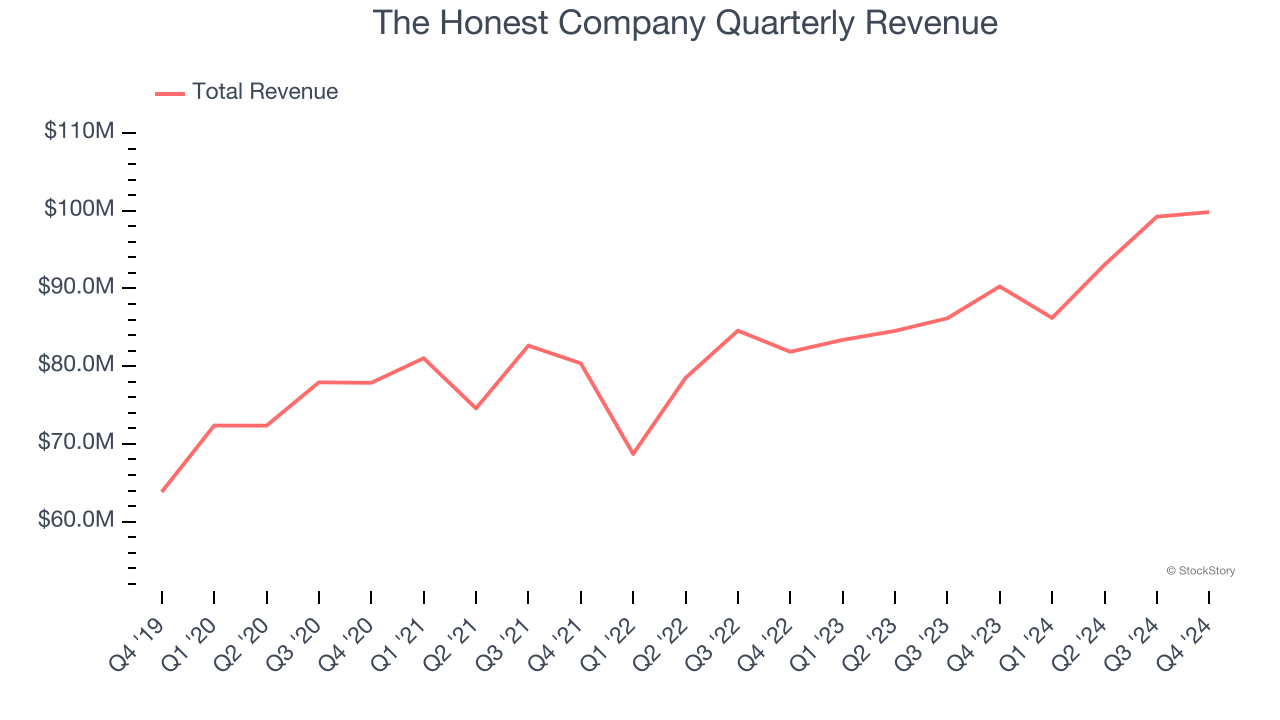

As you can see below, The Honest Company’s sales grew at a mediocre 5.9% compounded annual growth rate over the last three years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

This quarter, The Honest Company reported year-on-year revenue growth of 10.6%, and its $99.84 million of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and implies its newer products will help maintain its historical top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

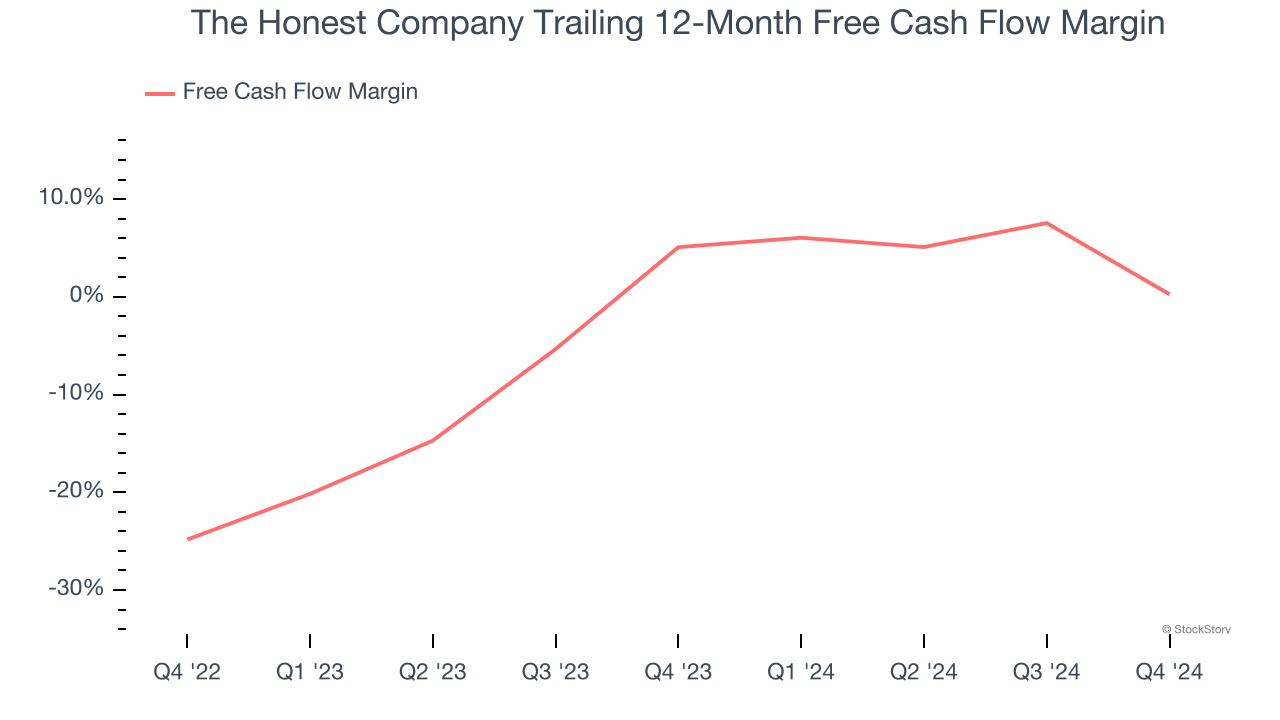

The Honest Company has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.6%, subpar for a consumer staples business.

Taking a step back, we can see that The Honest Company’s margin dropped by 4.8 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

The Honest Company burned through $17.17 million of cash in Q4, equivalent to a negative 17.2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from The Honest Company’s Q4 Results

We were impressed by how significantly The Honest Company blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The market seemed to be hoping for more, however, and the stock traded down 4.2% to $5.45 immediately after reporting.

Is The Honest Company an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.