Electronic signature company DocuSign (NASDAQ: DOCU) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 8.8% year on year to $800.6 million. Guidance for next quarter’s revenue was better than expected at $806 million at the midpoint, 1.1% above analysts’ estimates. Its non-GAAP profit of $0.92 per share was 8.6% above analysts’ consensus estimates.

Is now the time to buy DocuSign? Find out by accessing our full research report, it’s free.

DocuSign (DOCU) Q2 CY2025 Highlights:

- Revenue: $800.6 million vs analyst estimates of $780.9 million (8.8% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.92 vs analyst estimates of $0.85 (8.6% beat)

- Adjusted Operating Income: $238.7 million vs analyst estimates of $212.5 million (29.8% margin, 12.4% beat)

- The company lifted its revenue guidance for the full year to $3.20 billion at the midpoint from $3.16 billion, a 1.2% increase

- Operating Margin: 8.1%, in line with the same quarter last year

- Free Cash Flow Margin: 27.2%, down from 29.8% in the previous quarter

- Billings: $818 million at quarter end, up 12.9% year on year

- Market Capitalization: $15.34 billion

"Q2 was an outstanding quarter, with AI innovation launches and recent go-to-market changes leading to strong performance across the eSignature, CLM, and IAM businesses," said Allan Thygesen, CEO of Docusign.

Company Overview

Creating the digital equivalent of "sign on the dotted line" for over a billion users worldwide, DocuSign (NASDAQ: DOCU) provides an agreement management platform that enables businesses to electronically prepare, sign, and manage documents and contracts.

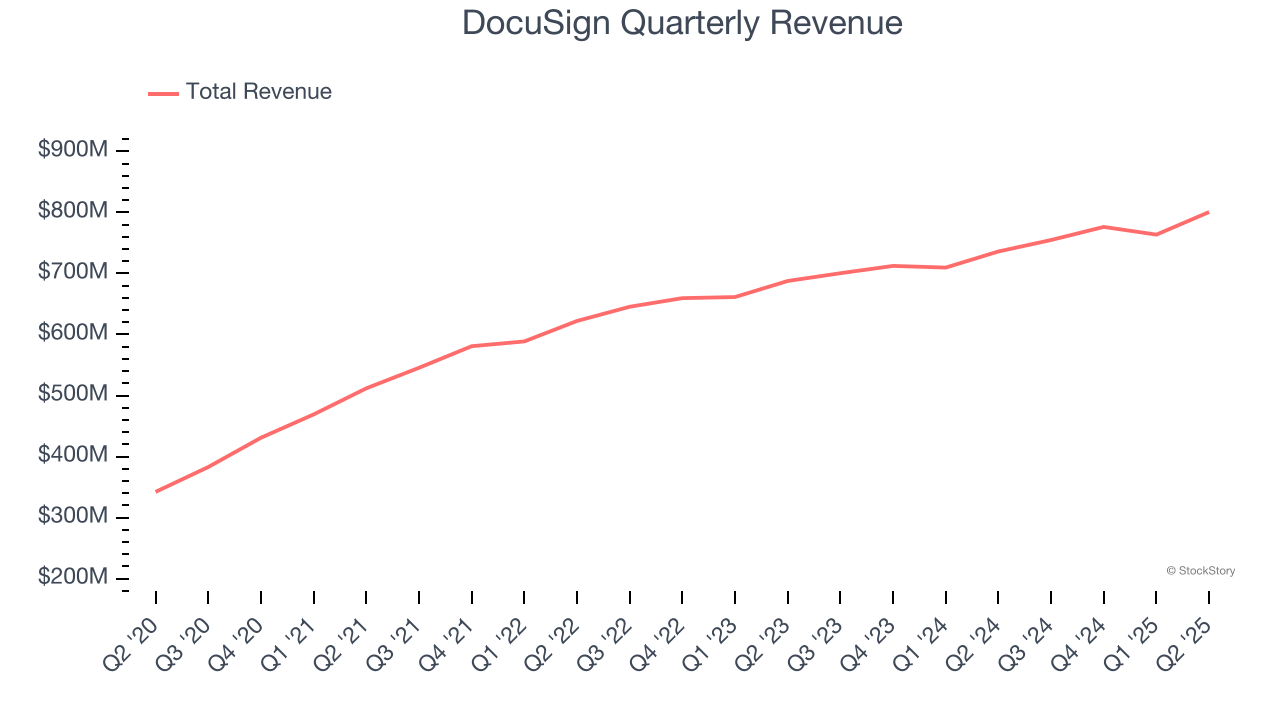

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, DocuSign’s sales grew at a sluggish 9.8% compounded annual growth rate over the last three years. This was below our standard for the software sector and is a rough starting point for our analysis.

This quarter, DocuSign reported year-on-year revenue growth of 8.8%, and its $800.6 million of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 6.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

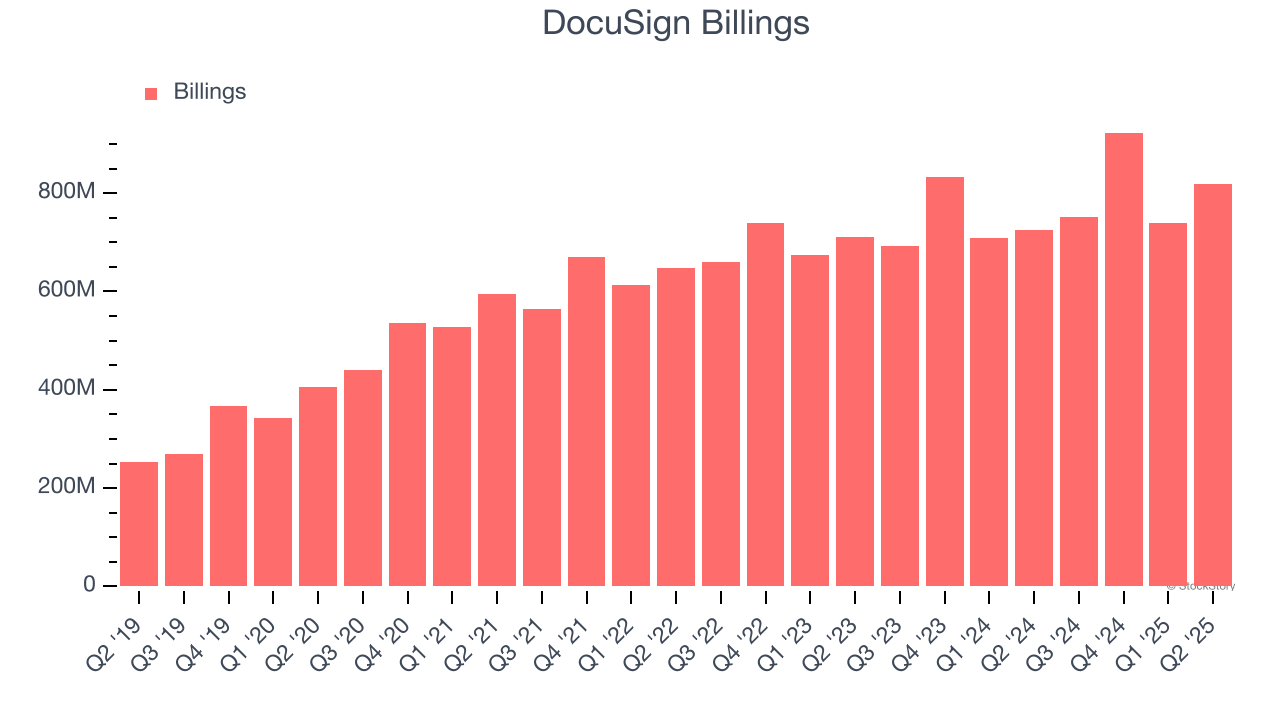

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

DocuSign’s billings came in at $818 million in Q2, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.2% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

DocuSign is extremely efficient at acquiring new customers, and its CAC payback period checked in at 12.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from DocuSign’s Q2 Results

This was a beat and raise quarter, We were impressed by how significantly DocuSign blew past analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Looking forward, full-year revenue guidance was raised, reflecting management's confidence in demand trends. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.7% to $81.39 immediately following the results.

Sure, DocuSign had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.