(BPT) - As soccer players know, you can't win unless you have a game plan.

According to the U.S. Bureau of Economic Analysis, the personal savings rate in the U.S. hovers below 4%, while household debt and credit card delinquency rates are both rising, especially among Gen Z, as reported by the Federal Reserve Bank of New York.

In the game of life, saving should be just one part of your financial strategy but knowing the benefits of responsibly managing your credit is equally important. Whether you are gearing up to buy a home, get an education or start a business - understanding your FICO® Score is an important first step in laying the foundation for financial literacy.

That's why this summer, FICO, a leading software analytics company, teamed up with Chelsea Football Club and the U.S. Soccer Foundation to offer free financial education workshops for students and adults in the cities where Chelsea is playing on their summer tour.

Workshop participants were also able to attend their local match for free.

Here is a starter playbook of the 3 ways soccer and financial literacy are similar:

- Know Your FICO® Score. A credit score is a three-digit number that helps lenders, such as a mortgage company, auto lender, or credit card issuer, quickly (based on data and without bias) determine how likely you are to repay a loan as agreed. The higher your number, the more likely it is lenders will offer you credit and better repayment terms such as interest rates.

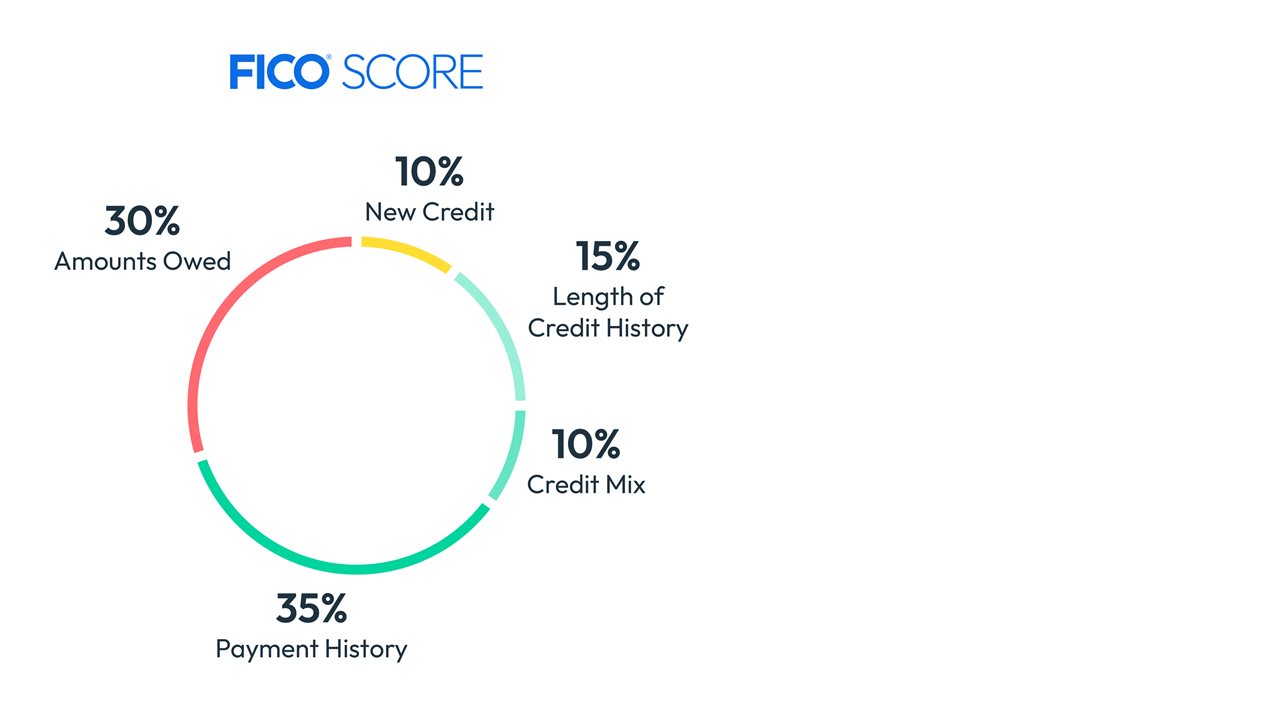

Many factors go into your FICO® Score. It's calculated based on data that is collected by the three major credit bureaus. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). Because your credit report changes based on your financial behaviors, like whether you pay your bills on time, so does your FICO Score. That means it's important to know how your financial choices can impact your FICO Score.

You can check your FICO® Score for free at https://www.myfico.com/free. - Have a Game Plan. Championships don't happen accidentally. They require thoughtful planning, precise execution, and the ability to make in-game adjustments as events unfold. It's just as important to have a game plan for your household finances to help foster positive habits such as creating a monthly budget, setting a system to stay up to date on bill payments, and keeping credit card balances under control.

FICO also offers free educational resources on myfico.com relating to budgeting - like a college budget calculator and articles about budgeting systems and budgeting for couples. - Focus on Continuous Learning and Improvement. Athletes continuously train to stay in shape and are always looking for ways to improve their skills. You can do the same to understand more about building good financial habits. FICO has developed many free educational tools and resources to help educate people throughout their financial journeys.

To access useful educational resources - and find out how to participate in a live or virtual Score A Better Future™ workshop - visit https://www.fico.com/sabf/.

Whether your goal is purchasing a home, financing a car, or simply starting off your financial journey strong, these educational tips can help you win in the game of life.

FICO and Score A Better Future are trademarks or registered trademarks of Fair Isaac Corporation in the U.S. and other countries.