VANCOUVER, British Columbia, June 20, 2024 (GLOBE NEWSWIRE) -- First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) (“First Atlantic” or “FAN” or the “Company”) is pleased to announce that subject to the final approval of the TSX Venture Exchange (the “Exchange”), the Company has closed a non-brokered private placement led by a strategic investor, of 9,928,571 flow-through shares (the “FT Shares”) issued at a price of C$0.21 per FT Share, for aggregate gross proceeds of $2,084,999.91 (the “Offering”). Each FT Share will consist of one common share of the Company issued as a “flow-through share” (within the meaning of subsection 66(15) of the Income Tax Act (Canada).

Highlights:

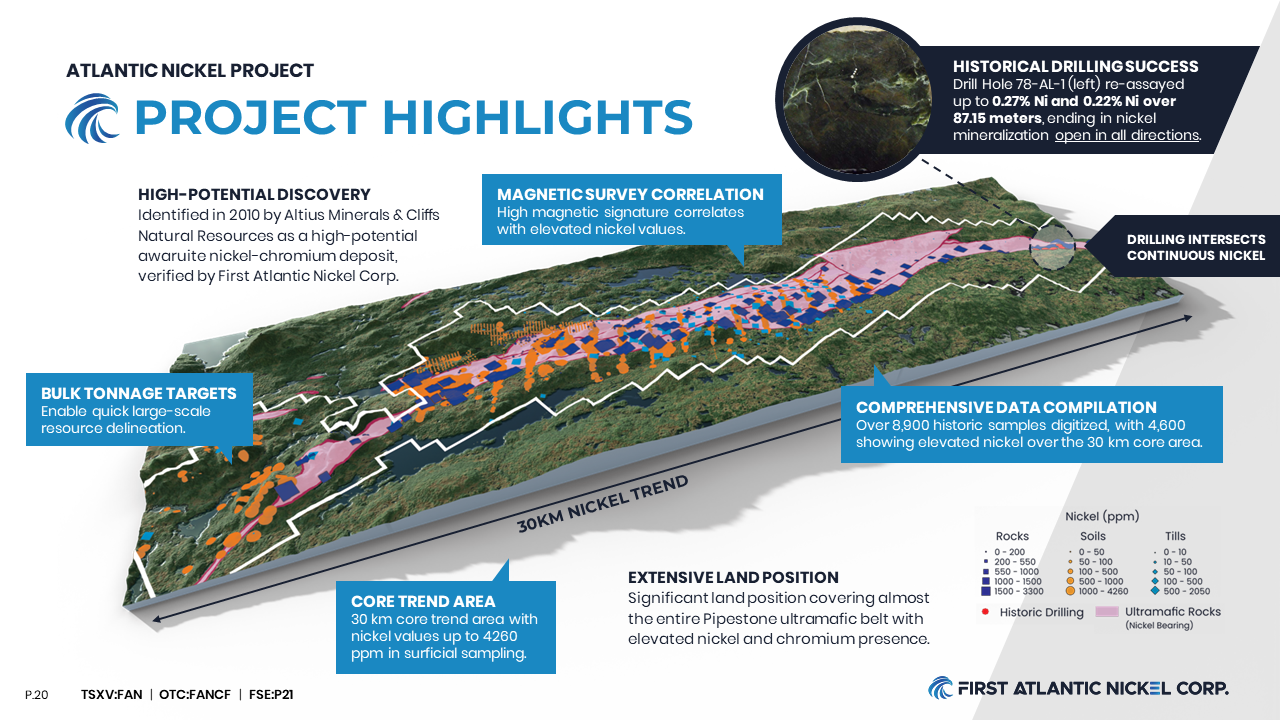

- The Company’s 2024 exploration program is now fully funded with a planned 5,000m drilling at the Atlantic Nickel Project to target numerous zones of awaruite nickel mineralization along a 30km ultramafic nickel trend.

- Financing of approximately $2.1M at C$0.21 per share represents a 58% premium to the 10-day Volume Weighted Average Price ("VWAP").

- Post-closing, a strategic investor holds a 9.98% equity stake in First Atlantic, secured by an investor rights agreement (the "Investor Rights Agreement") granting the right to maintain ownership in future financings.

- No warrants, finders fees, or commissions were payable in connection with the Offering.

Funds raised from the Offering will fully fund the Company's 2024 exploration programs, which will include geophysical surveys, surface exploration, and a planned 5,000-meter drilling campaign at the Atlantic Nickel Project. These activities will target high-priority zones along the extensive 30-kilometer ultramafic nickel trend. The summer's geophysical surveys and surface exploration will play a vital role in identifying the most promising initial drill targets for the planned multi-zone drilling program.

The Offering was led by a strategic investor who now holds a 9.98% equity position in First Atlantic. The FT Shares issued pursuant to the Offering were issued at a price of C$0.21 per share, which represented a 58% premium to the Company’s 10 VWAP. Upon closing the Offering, the Company and the strategic investor also entered into an Investor Rights Agreement which will grant the investor the right to participate in subsequent equity financings to maintain their current interest of up to 9.98%.

Adrian Smith, Chief Executive Officer of First Atlantic, commented, "We are thrilled to secure this substantial investment, which will enable the Company to fully fund its 2024 exploration program at the Atlantic Nickel Project and unlock the immense discovery potential along the 30km district-scale awaruite nickel trend."

The Atlantic Nickel Project's size, location, and geological potential, including the unique awaruite form of nickel mineralization, has the potential to be a source of clean and sustainable nickel. Awaruite, a naturally occurring nickel alloy, allows for simpler, more sustainable, and economic processing compared to traditional nickel deposits, reducing dependence on foreign countries for processing. The project's strategic location also has the potential to provide enhanced security to critical mineral supply chains in Europe and North America necessary for the production of stainless steel, electric vehicles, and clean energy technologies.

Figure 1: Atlantic Nickel Project highlights

The proceeds of the Offering will be used by the Company to incur eligible “Canadian exploration expenses” that will qualify as “flow-through mining expenditures” as such terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) related to the Company’s properties located in Newfoundland and Labrador on or before December 31, 2025. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2024.

All securities issued pursuant to the Offering are subject to an Exchange hold period and a four month plus one day hold period pursuant to applicable securities laws of Canada, which will expire on October 21, 2024.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States or any other jurisdiction. No securities may be offered or sold in the United States or in any other jurisdiction in which such offer or sale would be unlawful prior to registration under U.S. Securities Act of 1933 or an exemption therefrom or qualification under the securities laws of such other jurisdiction or an exemption therefrom.

First Atlantic Nickel Corp. shares trade in Canada on the TSX Venture Exchange under the symbol "FAN", in the United States on the OTCQB under the symbol “FANCF” and on several German exchanges, including Frankfurt and Tradegate, under the symbol "P21".

Investors are invited to sign up for the official FAN (First Atlantic Nickel) List found at www.fanickel.com and can follow First Atlantic Nickel on the following social media.

https://twitter.com/FirstAtlanticNi

https://www.facebook.com/firstatlanticnickel

https://www.linkedin.com/company/firstatlanticnickel/

For more information:

First Atlantic Nickel Relations

Robert Guzman

Tel: +1 844 592 6337

Rob@fanickel.com

http://www.fanickel.com

Disclosure

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company that owns 100% of the Atlantic Nickel Project, a large scale significant nickel awaruite project in Newfoundland and Labrador, Canada. By eliminating the need for smelting, nickel in the form of awaruite reduces dependence on foreign entities of concern for both supply and processing, thereby strengthening supply chain security. In 2022, the US Government designated nickel as a critical mineral, highlighting its importance to the nation's economy and security.

The Atlantic Nickel Project is a special asset due to its unique combination of size, location, proximity to infrastructure, and the presence of awaruite. By developing this domestic awaruite nickel project, FAN aims to enhance supply chain security for the stainless steel and electric vehicle industries in the USA, Canada, and Europe. The Company's strategic location and focus on awaruite nickel position it to play a key role in meeting the growing demand for responsibly sourced nickel in these sectors.

The Company is committed to responsible exploration, environmental stewardship, and working closely with local communities to create sustainable economic opportunities. With its experienced team and the project's significant potential, the Company is well-positioned to contribute to the future of the nickel industry and the global transition to a cleaner, more secure energy future.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the use of the proceeds from the Offering, the Company’s objectives, goals or future plans, statements, and estimates of market conditions. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. Additional factors and risks including various risk factors discussed in the Company’s disclosure documents which can be found under the Company’s profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

[1] https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/38a18ff6-7c8e-4edd-a9c4-c35fabe886dc