- Freeport Resources closes oversubscribed private placement, underscoring strong investor interest in its 100% of the Yandera Copper Project, one of the largest undeveloped copper deposits in the World, and the largest undeveloped copper project in Asia, the world’s leading copper refiner and consumer.

- Yandera is an advanced-stage copper project with over US$200 Mil in exploration and development expenditures completed to date, including a 2017 Pre-Feasibility Study, prepared by Worley Parsons, which estimated historical Measured and Indicated Resources of 728 million tonnes grading 0.39% copper equivalent*.

- PNG’s resource-focused economy is set to enter a construction supercycle with a number of multi-billion dollar infrastructure and mining projects in the pipeline including Wafi Golpu, Frieda River and Yandera Copper.

- Proceeds from the Private Placement will be used to complete the internal project optimization review and continue discussions with potential strategic partners to advance the Yandera Copper Project to Definitive Feasibility Study.

Vancouver, British Columbia-(July 2, 2024) – Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH) (“Freeport Resources” or the “Company“) is pleased to announce that it has closed the final tranche of its non-brokered private placement offering (the “Offering“) for gross proceeds of $800,545. In connection with completion of the final tranche of the Offering, the Company has issued 16,010,900 units (each, a “Unit“) at a price of $0.05 per Unit. Each Unit consists of one common share, and one-half-of-one common share purchase warrant (each whole warrant, a “Warrant“). Each Warrant entitles the holder to acquire an additional common share of the Company at a price of $0.25 until June 28, 2026.

In connection with completion of final tranche of the Offering, the Company paid finders’ fees of $5,600 and issued 112,000 Warrants, exercisable at a price of $0.25 until June 28, 2026, to certain arms-length parties who assisted in introducing subscribers to the Offering. All securities issued under the final tranche of the Offering are subject to restrictions on resale until October 29, 2024 in accordance with applicable securities laws.

Following completion of the final tranche, the Company has raised gross proceeds $5,235,406 through the issuance of 104,708,120 units in connection with the Offering.

“Strong investor interest and an over-subcribed Offering will allow us to leverage over USD $200 million in exploration and development expenditures committed to the Yandera Copper Project since 2005, culminating in the 2017 Pre-Feasibility Study delineating one of the world’s largest undeveloped copper resources*. Proceeds from the Offering will be used to complete the internal project optimization review and continue discussions with potential strategic partners to advance the Yandera Copper Project to Definitive Feasibility Study and a Final Investment Decision,” commented Mr. Gord Freisen, Chief Executive Officer, of Freeport Resources.

“Over the coming decades, the global economy will demand unprecedented production of mined copper. With many of the world’s largest copper mines nearing end-of-life, the copper market is expected to enter and remain in a deficit position. Papua New Guinea hosts the world’s greatest concentration of copper and gold deposits with in-country operations by some of the world’s largest mining companies and state-owned enterprises. As a resource-focused economy, PNG is set to enter a construction supercycle over the coming years with a number of multi-billion dollar infrastructure and mining projects currently in the pipeline including Wafi Golpu, Frieda River, and Yandera Copper,” concluded Mr. Friesen.

Incentive Stock Option Grant

The Company also announces that it has granted a total of 15,000,000 incentive stock options (the “Options“) to certain directors, officers and consultants of the Company in accordance with the omnibus incentive plan adopted by the Company. The Options vest immediately, and are exercisable at a price of $0.10 until June 28, 2029.

Yandera – One of the World’s Largest Undeveloped Copper Projects

Freeport Resources’ wholly-owned Yandera Copper Project is located in the highly prolific PNG Orogenic Belt, the same geological arc as some of the world’s largest gold and copper deposits including Grasberg, Frieda River, Porgera, Lihir, Wafi-Golpu and Kainantu. Yandera is a project of strategic national interest in PNG and has the potential to become one of the country’s most significant copper mines. The project’s proximity to Asia, the world’s largest copper refiner and consumer, positions Yandera as an attractive potential long-term source of copper supply.

The renewed license EL 1335 covers a 245.5 square kilometer (“km”) tenement comprising the Yandera Project. Approximately USD $200 million in exploration and development expenditures have been spent on EL 1335 since 2005. Work completed and studies funded to date include approximately 154,600 meters of exploration drilling, the vast majority of which has focused on the Yandera Central deposit, as well as scoping studies, engineering studies, environmental studies, the 2017 Pre-Feasibility Study*, and infrastructure-related studies.

The 2017 Pre-Feasibility Study titled, Independent Technical Report on the Yandera Project – Pre-Feasibility Study*, prepared by Worley Parsons, with an effective date of November 27, 2017, estimated a historical open-pit, Measured and Indicated Resources of 728 million tonnes grading 0.39% copper equivalent.

The internal project optimization review is part of Freeport Resources’ ongoing strategic review process aimed at maximizing the value of the Yandera Copper Project which the Company believes is significantly undervalued based on historical expenditures, current copper prices and the potential for resource expansion. The Company’s internal project optimization review will be led by Dr. Nathan Chutas, Senior Vice-President of Operations, who helped manage the 2017 Pre-Feasibility Study.

* Independent Technical Report on the Yandera Project – Pre-Feasibility Study, prepared for Era Resources Inc. and dated effective November 27, 2017. The study was prepared prior to the Company acquiring an interest in the Yandera Project, and is derived from historical estimates which the Company is not treating as current. This information is intended to provide readers with context on historical analysis conducted on the Yandera Project, however the Company cautions that a qualified person has not done sufficient work to classify any historical estimates in respect of the Yandera Project as current and any analysis conducted by previous owners of the Project may rely upon assumptions which are no longer reasonable or accurate in the context of the current market.

Yandera – Feasibility Study

The renewal of EL 1335, through November 19, 2025, allows Freeport Resources to commence work on a Definitive Feasibility Study to advance the Yandera Copper Project toward a Final Investment Decision. Concurrent with the Definitive Feasibility Study program planning, Freeport Resources has begun discussions with key international strategic investors and prospective partners for development of the Yandera Copper Project. Demand for copper is undergoing unprecedented structural change driven by the global energy transition with mined copper supply forecast to enter a deficit position starting as early as 2025 (see Copper Supply and Demand Imbalance Chart below).

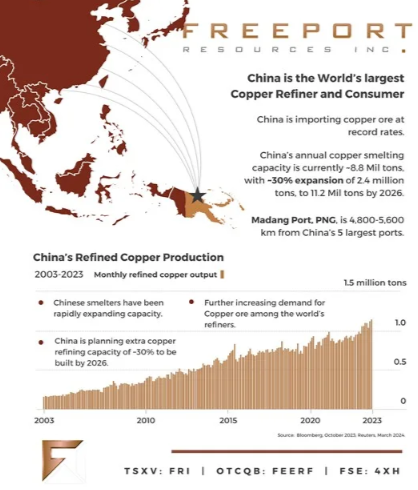

Yandera’s Location is Well Positioned to Supply China, the World’s largest Copper Refiner and Consumer

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5826/215145_2024-07-02%20-%20fri%20nr%20closes%20oversub%20pp%20final%20-%20july%202%202024.png

The Definitive Feasibility Study will build on earlier work undertaken with local and regional communities to determine opportunities to achieve mutually beneficial partnerships and sustainable long-term social benefits related to job creation, indigenous advancement, health and wellness, environment, education and community development.

Freeport and the Community

The Yandera Copper Project is 95-km southwest of the capital city of Madang Province and 235-km to the northwest of Lae which is the largest port city in PNG and an important industrial center. As one of the largest undeveloped copper resources* in the world, the Yandera Project has the potential to support communities and create jobs along the Yandera Corridor. The Company anticipates the potential economic influence of the Yandera Copper Project could span 5 provinces and create wealth for generations including, but not limited to, strategic road and highway building, power generation and related infrastructure.

The landowners and communities of Yandera are stakeholders in the Yandera Project. The overwhelming community support that the Company received at the Warden’s Hearing held during the summer of 2023, demonstrated the level of commitment the people of Yandera have for the project. Freeport is also firmly committed to advancing the project and continuing support of the community. The Company expects to continue to develop initiatives to be an active and visible presence in the Community.

Qualified Person

Dr. Nathan Chutas, PhD, CPG, Senior Vice-President of Operations for Freeport Resources, is a qualified person for the purposes of National Instrument 43-101. Dr. Chutas has reviewed and approved the technical content in this announcement.

About Freeport Resources Inc.

Freeport Resources is a Canadian mineral exploration company with a primary focus on advancing the development of the Yandera copper-gold-molybdenum project, located in Madang Province, Papua New Guinea. The Yandera project is one of the largest undeveloped copper-gold deposits in the world covering approximately 245.5 square kilometers

Please visit www.freeportresources.com or contact the email address below for more information.

On behalf of the Board,

Freeport Resources Inc.

Gord Friesen, Chief Executive Officer

T. (236) 334-1660 or gord@freeportresources.com

E. gord@freeportresources.com

www.freeportresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule”, “intends” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube