Egg company Cal-Maine Foods (NASDAQ: CALM) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 17.4% year on year to $922.6 million. Its GAAP profit of $4.12 per share was 19.2% below analysts’ consensus estimates.

Is now the time to buy Cal-Maine? Find out by accessing our full research report, it’s free.

Cal-Maine (CALM) Q3 CY2025 Highlights:

- Revenue: $922.6 million vs analyst estimates of $960.4 million (17.4% year-on-year growth, 3.9% miss)

- EPS (GAAP): $4.12 vs analyst expectations of $5.10 (19.2% miss)

- Operating Margin: 27%, up from 23.6% in the same quarter last year

- Market Capitalization: $4.56 billion

“We delivered our strongest first quarter in company history, aided by higher specialty egg sales, the expansion of our prepared foods platform, and supported by solid performance in conventional eggs. Cal-Maine Foods enters fiscal 2026 from a position of strength and is a uniquely attractive combination of both value and growth in today’s food sector,” said Sherman Miller, president and chief executive officer of Cal-Maine Foods.

Company Overview

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.40 billion in revenue over the past 12 months, Cal-Maine carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

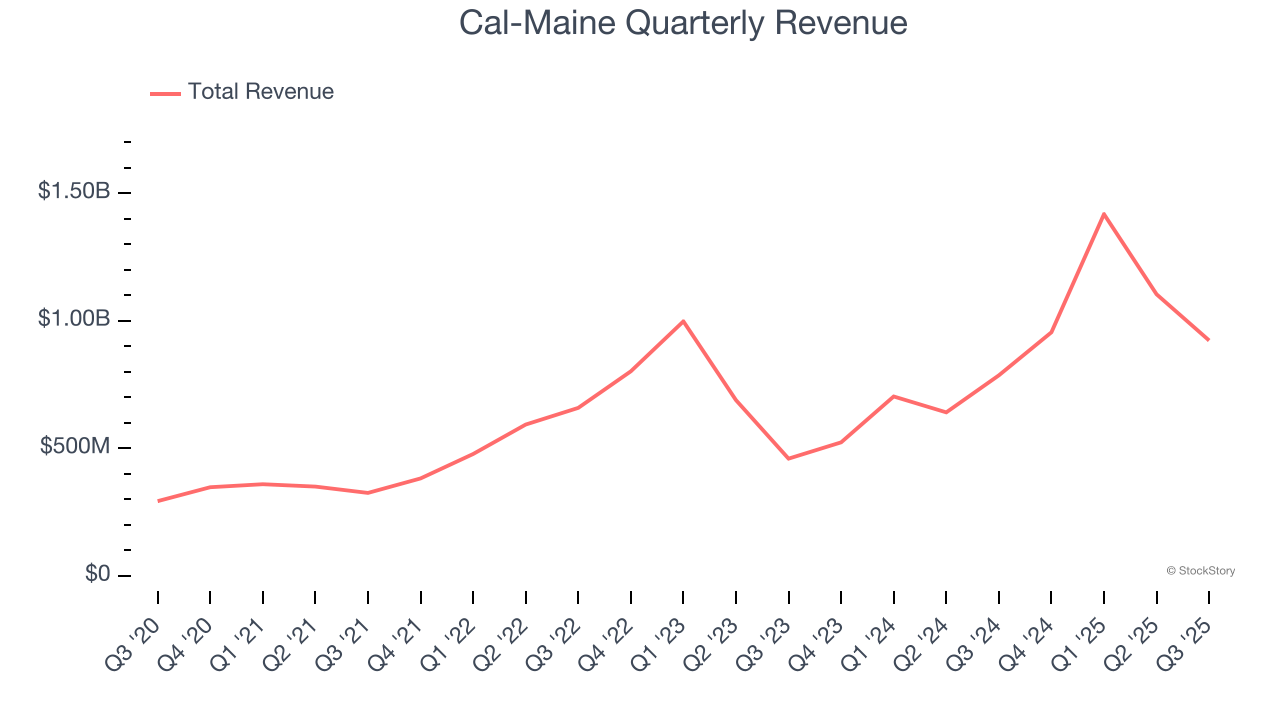

As you can see below, Cal-Maine grew its sales at an exceptional 27.7% compounded annual growth rate over the last three years. This is a great starting point for our analysis because it shows Cal-Maine’s demand was higher than many consumer staples companies.

This quarter, Cal-Maine’s revenue grew by 17.4% year on year to $922.6 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 20.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

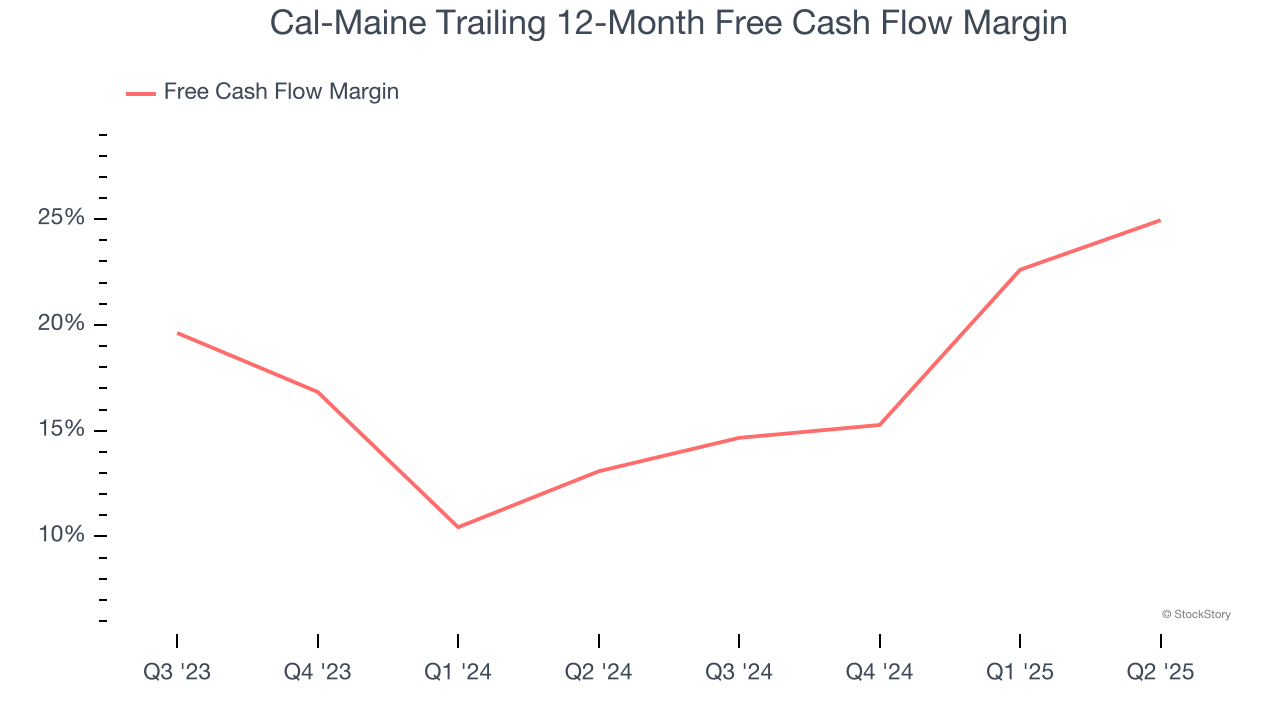

Cal-Maine has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 22.4% over the last two years.

Key Takeaways from Cal-Maine’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.7% to $88 immediately after reporting.

Cal-Maine’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.