As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the design software industry, including Adobe (NASDAQ: ADBE) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 6 design software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q3: Adobe (NASDAQ: ADBE)

Originally named after Adobe Creek that ran behind co-founder John Warnock's house, Adobe (NASDAQ: ADBE) develops software products used for digital content creation, document management, and marketing solutions across desktop, mobile, and cloud platforms.

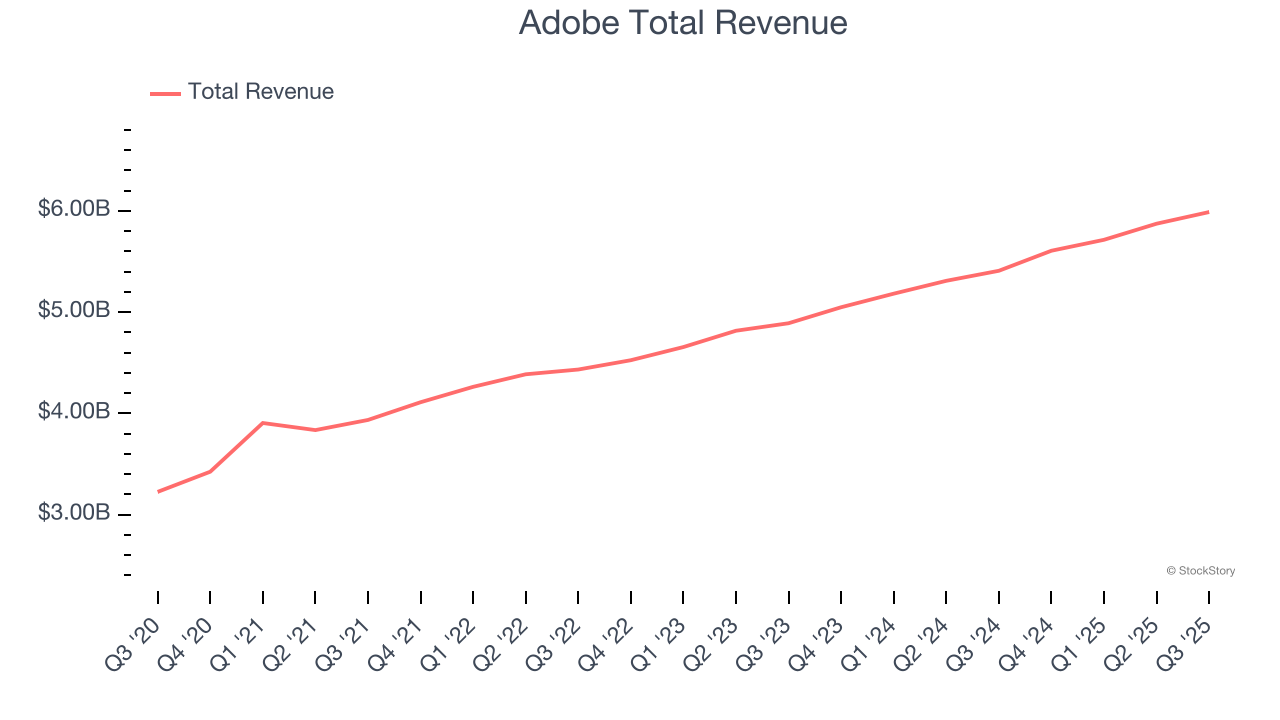

Adobe reported revenues of $5.99 billion, up 10.7% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 9.1% since reporting and currently trades at $319.89.

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Autodesk (NASDAQ: ADSK)

Starting with AutoCAD in the 1980s and evolving into a comprehensive design ecosystem, Autodesk (NASDAQ: ADSK) provides software solutions for architecture, engineering, construction, manufacturing, and entertainment industries to design, simulate, and visualize projects.

Autodesk reported revenues of $1.85 billion, up 18% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with full-year EPS guidance exceeding analysts’ expectations and EPS guidance for next quarter exceeding analysts’ expectations.

Autodesk achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 6% since reporting. It currently trades at $312.33.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free for active Edge members.

Cadence Design Systems (NASDAQ: CDNS)

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ: CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

Cadence Design Systems reported revenues of $1.34 billion, up 10.1% year on year, exceeding analysts’ expectations by 0.9%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and full-year EPS guidance beating analysts’ expectations.

Cadence Design Systems delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 13.3% since the results and currently trades at $304.84.

Read our full analysis of Cadence Design Systems’s results here.

PTC (NASDAQ: PTC)

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ: PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

PTC reported revenues of $893.8 million, up 42.7% year on year. This print topped analysts’ expectations by 18.7%. It was a strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

PTC scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update among its peers. The stock is down 7.6% since reporting and currently trades at $175.46.

Read our full, actionable report on PTC here, it’s free for active Edge members.

Procore Technologies (NYSE: PCOR)

With a mission to build software for the people that build the world, Procore Technologies (NYSE: PCOR) provides cloud-based software that enables owners, contractors, and other stakeholders to collaborate and manage construction projects from any device.

Procore Technologies reported revenues of $338.9 million, up 14.5% year on year. This result beat analysts’ expectations by 3.3%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The company added 122 customers to reach a total of 17,623. The stock is up 2% since reporting and currently trades at $73.00.

Read our full, actionable report on Procore Technologies here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.