As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the engineered components and systems industry, including ESCO (NYSE: ESE) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 engineered components and systems stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 1.1% below.

Luckily, engineered components and systems stocks have performed well with share prices up 10.6% on average since the latest earnings results.

ESCO (NYSE: ESE)

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

ESCO reported revenues of $265.5 million, up 6.6% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with full-year EPS guidance exceeding analysts’ expectations.

Bryan Sayler, Chief Executive Officer and President, commented, “Q2 was another strong quarter as we delivered 7 percent top line growth, 250 basis points of Adjusted EBITDA margin expansion, and a 24 percent increase in Adjusted EPS compared to the prior year. All three segments delivered solid revenue growth, highlighted by strength across our Navy, commercial aerospace, utility, and Test end-markets. It was very positive to see orders increase 22 percent over the prior year, with particular strength in both USG and Test.

ESCO scored the fastest revenue growth and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 9.8% since reporting and currently trades at $179.60.

We think ESCO is a good business, but is it a buy today? Read our full report here, it’s free.

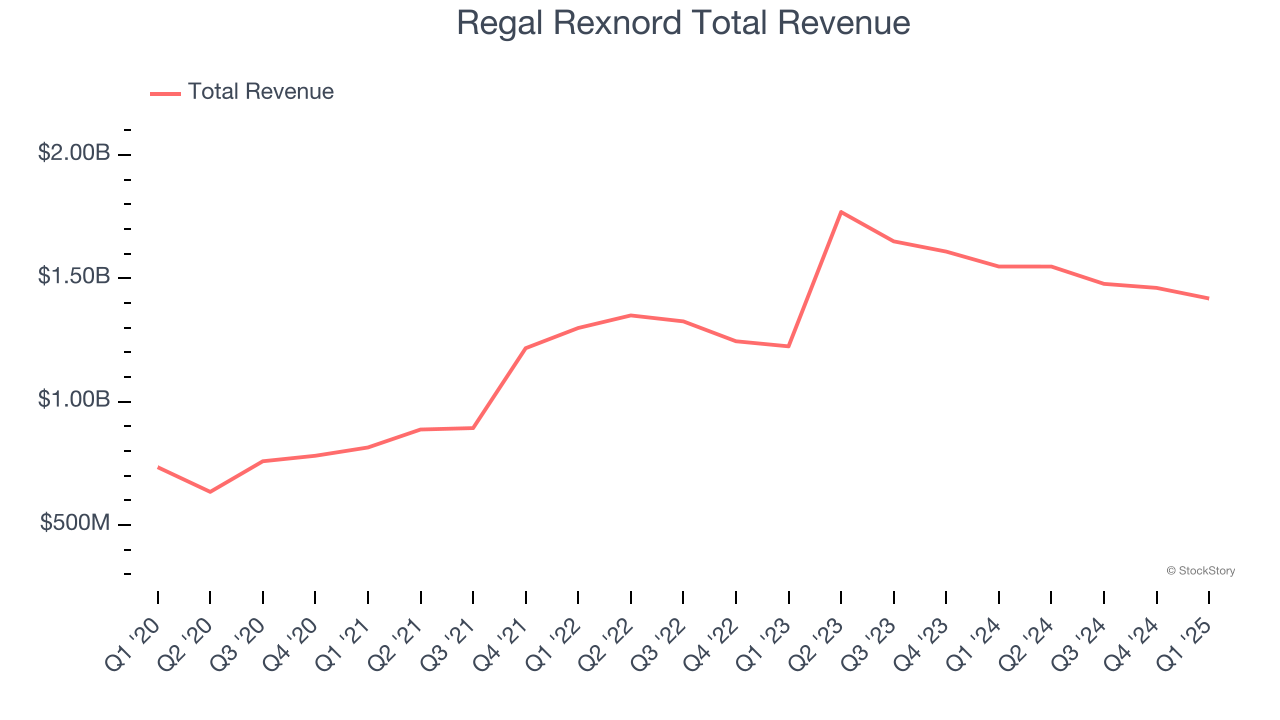

Best Q1: Regal Rexnord (NYSE: RRX)

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.42 billion, down 8.4% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with a solid beat of analysts’ organic revenue and EBITDA estimates.

The market seems happy with the results as the stock is up 19.6% since reporting. It currently trades at $131.78.

Is now the time to buy Regal Rexnord? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $405.4 million, down 2.9% year on year, falling short of analysts’ expectations by 4.7%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Park-Ohio delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.5% since the results and currently trades at $17.82.

Read our full analysis of Park-Ohio’s results here.

Arrow Electronics (NYSE: ARW)

Founded as a single retail store, Arrow Electronics (NYSE: ARW) provides electronic components and enterprise computing solutions to businesses globally.

Arrow Electronics reported revenues of $6.81 billion, down 1.6% year on year. This print topped analysts’ expectations by 7.2%. It was an exceptional quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Arrow Electronics achieved the biggest analyst estimates beat among its peers. The stock is up 5.7% since reporting and currently trades at $117.51.

Read our full, actionable report on Arrow Electronics here, it’s free.

Worthington (NYSE: WOR)

Founded by a steel salesman, Worthington (NYSE: WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Worthington reported revenues of $304.5 million, down 3.9% year on year. This result surpassed analysts’ expectations by 6.7%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 41.6% since reporting and currently trades at $58.94.

Read our full, actionable report on Worthington here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.