Auto parts and accessories retailer Advance Auto Parts (NYSE: AAP) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 1.2% year on year to $1.97 billion. On the other hand, the company’s full-year revenue guidance of $8.53 billion at the midpoint came in 1.6% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Advance Auto Parts? Find out by accessing our full research report, it’s free.

Advance Auto Parts (AAP) Q4 CY2025 Highlights:

- Revenue: $1.97 billion vs analyst estimates of $1.95 billion (1.2% year-on-year decline, 1% beat)

- Adjusted EPS: $0.86 vs analyst estimates of $0.41 (significant beat)

- Adjusted EBITDA: $351.8 million vs analyst estimates of $128.8 million (17.8% margin, significant beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.75 at the midpoint, beating analyst estimates by 4.6%

- Operating Margin: 2.2%, up from -41.1% in the same quarter last year

- Free Cash Flow was -$297.7 million compared to -$124.4 million in the same quarter last year

- Locations: 4,297 at quarter end, down from 4,788 in the same quarter last year

- Same-Store Sales rose 1.1% year on year (-1% in the same quarter last year)

- Market Capitalization: $3.49 billion

"I am pleased with the progress achieved during 2025 and I want to thank our team members for their hard work,” said Shane O'Kelly, president and chief executive officer.

Company Overview

Founded in Virginia in 1932, Advance Auto Parts (NYSE: AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Revenue Growth

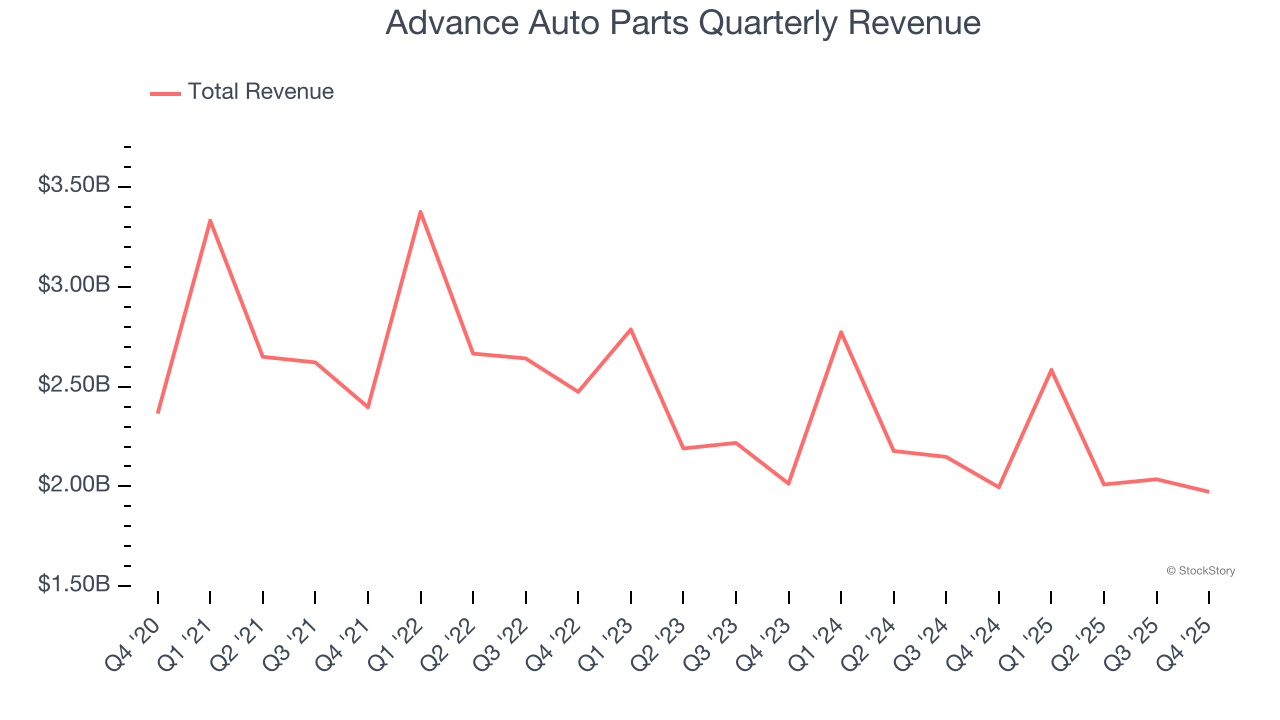

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $8.60 billion in revenue over the past 12 months, Advance Auto Parts is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Advance Auto Parts’s demand was weak over the last three years. Its sales fell by 8.3% annually as it closed stores.

This quarter, Advance Auto Parts’s revenue fell by 1.2% year on year to $1.97 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products will spur better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

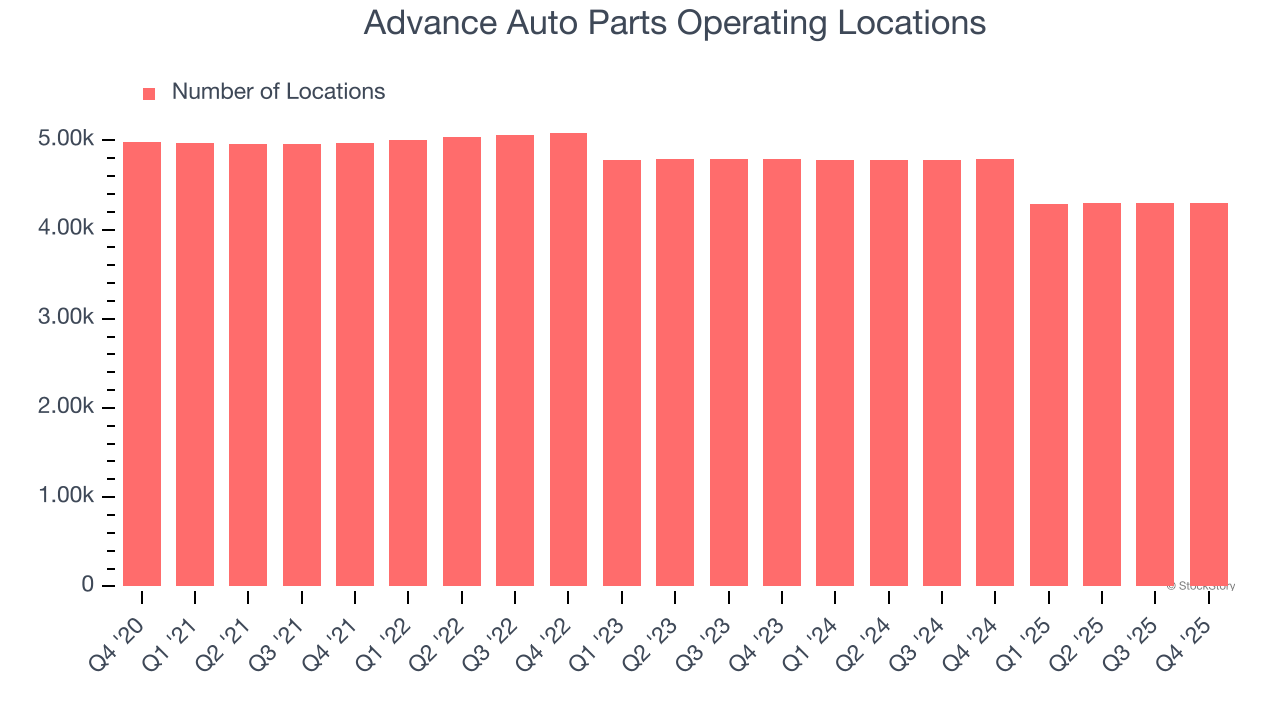

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Advance Auto Parts listed 4,297 locations in the latest quarter and has generally closed its stores over the last two years, averaging 5.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

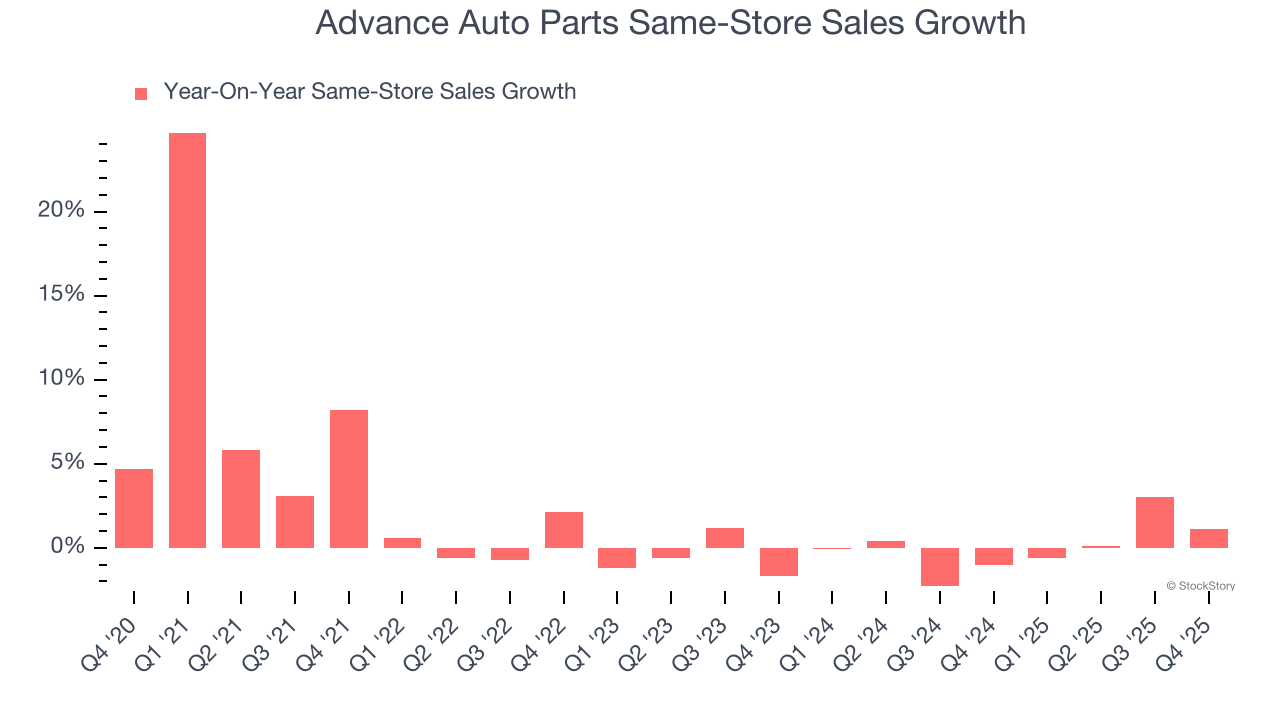

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Advance Auto Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Advance Auto Parts is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Advance Auto Parts’s same-store sales rose 1.1% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Advance Auto Parts’s Q4 Results

It was good to see Advance Auto Parts beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance missed. Zooming out, we think this quarter was mixed. The stock remained flat at $58.58 immediately after reporting.

Indeed, Advance Auto Parts had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).