Wrapping up Q4 earnings, we look at the numbers and key takeaways for the consumer discretionary - media stocks, including News Corp (NASDAQ: NWSA) and its peers.

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare. Media companies create, aggregate, and distribute content—including news, entertainment, and advertising—across television, print, digital, and out-of-home channels. Tailwinds include growing digital advertising budgets, content licensing opportunities, and global audience expansion through streaming and social platforms. Headwinds are substantial: traditional advertising revenue from print and linear TV continues its structural decline as audiences migrate to digital alternatives. Content creation costs are escalating amid intense competition for talent and intellectual property. Media fragmentation makes it difficult to build sustainable audience scale, while AI-generated content threatens to commoditize production and disrupt established business models.

The 6 consumer discretionary - media stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 47.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.1% since the latest earnings results.

News Corp (NASDAQ: NWSA)

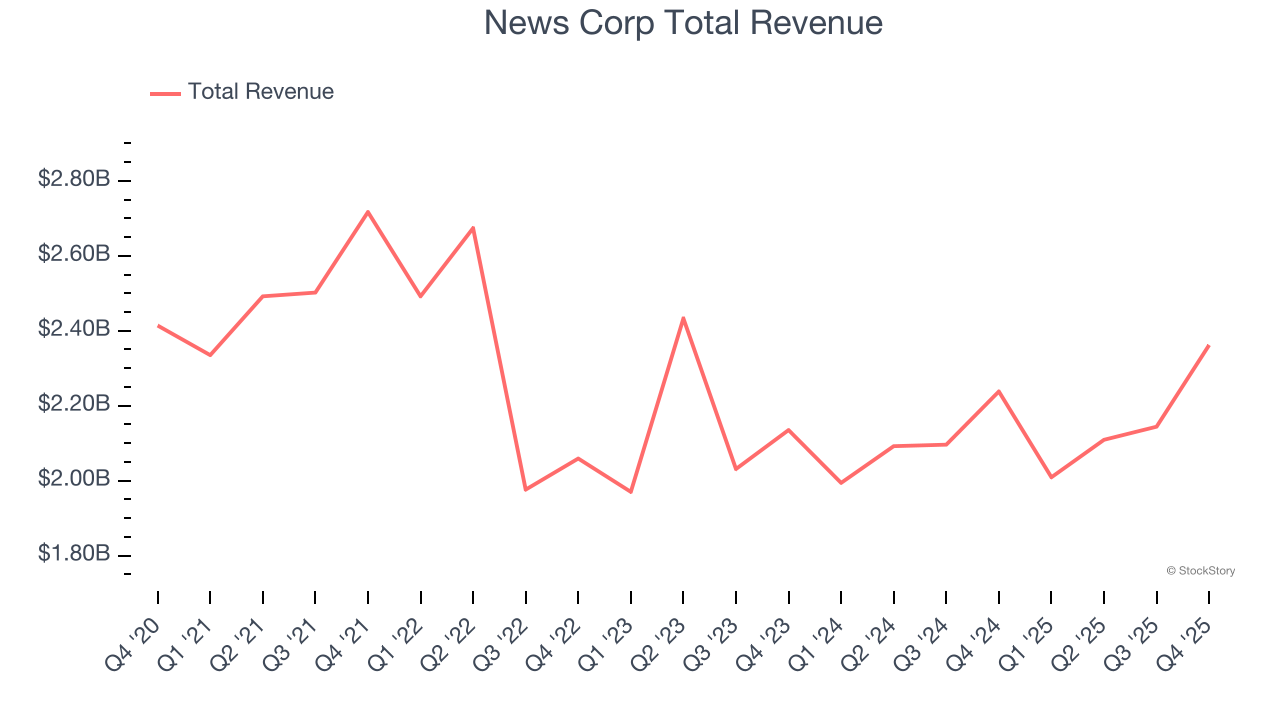

Established in 2013 after a restructuring, News Corp (NASDAQ: NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

News Corp reported revenues of $2.36 billion, up 5.5% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a strong quarter for the company with a decent beat of analysts’ revenue estimates and a decent beat of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 6.2% since reporting and currently trades at $22.72.

Is now the time to buy News Corp? Access our full analysis of the earnings results here, it’s free.

Best Q4: Warner Music Group (NASDAQ: WMG)

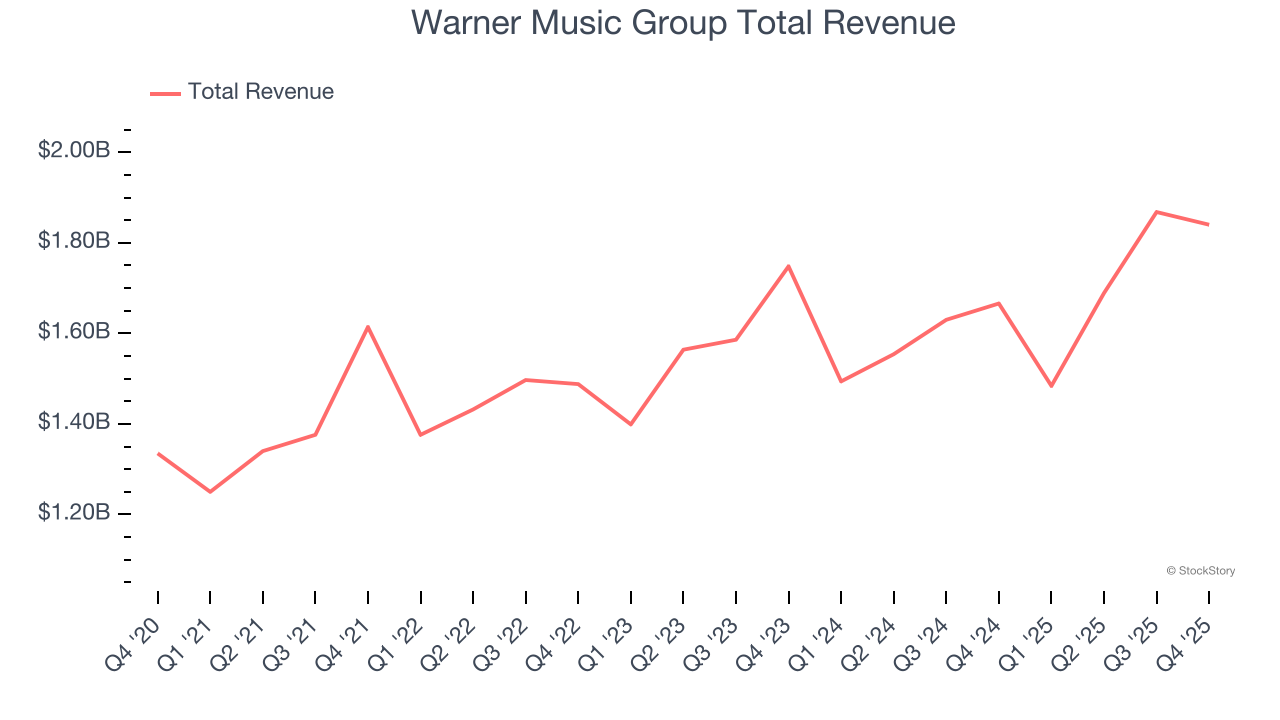

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ: WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Warner Music Group reported revenues of $1.84 billion, up 10.4% year on year, outperforming analysts’ expectations by 4.1%. The business had a very strong quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4.1% since reporting. It currently trades at $29.36.

Is now the time to buy Warner Music Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The New York Times (NYSE: NYT)

Founded in 1851, The New York Times (NYSE: NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

The New York Times reported revenues of $802.3 million, up 10.4% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a mixed quarter as it posted a miss of analysts’ EBITDA estimates.

The stock is flat since the results and currently trades at $72.51.

Read our full analysis of The New York Times’s results here.

Disney (NYSE: DIS)

Founded by brothers Walt and Roy, Disney (NYSE: DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $25.98 billion, up 5.2% year on year. This number beat analysts’ expectations by 0.8%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is down 6.6% since reporting and currently trades at $105.35.

Read our full, actionable report on Disney here, it’s free.

fuboTV (NYSE: FUBO)

Originally launched as a soccer streaming platform, fuboTV (NYSE: FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV reported revenues of $1.55 billion, up 249% year on year. This result topped analysts’ expectations by 279%. Taking a step back, it was a satisfactory quarter as it also logged a solid beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

fuboTV scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 40.7% since reporting and currently trades at $1.35.

Read our full, actionable report on fuboTV here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.